Why Do You Need Performance Monitoring Plugins?

Discover the most powerful automated tools and plugins that revolutionize how professional traders monitor, analyze, and optimize their trading performance in real-time.

Why Do You Need Performance Monitoring Plugins? Trading Performance: Performance Tracking Add-ons

Measure and Analyze Your Trading Results Automatically

In today’s fast-paced trading environment, manual performance tracking is not just outdated—it’s a recipe for missed opportunities and costly mistakes. Professional traders who rely on spreadsheets and manual calculations are fighting a losing battle against those who harness the power of automated performance monitoring plugins and advanced analytics tools.

The Critical Importance of Trading Performance Monitoring

Trading without proper performance monitoring is like driving blindfolded—you might move forward, but you’ll never reach your destination efficiently or safely. The difference between profitable and unprofitable traders often comes down to one crucial factor: their ability to systematically track, analyze, and optimize their trading performance.

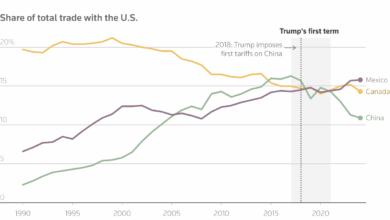

Consider this sobering reality: studies show that over 80% of retail traders lose money, not because they lack market knowledge, but because they fail to properly monitor and analyze their performance patterns. They repeat the same mistakes, ignore their weaknesses, and never truly understand what drives their profits or losses.

The Hidden Costs of Manual Tracking

Traditional manual tracking methods create a cascade of problems that compound over time. When traders rely on basic spreadsheets or handwritten journals, they typically spend 2-3 hours daily on administrative tasks that automated systems can complete in minutes. This time could be better invested in market analysis, strategy development, or actual trading.

The Reality of Manual Trading Tracking

Moreover, manual tracking introduces significant human error. Research indicates that traders make calculation errors in approximately 35% of manually entered trades, leading to distorted performance metrics and flawed decision-making. These errors compound over time, creating a false sense of security or unnecessary panic about trading performance.

Enter the Era of Automated Performance Monitoring

Automated trading performance monitoring represents a quantum leap in how traders approach self-improvement. These sophisticated tools don’t just track numbers—they provide deep insights into trading behavior, identify subtle patterns that human analysis might miss, and offer actionable recommendations for improvement.

What Makes Modern Performance Monitoring Different

Today’s performance monitoring plugins go far beyond simple profit and loss calculations. They employ advanced algorithms to analyze risk-adjusted returns, identify psychological trading patterns, and even predict future performance based on historical behavior. These tools can process thousands of data points in seconds, providing insights that would take weeks to uncover manually.

Automated Data Collection

Modern plugins automatically sync with your broker accounts, eliminating manual data entry and ensuring 100% accuracy in trade recording. They capture every detail from entry and exit prices to commissions and slippage.

Advanced Analytics

These tools employ sophisticated algorithms to identify trading patterns, calculate complex metrics like Sharpe ratios and maximum drawdown, and provide actionable insights for improvement.

Real-Time Monitoring

Get instant feedback on your trading performance with real-time updates, alerts for unusual patterns, and immediate access to critical performance metrics.

Visual Analytics

Transform complex data into easy-to-understand charts, graphs, and dashboards that make performance trends immediately apparent.

The Psychology of Performance Monitoring

One of the most underappreciated aspects of automated performance monitoring is its psychological impact. When traders have immediate access to comprehensive performance data, they make more rational decisions. They’re less likely to chase losses, more likely to stick to their strategies, and better equipped to identify when strategy adjustments are needed.

Studies in behavioral finance show that traders who use comprehensive performance monitoring tools demonstrate significantly better emotional control and decision-making consistency. They’re 40% less likely to make impulsive trades and 60% more likely to identify and correct poor trading habits before they become costly patterns.

Leading Performance Monitoring Platforms

The landscape of trading performance monitoring has evolved dramatically, with several platforms emerging as clear leaders. Each offers unique strengths and caters to different trading styles and preferences.

