Analysis of the US-China Trade War Impact on Global Stock Markets 2025

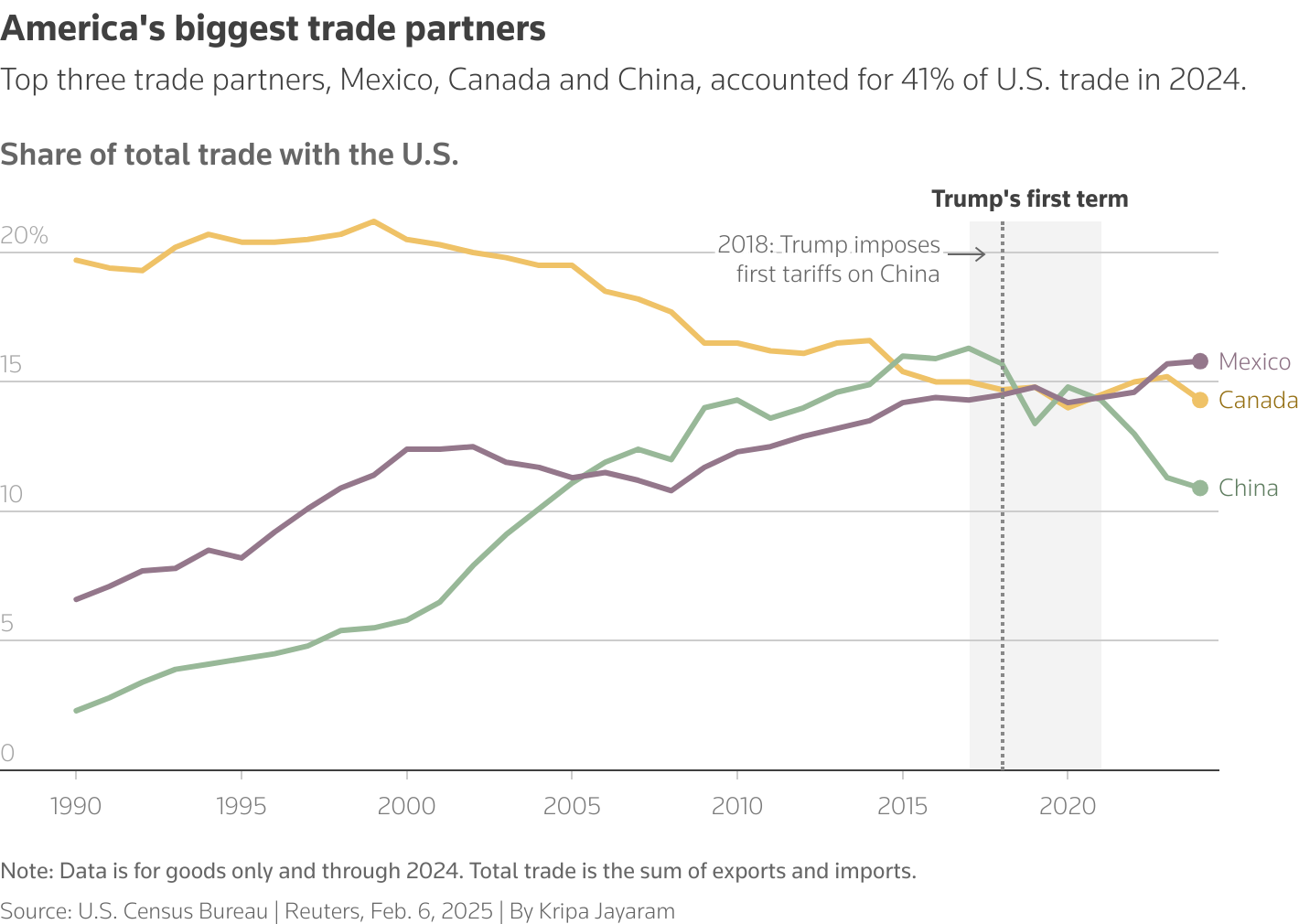

Global financial markets in 2025 are experiencing unprecedented turbulence due to escalating trade tensions between the United States and China. With President Donald Trump imposing 145% tariffs on Chinese goods, and China responding with 125% tariffs, the global economy has entered a new phase of uncertainty. This analysis explores the wide-ranging impacts of this trade war on global stock markets and provides insights for investors in these volatile conditions.

