Gold at $3000: Reasons for the Record Rise and Future Outlook until 2026

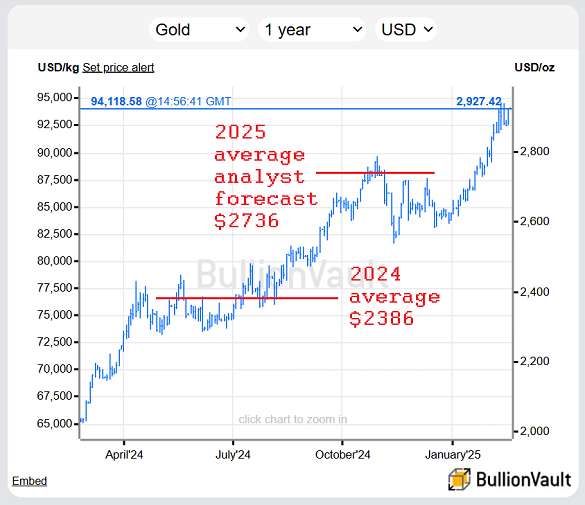

2025 witnessed a historic event in the precious metals market with gold reaching an unprecedented level of $3000 per ounce. This record rise, which exceeded most analysts’ expectations, comes amid a mix of geopolitical, economic, and monetary factors that have combined to push gold to new horizons. While some analysts expect a short-term correction, the consensus indicates that gold’s upward trajectory may not stop at this level, with predictions of reaching higher levels by 2026.

“Gold is not just a precious metal, but a measure of investor confidence in the global financial system. Its rise to $3000 reflects growing concerns about economic stability and the erosion of paper currency values in the face of expansionary monetary policies.”

Driving Factors Behind the Record Rise

Geopolitical Tensions

Escalating tensions in different regions of the world have increased demand for safe havens. Ongoing conflicts and trade tensions between major economic powers have created an environment of investment uncertainty.

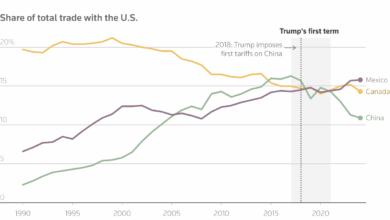

US Dollar Weakness

The US dollar has seen a notable decline against a basket of major currencies, driven by concerns about growing US public debt and policy shifts toward trade protectionism, enhancing gold’s appeal as an alternative to the American currency.

Central Bank Purchases

Global central banks, especially in emerging markets, have continued to diversify their foreign exchange reserves toward gold. 2025 marked the fourth consecutive year of purchases exceeding 1000 tons.

