Best Technical Analysis Mobile Trading Apps in 2025

Best Technical Analysis Mobile Trading Apps in 2025

With the continuous advancement in mobile technology, traders and investors can now perform advanced technical analysis and trade from anywhere, anytime. The year 2025 has witnessed significant development in technical analysis trading applications, with these apps becoming smarter and more user-friendly, adding numerous advanced features that were previously exclusive to desktop platforms.

“In 2025, the ability to perform advanced technical analysis from a mobile phone has become essential for successful traders. You no longer need to stay in front of a computer all day to make informed trading decisions.”

Why Have Technical Analysis Apps Become Essential in 2025?

24/7 Financial Markets

With the emergence of digital assets and the expansion of global trading, financial markets now operate around the clock. Technical analysis apps allow traders to monitor, analyze, and respond to market movements at any time.

AI Integration

2025 apps feature integrated AI and machine learning technologies that provide more accurate analysis, detect complex patterns, and offer customized recommendations based on individual trading styles.

Decision-Making Speed

In fast-moving markets, the ability to make quick decisions is crucial. Technical analysis apps provide instant access to data, analytics, and tools necessary to make informed decisions quickly.

Best Technical Analysis Apps in 2025

1. TradingView

TradingView is the first choice for professional traders in 2025, combining powerful technical analysis tools with a smooth user interface. The app features 2025 updates that added AI capabilities for pattern recognition, advanced indicators, and customized trading signals.

Key Features:

- Over 150 advanced technical indicators

- Japanese candlestick pattern alert engine

- Market scanning with custom criteria

- Integration with more than 50 global brokers

- AI algorithms for suggesting entry and exit points

Plans and Pricing:

- Free: Basic features, 1 chart per window, 3 indicators

- Pro: $14.95 monthly, 8 charts, 10 indicators

- Pro+: $29.95 monthly, 4 devices, advanced alerts

- Premium: $59.95 monthly, all features, priority support

Michael Thompson

Professional Trader, London

“I’ve been using TradingView for years, and the 2025 updates have been truly amazing. The AI-powered pattern recognition features helped me improve my trading accuracy by 28%. Now I can analyze markets completely from my mobile phone without losing any of the capabilities I need for professional trading.”

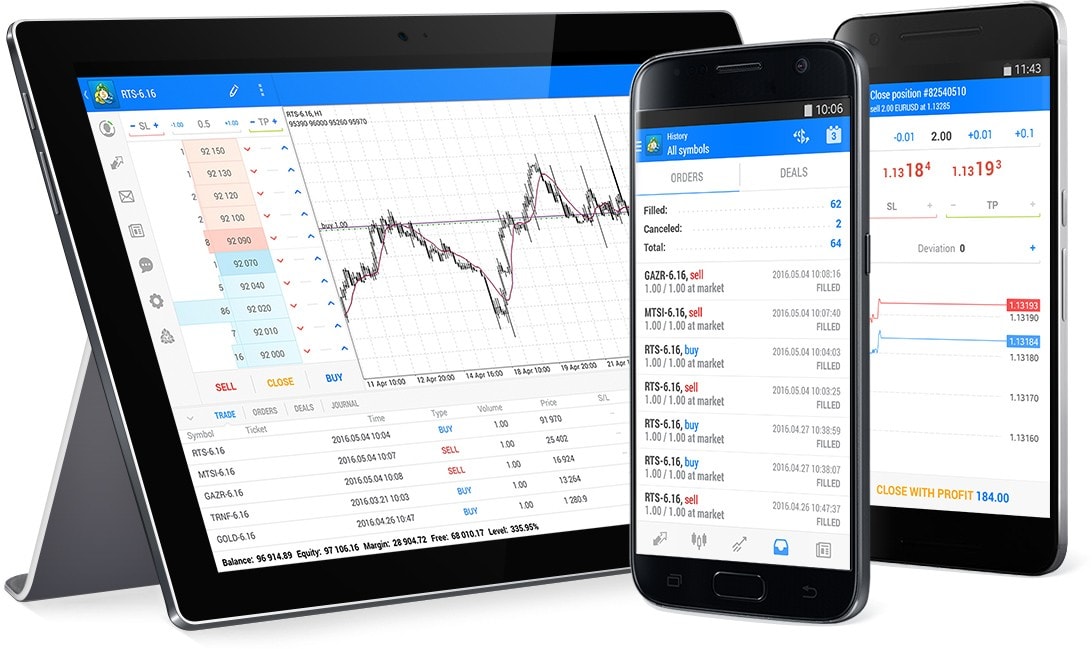

2. MetaTrader 5

MetaTrader 5 remains one of the most popular trading platforms in 2025, with significant improvements in user interface and data processing speed. The app excels in providing an integrated trading environment that combines market analysis, trade execution, and automated trading in one application.