“Growing concerns about Federal Reserve independence, alongside the trade war, are pushing investors to seek safe havens outside traditional US assets, creating a significant shift in global market dynamics.”

Dollar Collapse and Capital Flight

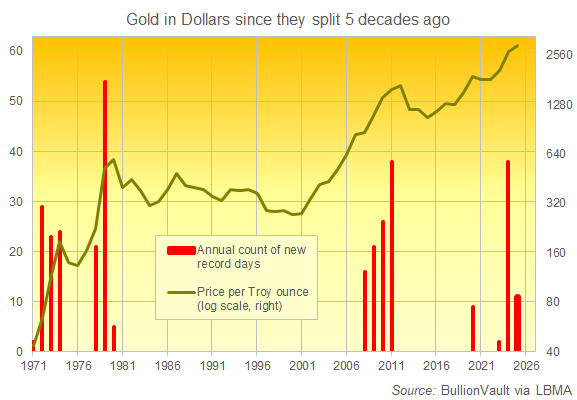

Record Gold Surge as Dollar Collapses

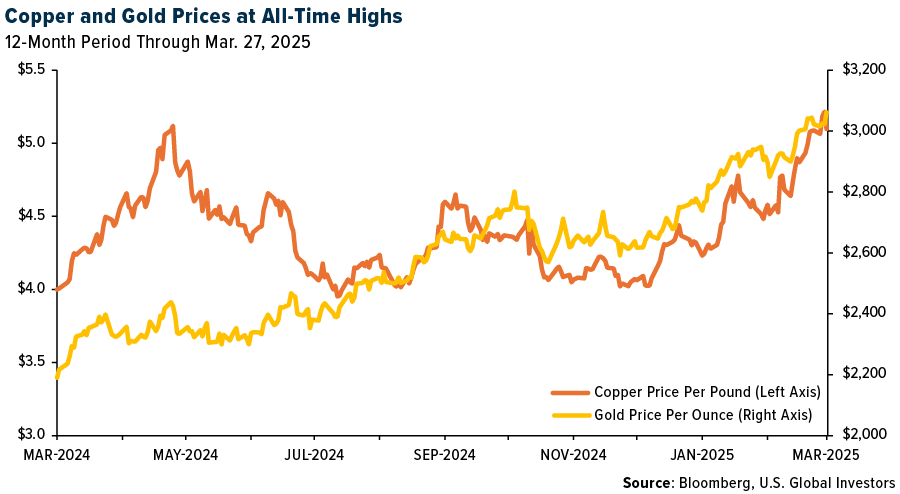

Gold reached its historical high at $3,370 per ounce, while the dollar index has fallen by 9% since the beginning of the year.

2025 has witnessed a radical shift in the view of the US dollar as a traditional safe haven. The dollar index has fallen by more than 9% since the beginning of the year, reaching its lowest level in three years at 98.31. This sharp decline reflects investors’ concerns about US trade policy directions and their impact on the economy.

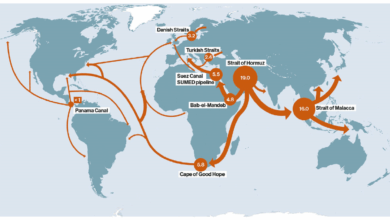

At the same time, capital has begun to flow out of US assets, heading toward alternative markets and safe havens. This shift, described by some analysts as a “flight from the dollar,” represents a major challenge to US financial dominance that has persisted for decades.

US Dollar: A False Smile

Investors may hesitate to invest their capital in US assets for fear of a 30% decline in the US dollar index, which has already fallen following capital flight from the United States due to global trade wars. Some analysts expect the EUR/USD pair to reach 1.3 in 2026.

Trade War Impact on the Technology Sector

Major technology companies suffering sharp declines as trade tensions escalate

Major US technology companies, especially semiconductor manufacturers, are among the biggest casualties of the raging trade war. The “Magnificent Seven” stocks have seen sharp declines in 2025, with Alphabet (Google) down 20% and Tesla down 40%.

These losses come amid fears that reciprocal trade restrictions will negatively impact global supply chains for electronic chips, increase production costs, and reduce profit margins. China’s decision to add more US companies to its export control list has increased pressure on the technology sector.