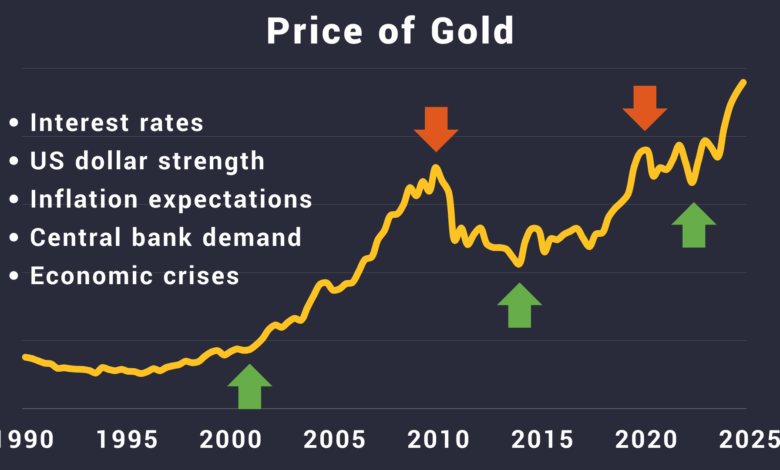

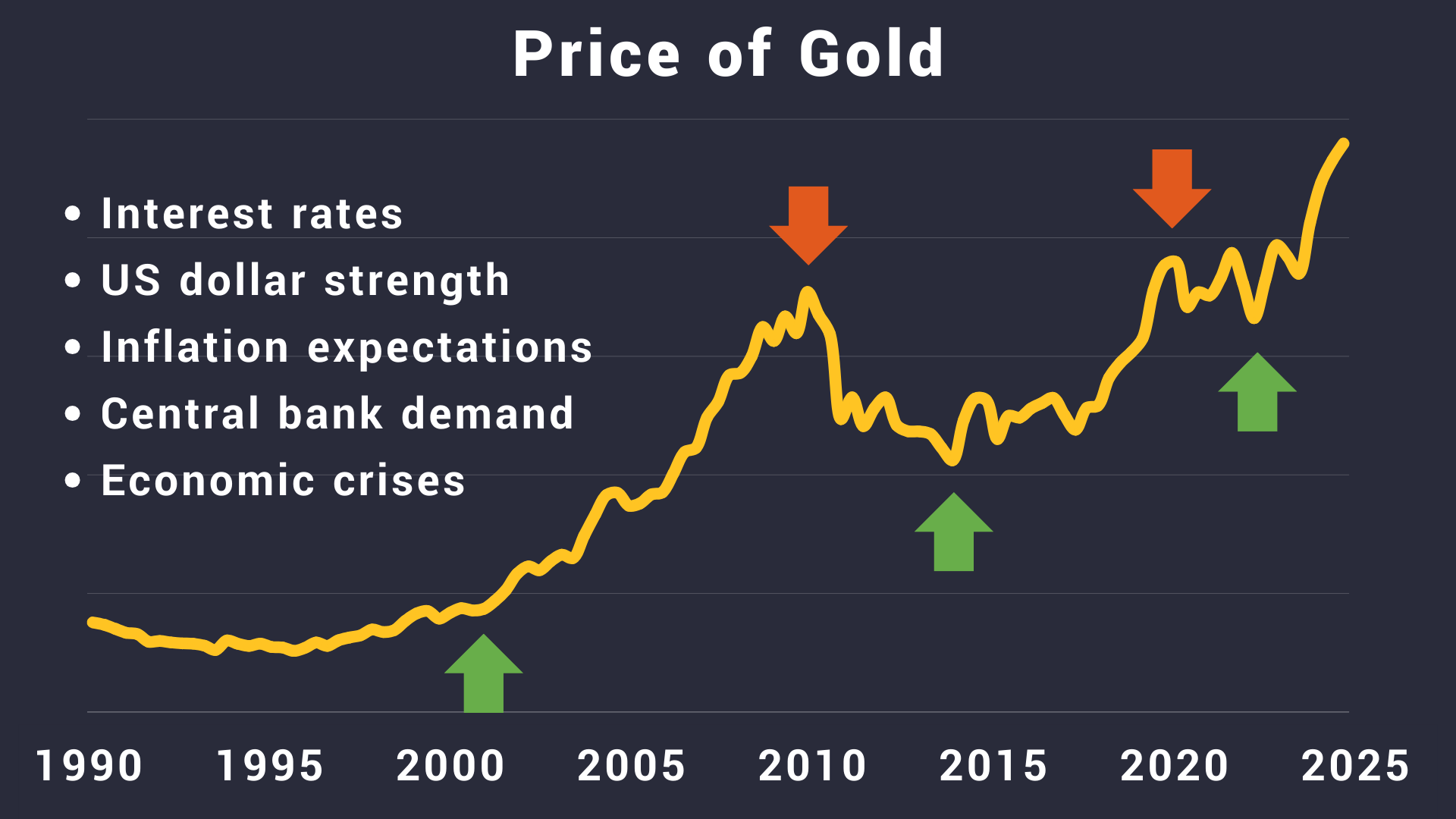

Key factors influencing gold price and their interrelationships

High Inflation Rates

Despite central banks’ efforts to contain inflation, inflationary pressures have persisted in many major economies, boosting demand for gold as a traditional hedge against erosion of purchasing power.

Stock and Bond Market Volatility

Global stock and bond markets experienced sharp fluctuations during 2025, with major stock indices retreating and bond yields rising, pushing investors to seek more stable alternatives.