Key Features:

- 38 built-in technical indicators

- Support for custom indicators and robots (MQL5)

- Advanced market analysis

- Trade currencies, stocks, futures, and options

- One-click trading and pending orders

Plans and Pricing:

- App is free, but linked to trading broker

- Some advanced indicators and robots available for purchase

- MQL5 marketplace for indicators and add-ons

- Signal subscription: ranges from $30 to $100 monthly

Sofia Nakamura

Currency Trader, Tokyo

“I spend most of my time on the go, and MetaTrader 5 has been a lifesaver for my professional career. The connection speed improvements in the 2025 version are truly amazing. I can now run complex trading robots from my mobile phone and adjust them in real-time. The only downside is that the user interface still looks outdated compared to other apps.”

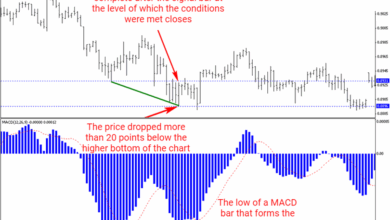

3. TrendSpider

TrendSpider stands out as one of the most advanced applications for automated technical analysis. In 2025, the app has developed many unique features that use artificial intelligence to automatically identify trends, support and resistance lines, and technical patterns.

Key Features:

- AI-powered automated trend analysis

- Automatic detection of candlestick and price patterns

- Multi-timeframe analysis on a single screen

- Automatic support and resistance line tracking

- Real-time market scanning

Plans and Pricing:

- Premium: $97 monthly (all basic features)

- Elite: $129 monthly (with advanced features)

- Premium + Futures: $129 monthly

- Elite + Futures: $149 monthly

Alexander Weber

Fund Manager, Frankfurt

“TrendSpider has completely changed how I analyze markets. My favorite feature is the ‘Raindrop Charts’ that was added in 2025, which allows me to see liquidity distribution across price ranges. I’ve been able to reduce analysis time by 70% while improving the accuracy of my predictions. It’s expensive but worth every cent for serious traders.”

4. TC2000

TC2000 is one of the oldest and most respected technical analysis software programs, and it has evolved significantly in the 2025 version to provide a powerful mobile experience. It features advanced stock scanning tools and deep customization features that make it suitable for stock-focused investors.

Key Features:

- Advanced stock screening tools

- Price alerts and custom conditions

- Advanced charts with custom indicators

- Customizable dashboards

- Trading integration with multiple brokers

Plans and Pricing:

- Silver: $29.99 monthly (basic tools)

- Gold: $59.99 monthly (advanced indicators)

- Platinum: $89.99 monthly (all features)

- Brokerage: Integrated for additional $20 monthly

Elizabeth Reynolds

Stock Investor, Toronto

“I’ve been using TC2000 for over a decade, and the mobile version gets better every year. The new EasyScan feature in 2025 is great for filtering stocks based on multiple criteria. I love that I can access all my custom dashboards from my phone. My only note is that the mobile version doesn’t have a native Android app, but the browser-based version works well.”

