Asset Allocation Strategies Using Global Exchange-Traded Funds (ETFs)

In the constantly evolving world of investment, Exchange-Traded Funds (ETFs) have become an essential tool for investors seeking to build diversified and cost-effective portfolios. With the global ETF market reaching record volumes in 2025, it has become crucial to understand optimal asset allocation strategies that can help investors achieve their financial goals while minimizing risks.

“2025 has witnessed a significant shift in investor behavior, with BBH’s Global ETF Investor Survey showing that 95% of investors plan to increase their allocations to ETFs over the next 12 months, compared to 82% in the previous year, reflecting growing confidence in these investment tools.”

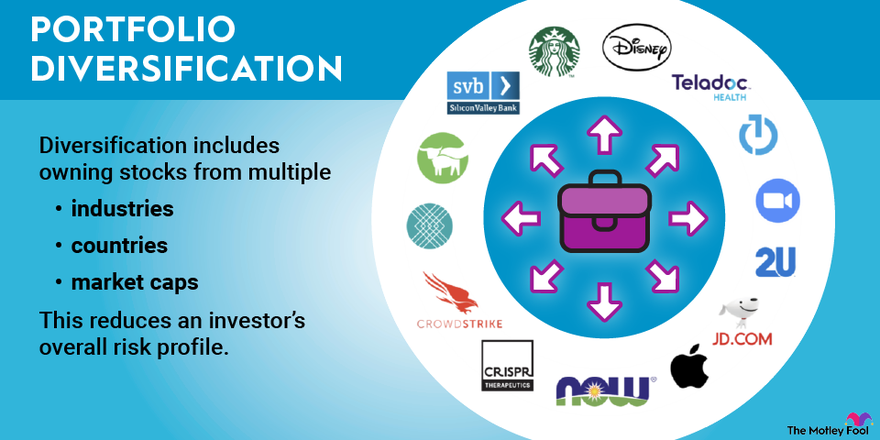

Effective Diversification: Strategies for Building a Balanced Portfolio

Model of a diversified investment portfolio using Exchange-Traded Funds (ETFs)

Diversification is one of the fundamental principles of successful investing and can be effectively achieved by distributing investments across a diverse range of exchange-traded funds. In 2025, market data shows that investors who adopt strong diversification strategies using ETFs achieve 15-20% better risk-adjusted returns than those who focus on limited asset classes.

Key Levels of Diversification

- Asset Class Diversification: Allocating investments across stocks, bonds, commodities, and real estate

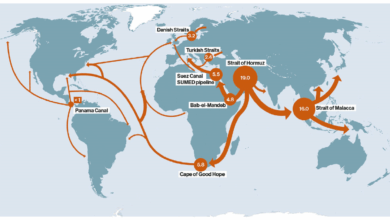

- Geographic Diversification: Investing in multiple markets across developed and emerging markets

- Sector Diversification: Distributing investments across various economic sectors

- Size and Style Diversification: Combining companies with different market capitalizations and growth/value strategies

- Temporal Diversification: Using Dollar-Cost Averaging (DCA) strategy to reduce market timing risks

According to a recent survey by Brown Brothers Harriman, 78% of institutional investors now use ETFs as essential tools for diversification, while 65% rely on a multi-factor asset allocation framework to achieve more resilient portfolios in the face of market volatility.