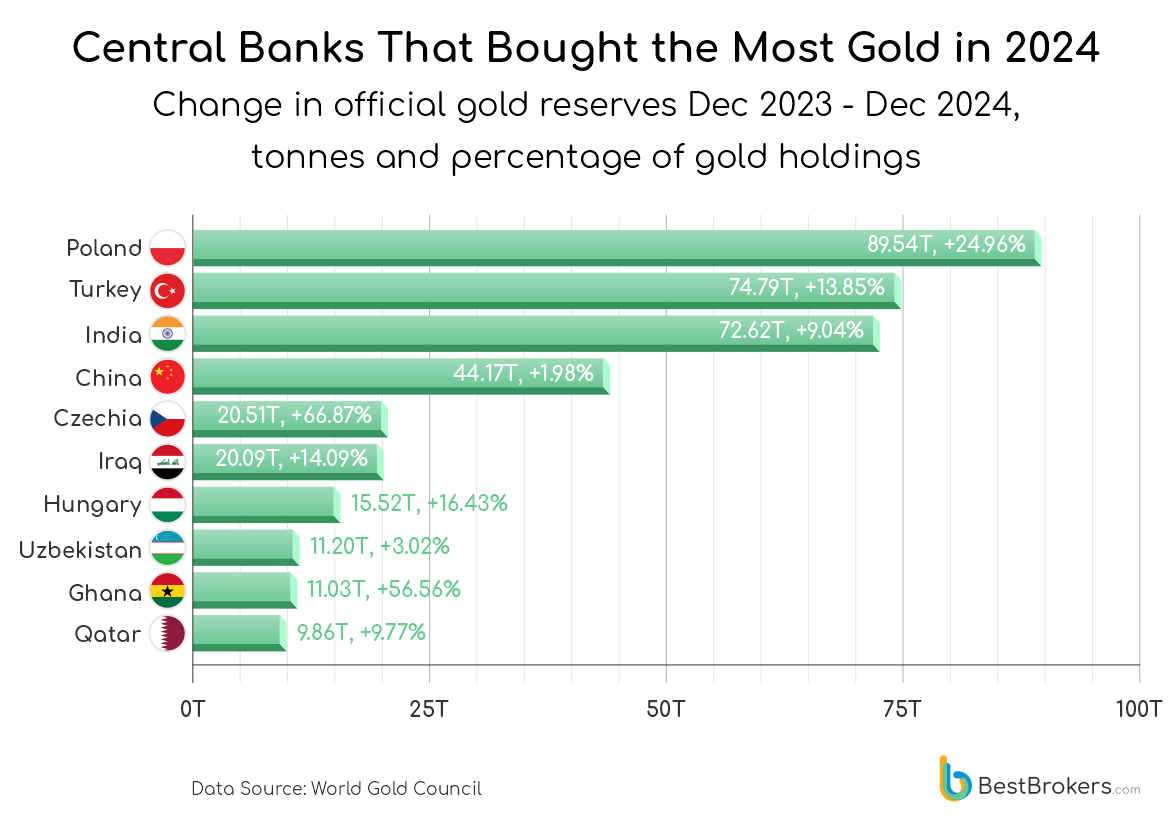

Central Banks’ Role in Supporting Gold Prices

Largest central banks purchasing gold in recent years

Central bank purchases are one of the most important factors that contributed to gold reaching $3000 per ounce. In recent years, central banks have shifted from being net sellers of gold to net buyers, with the pace of purchases accelerating significantly.

Why Do Central Banks Buy Gold?

- Diversifying reserves away from the US dollar

- Hedging against currency fluctuations and financial sanctions risks

- Enhancing confidence in the country’s financial stability

- Protection against erosion of reserve asset values due to inflation

According to recent reports, the Chinese central bank has led the purchasing wave for the fifth consecutive month, adding approximately 30 tons monthly to its reserves. Other central banks, such as the Turkish Central Bank and the Reserve Bank of India, have also recorded strong purchases in recent months.