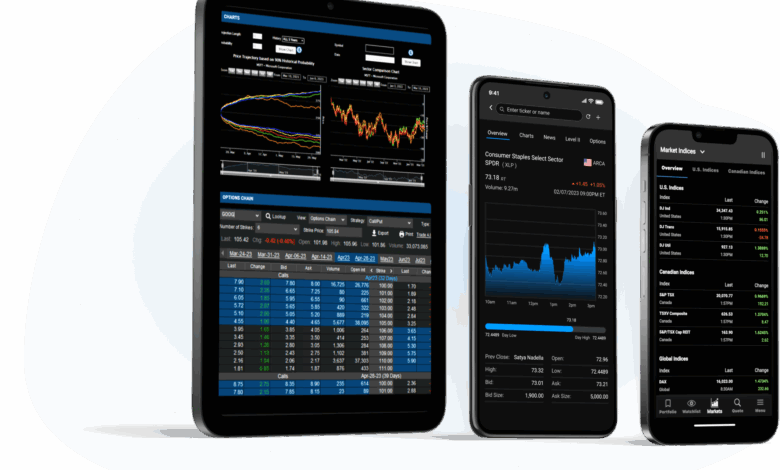

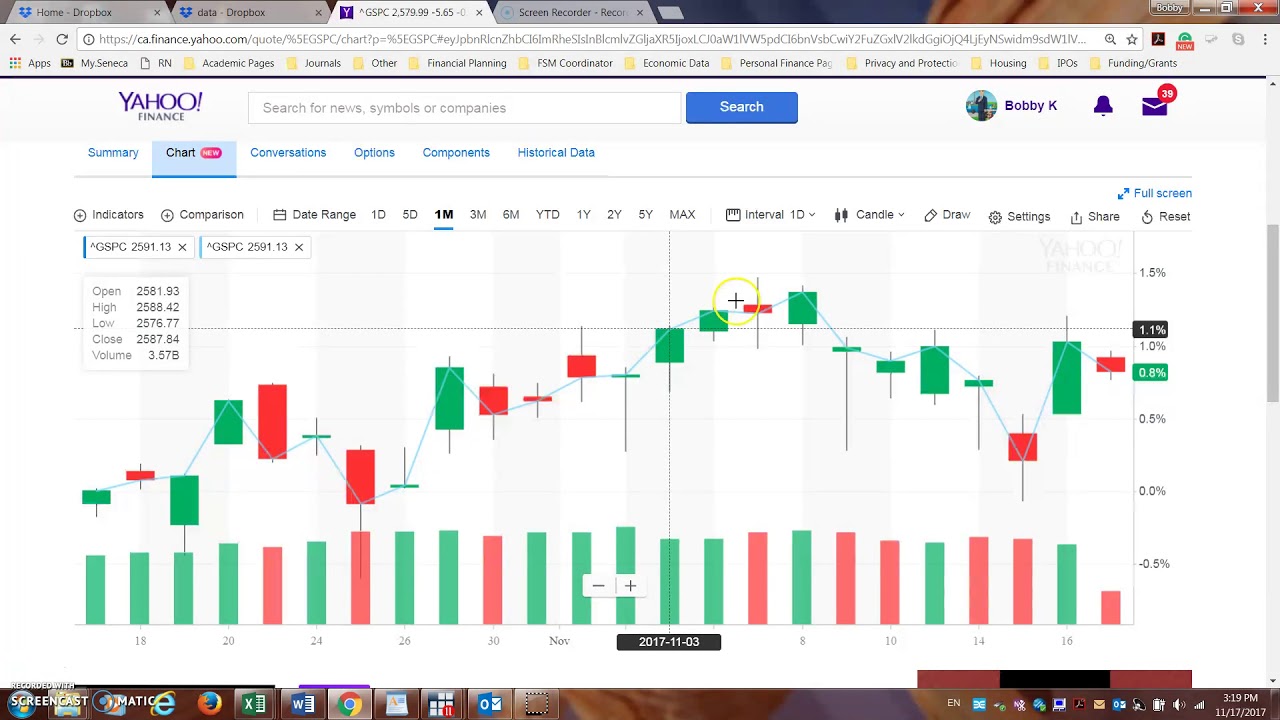

5. Yahoo Finance

The Yahoo Finance app is an excellent option for investors who want to combine technical and fundamental analysis. The 2025 updates added many advanced technical analysis tools, making it a strong competitor to specialized applications while maintaining the advantage of providing comprehensive market data and news.

Key Features:

- Integrated technical analysis tools

- Comprehensive news coverage and fundamental data

- Interactive charts with multiple indicators

- Virtual portfolios and performance tracking

- Customizable price and news alerts

Plans and Pricing:

- Free: Basic tools and charts

- Yahoo Finance Plus Basic: $25 monthly

- Yahoo Finance Plus Essential: $35 monthly

- Yahoo Finance Plus Dashboard: $35 monthly

Robert Chen

Long-Term Investor, Singapore

“Yahoo Finance is the perfect app for investors who want to understand the complete market context. The technical chart improvements in 2025 are impressive, especially the addition of Ichimoku Cloud and Pivot Points indicators. What I love most is how the app combines technical analysis, fundamentals, and news in one place. It still lacks some advanced features found in TradingView, but it’s much better for investors looking at the complete picture.”

6. FinViz Elite

Although FinViz doesn’t have a dedicated app, its mobile-optimized web interface in 2025 works perfectly on mobile devices. It excels in advanced stock screening and visual market analysis through heat maps and innovative visualizations.

Key Features:

- Most comprehensive stock screening tool

- Heat maps for sectors and industries

- Automatic technical pattern detection

- Real-time market data

- Pattern-based trading signals

Plans and Pricing:

- Free: Basic screening with delayed data

- Elite: $39.50 monthly (or $299.50 annually)

- 20% discount for annual subscriptions

David Mueller

Portfolio Manager, Zurich

“As a portfolio manager, I rely heavily on FinViz Elite for stock discovery and market trend analysis. Visual representations like heat maps give me a comprehensive view of the market at a glance. The 2025 improvements that added sector money flow analysis tools are really great. I wish there was a dedicated app, but the mobile-optimized web version works well on my phone. It’s definitely the best investment for those looking for new trading ideas.”