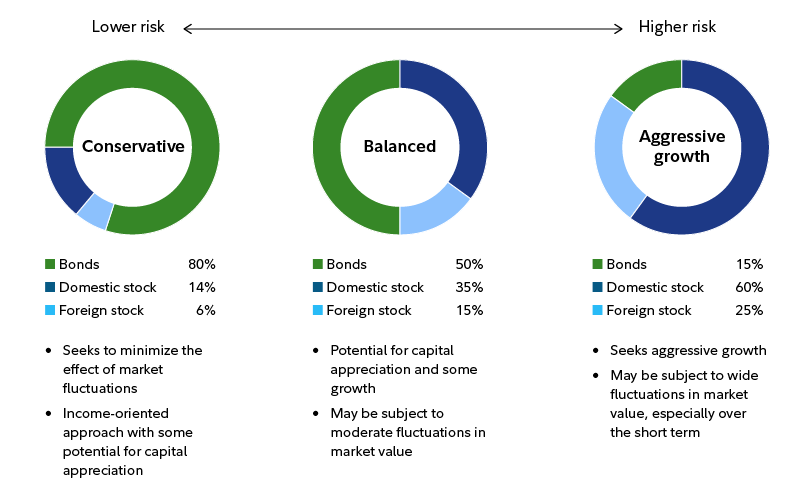

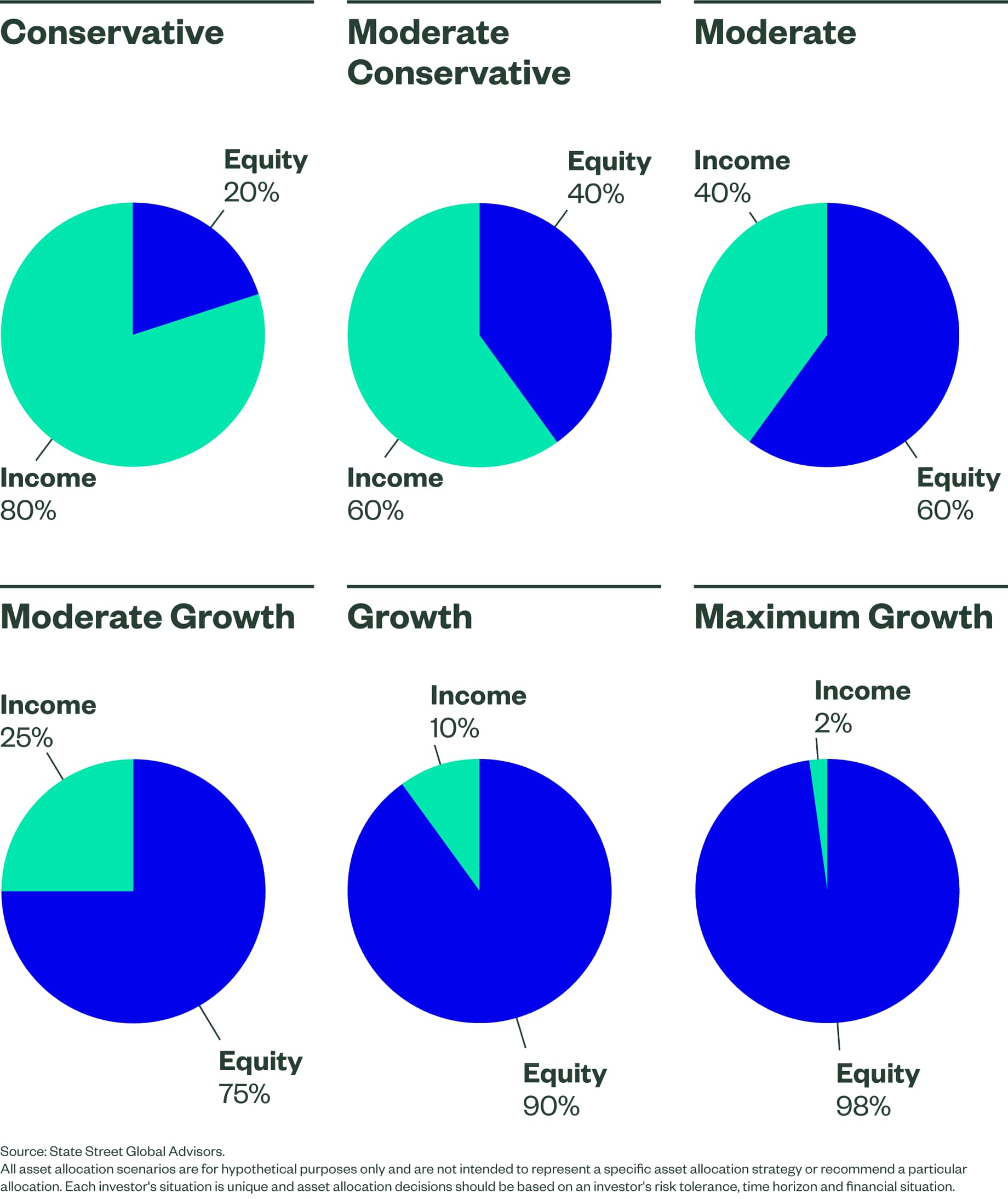

Comparison of asset allocation in ETF portfolio models based on different risk and return objectives

Simplicity Strategy (2-4 funds)

- Global equity ETF such as VT or ACWI

- Global bond ETF such as BNDW

- Simple allocation (example: 60% stocks / 40% bonds)

- Annual or semi-annual rebalancing

- Suitable for beginning investors or those who prefer a passive approach

Medium Diversification Strategy (5-8 funds)

- Separate ETFs for developed and emerging markets

- ETFs for government and corporate bonds

- Adding a REIT fund for real estate exposure

- A fund for commodities or precious metals for hedging

- More detailed allocation based on risk tolerance

Advanced Diversification Strategy (9+ funds)

- Region-specific ETFs

- Sector ETFs for exposure to specific sectors

- Factor ETFs (value, growth, momentum)

- Multiple bond ETFs (government, corporate, emerging)

- Alternative ETFs (hedging strategies, inflation-targeted)

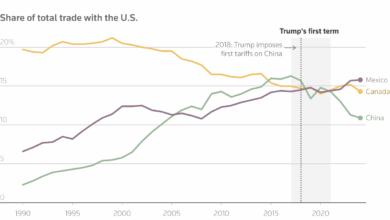

Geographic and Sector Distribution: Finding the Perfect Balance in 2025

Performance of global equities compared to US equities in 2025

2025 has seen a notable shift in global market dynamics, with international markets outperforming US markets for the first time in years. This shift confirms the importance of balanced geographic distribution in ETF portfolios, as it helps reduce country-specific risks and increase growth opportunities.

“Investors who allocated at least 40% of their portfolios to international markets in 2025 were able to achieve above-average returns of 3.5%, confirming the importance of global thinking in asset allocation strategies.”