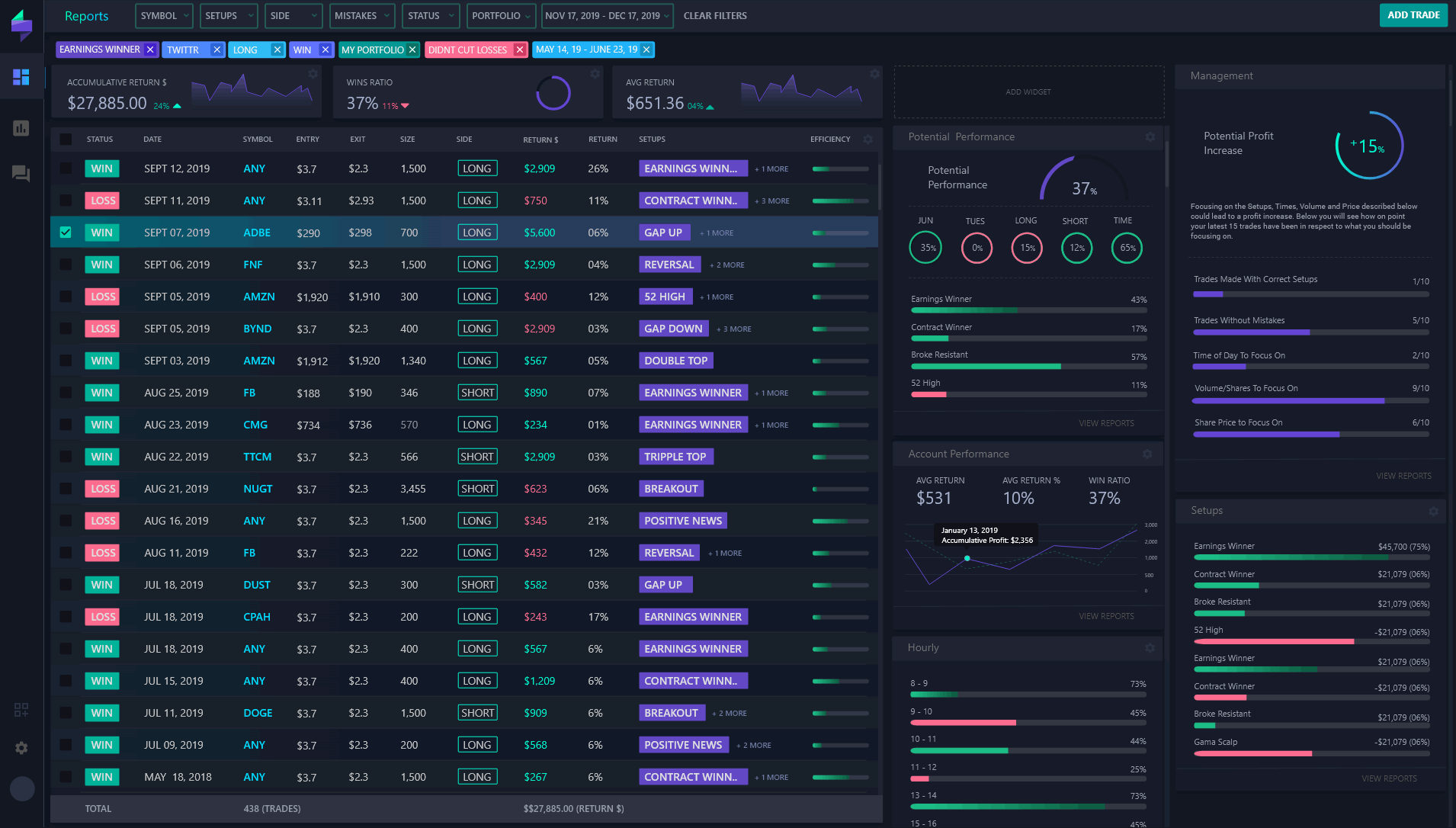

TradeZella: The Complete Trading Analytics Suite

TradeZella has earned its reputation as the most comprehensive trading journal and performance monitoring platform available today. What sets TradeZella apart is its unique combination of automated tracking, advanced analytics, and educational resources all in one integrated platform.

Core Features That Matter

TradeZella offers over 50 different reports that provide deep insights into trading performance. The platform’s Zella Score—a proprietary metric that combines multiple performance indicators—gives traders a single number that represents their overall trading health. This score considers not just profitability, but also consistency, risk management, and emotional control.