Since the beginning of April 2025, the Nasdaq index has fallen by more than 2%, affected by news related to new restrictions on chip sales to China and continuing uncertainty about tariffs.

Trade War Impact on Major Technology Companies

Federal Reserve Independence Crisis

US President Donald Trump launched a series of attacks against Federal Reserve Chair Jerome Powell on Thursday, with reports that his team is evaluating whether they could fire Powell. This move has major implications for central bank independence and global markets.

“Markets are already on edge due to escalating geopolitical tensions, and now concerns are rising that Trump’s potential interference with the Fed could add another layer of uncertainty. Any signs of political pressure on monetary policy could undermine the Fed’s independence and complicate the path ahead for interest rates.”

Chicago Federal Reserve President Austan Goolsbee said on Sunday that he hopes the United States is not moving to an environment where the ability of the central bank to set monetary policy independent of political pressure is questioned.

Market Reaction to Federal Reserve Independence Concerns

Markets declined sharply following Trump’s critical statements about the Federal Reserve, reflecting concerns about political intervention in monetary policy.

Safe Haven Shift: Gold and Alternative Currencies

Gold

Year-to-date

Gold reached a record level at $3,370 per ounce, driven by the search for safe havens amid growing concerns about economic instability.

Swiss Franc

Against US Dollar

The Swiss franc reached its highest level against the dollar in more than 10 years, reflecting its strength as a traditional safe haven in times of turmoil.

Japanese Yen

Against US Dollar

The Japanese yen has benefited from its status as a safe-haven currency, as investors turn to safer assets amid declining confidence in the US dollar.

With declining confidence in the US dollar and US assets, investors have turned to traditional safe havens such as gold and stable currencies. Gold has risen by 26% since the beginning of the year, recording consecutive record levels.

One analyst stated: “The US dollar is no longer a safe investment option as gold, the Swiss franc, and the Japanese yen have emerged as more reliable alternatives, making it likely that the US dollar will experience a sharp decline due to the deterioration of the US economy and capital flight from the United States as a result of declining confidence in US assets.”

Strategies for Investors Amid Current Volatility

Short-Term Strategies

- Shift toward companies with limited exposure to China and trade risks

- Diversify portfolio to include safe assets such as gold and silver

- Invest in non-US stock markets that have shown resilience in the face of trade tensions

- Reduce exposure to major technology companies dependent on global supply chains

- Capitalize on price volatility through short-term trading strategies

Medium and Long-Term Strategies

- Adopt a value-based investment approach focusing on companies with strong balance sheets

- Look for opportunities in sectors benefiting from supply chain reshoring

- Allocate part of the portfolio to emerging markets that may benefit from changing global trade paths

- Invest in resilient companies with ability to pass cost increases on to consumers

- Focus on markets with attractive valuations and political and monetary stability

Future Outlook: Potential Scenarios for the Coming Months

Positive Scenario

Reaching a de-escalation in trade tensions through negotiations, with a gradual reduction in tariffs. In this scenario, we might see:

- Recovery in global stock markets

- Decline in gold prices with improved confidence

- US dollar regaining some strength

- Investors returning to US assets

Moderate Scenario

Continuation of current tensions with sporadic attempts at de-escalation. In this scenario, we might see:

- Continued market volatility with a general downward trend

- Continued moderate dollar weakness

- Gradual increase in gold prices

- Gradual adaptation of global supply chains

Negative Scenario

Greater escalation in the trade war, with extension to new areas and impact on central bank independence. In this scenario, we might see:

- Sharp drop in global stock markets

- Additional dollar collapse by up to 20-30%

- New record high for gold exceeding $4,000

- Risk of global recession in late 2025

Conclusion

The trade war between the United States and China in 2025 represents an unprecedented challenge for global financial markets. With continuing tensions and threats to Federal Reserve independence, investors face a highly volatile environment that requires flexibility and adaptive strategies.

The global financial system is experiencing a structural shift with the decline of dollar dominance and the rise of alternative safe havens. Smart investors are those who recognize these shifts and adapt to them, through portfolio diversification and adopting a more flexible investment approach prepared to deal with various scenarios.

Under these conditions, the importance of continuous monitoring of geopolitical and economic developments, accurate analysis of data and indicators, and the necessity of building balanced investment portfolios that combine growth and safety becomes apparent. Crises, despite their challenges, always carry opportunities for investors who possess sufficient insight and preparedness.