Comparison of the Best Technical Analysis Apps in 2025

| App | Key Strengths | Weaknesses | Best For | Monthly Price |

|---|---|---|---|---|

| TradingView | Advanced technical indicators, active community, smooth user interface | Some advanced features reserved for paid plans | Traders of all levels | Free – $59.95 |

| MetaTrader 5 | Live trading, trading robots, multi-asset support | Relatively outdated user interface, steep learning curve | Active and automated traders | Free (broker-linked) |

| TrendSpider | Automated analysis, AI pattern discovery, multi-timeframe analysis | Relatively expensive, specialized platform | Professional traders and institutions | $97 – $149 |

| TC2000 | Powerful screening tools, advanced charting, trading integration | No dedicated Android app, focus on U.S. stock market | Stock traders and investors | $29.99 – $89.99 |

| Yahoo Finance | Technical and fundamental analysis, news coverage, intuitive | Less advanced technical features than specialized platforms | Long-term investors | Free – $35 |

| FinViz Elite | Advanced screening, market visualizations, pattern discovery | No dedicated app, complex for beginners | Professional stock traders, portfolio managers | Free – $39.50 |

International Professional User Experiences

James Wilson

Independent Trader, Sydney

“As a day trader focusing on the S&P 500 index and forex, I’ve tried most of the available technical analysis apps. In 2025, mobile apps have become powerful enough to replace traditional desktop software. I now spend 70% of my trading time on TradingView Mobile and MetaTrader 5.”

“What impressed me most about the 2025 developments is the ability of these apps to run complex backtesting strategies on mobile phones, which previously required powerful computers. AI pattern recognition technologies and breakout alerts give me a real competitive edge in the market.”

Emma Johnson

Technical Analyst, New York

“As a technical analyst providing recommendations to clients, I rely heavily on TrendSpider and FinViz Elite. What amazed me in 2025 is how accurate AI algorithms have become in predicting trends and identifying potential reversal points.”

“The ‘Multi-Timeframe Analysis’ feature in TrendSpider on mobile now provides deeper insights than older desktop software. I can set up complex alert configurations on the go, which send direct signals to my phone when opportunities arise. I recommend new traders start with TradingView to learn technical analysis, then upgrade to a more specialized platform based on their strategy.”

Dr. Hiroshi Tanaka

Professor of Financial Economics, Tokyo

“As a financial markets researcher, I find the evolution of mobile technical analysis apps in 2025 academically interesting. We conducted a study of 250 professional traders using mobile technical analysis apps and found that those using AI-powered apps like TrendSpider and TradingView achieved 18% higher returns compared to those using traditional tools.”

“The real challenge we observed is ‘over-analysis’ – where these apps now provide so much data and analysis that they can lead to decision paralysis. I recommend traders choose a specific set of technical indicators and stick with them, rather than chasing every new feature. Ultimately, our research shows that simplicity and consistency in using these apps are key to success.”

Future Trends in Technical Analysis Apps

Enhanced AI Capabilities

The future will see further development in the use of generative AI to provide more complex analyses and insights. We’ll see apps interpreting patterns and offering potential predictions based on thousands of similar historical scenarios.

3D and AR Analysis Experiences

Technical analysis apps will evolve to offer three-dimensional charts and visualizations through augmented reality technologies. Imagine being able to see price and volume models floating in the air in front of you, allowing for a deeper understanding of market dynamics.

Integrated Social and Sentiment Analysis

Future apps will more deeply integrate sentiment analytics from social media, trading platforms, and news into traditional technical analysis, providing a more comprehensive picture of market trends.

Conclusion

With advancing technology and the continued growth of the global trading market, mobile technical analysis apps have become essential tools for traders and investors at all levels. The year 2025 has seen a surge in the capabilities of these apps, especially with the integration of AI technologies and improved user interfaces.

Among the reviewed apps, TradingView stands out as a balanced option for traders of all levels, while TrendSpider offers advanced options for professionals, and MetaTrader 5 remains the best choice for automated trading. Additionally, apps like Yahoo Finance, TC2000, and FinViz Elite offer specialized options for many types of traders.

What’s important to remember is that the best app is the one that suits your trading style and individual needs. Some traders may prefer a simple interface with basic features, while others may need highly advanced tools for complex analysis. We recommend trying some of these apps in their free version before committing to any paid subscription.