Investment Banks’ Gold Price Forecasts Through 2026

Goldman Sachs

Goldman Sachs raised its gold price forecast for the end of 2025 to $3300, citing strong central bank purchases and robust inflows into gold ETFs.

Bank of America

Bank of America expects gold to average $3063 in 2025, with a larger increase in 2026, supported by increasing demand amid geopolitical tensions and economic concerns.

JP Morgan

JP Morgan expects gold prices to continue rising, noting that US dollar weakness and lower real interest rates will continue to support the yellow metal’s prices.

Gold price forecasts for 2025 from various global financial institutions

Future Influence Factors

Factors Supporting Price Increases

- Continued expansion of central bank balance sheets and gold purchases

- Investor preference for real assets in the face of high inflation

- Growing concerns about a global debt crisis

- Continuing geopolitical and trade tensions

- US dollar weakness and expansionary monetary policies

Potential Correction Factors

- Rising real interest rates

- Tightening of global monetary policies

- Improvement in global economic confidence

- Sharp decline in inflation indicators

- Strengthening of the US dollar

Potential Scenarios for the Gold Market Through 2026

Optimistic Scenario

Gold price rising to record levels between $3500-4000 per ounce, driven by a crisis of confidence in the global financial system, accelerating inflation, and deepening geopolitical tensions.

Base Scenario

Gold price stabilizing in the range of $3000-3500 per ounce with limited fluctuations, amid continued current supporting factors with some improvement in global economic conditions.

Pessimistic Scenario

Gold price correcting to levels of $2500-2800 per ounce, due to tightening global monetary policies, significant improvement in economic confidence, and strengthening of the US dollar.

Critical Factors to Monitor in 2026

- Monetary Policies of Major Central Banks: Especially the US Federal Reserve and the European Central Bank

- Global Inflation Trajectories: Continuation or retreat of inflationary pressures

- Geopolitical Developments: Especially in current conflict zones and trade tensions

- Institutional Investor Behavior: ETF flows and institutional investments

- Central Bank Purchases: Continuation or slowing of purchase pace

- Currency Market Performance: Especially the US dollar against major currencies

Gold Investment Strategies in a $3000 Environment

Strategies for Long-Term Investors

With gold reaching new record levels, long-term investors need to adopt a strategic approach that capitalizes on fundamental trends while avoiding short-term volatility.

- Gradual accumulation during correction periods

- Investing in low-fee gold ETFs

- Allocating 5-15% of the investment portfolio to gold as a strategic hedge

- Considering mining companies with strong balance sheets and low costs

- Studying investment opportunities in other precious metals such as silver and platinum

Tactical Investment Tips

Tactical investors can benefit from the expected fluctuations in the gold market during the coming period, while maintaining strict risk management.

- Using moving price averages to determine entry and exit points

- Monitoring the Relative Strength Index (RSI) to identify overbought and oversold levels

- Setting stop-loss orders strategically to protect gains

- Utilizing gold futures and options while carefully managing financial leverage

- Following inflation data and key economic data that affect gold prices

“In an era of digital currency volatility and global economic challenges, gold at $3000 is more than just a record number – it’s a message from financial markets that traditional assets can still provide safety in a turbulent world.”

Conclusion

Gold reaching $3000 represents an important turning point in precious metals markets and reflects deeper shifts in the global economy and financial system. Despite the possibility of short-term corrections, the structural factors supporting the gold market – including geopolitical tensions, dollar weakness, central bank purchases, and inflation concerns – are likely to continue until 2026 and beyond.

Most analysts and investment banks agree that gold’s upward path remains intact, with expectations of reaching higher levels in 2026. However, investors should be cautious of potential volatility and prepare for different scenarios, applying investment strategies that align with their goals and risk tolerance.

Ultimately, gold – even at $3000 – remains an essential part of a diversification strategy for prudent investors and a protective shield against economic fluctuations and global uncertainty. As history has repeatedly proven, the yellow metal remains a safe haven that investors turn to in times of turmoil, regardless of how the global economic landscape changes.