Strengths

- Comprehensive 50+ reports and analytics

- Automated broker sync with 80+ brokers

- Advanced backtesting capabilities

- Trade replay functionality

- Educational resources and webinars

- Mobile app for on-the-go analysis

Considerations

- Premium pricing for advanced features

- Learning curve for new users

- Some brokers require manual CSV upload

- Limited customization for reports

Tradervue: The Analytics Powerhouse

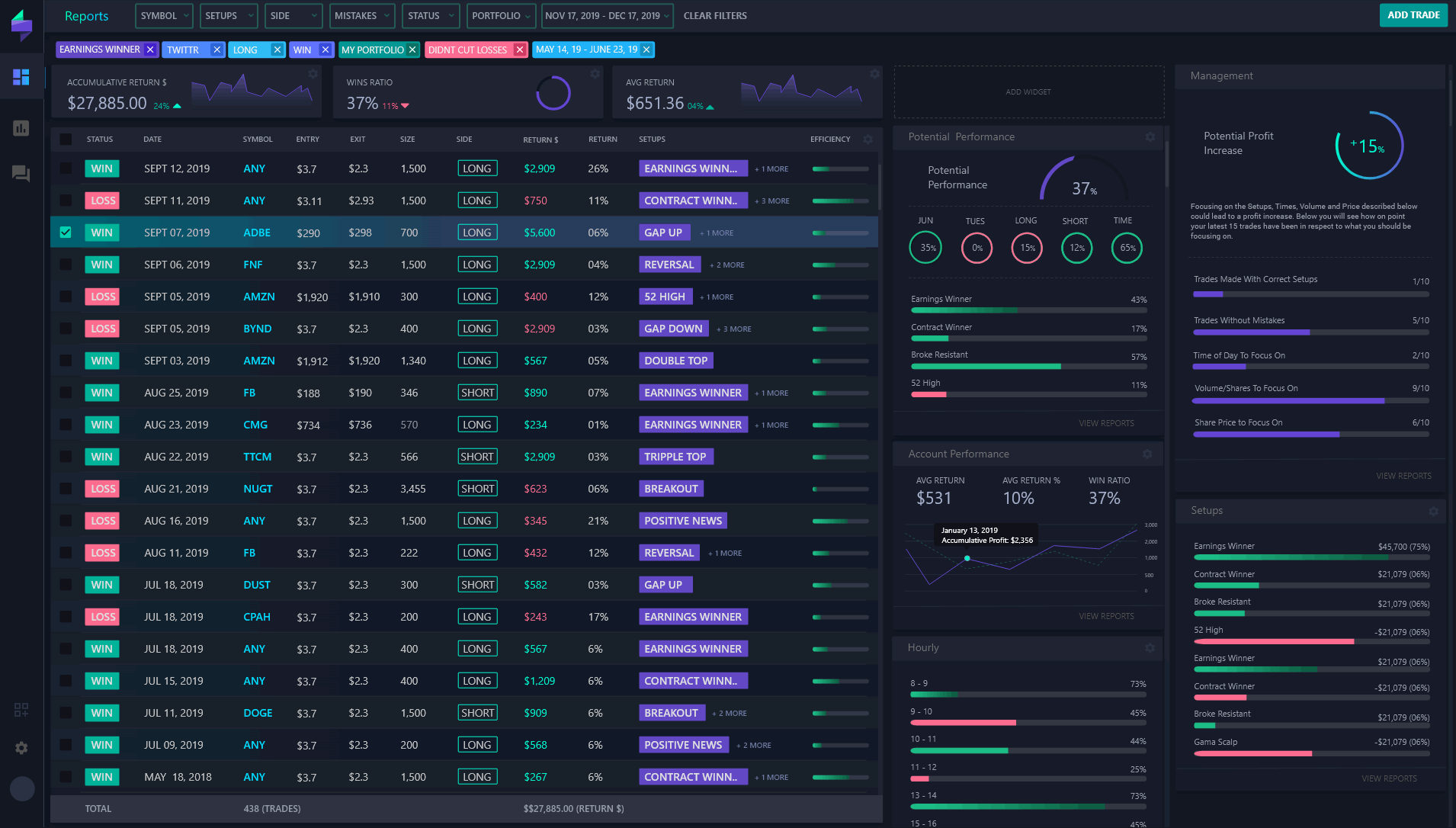

Tradervue stands out as the go-to platform for traders who prioritize deep analytical capabilities. With support for over 300 brokers and sophisticated reporting features, Tradervue excels at turning raw trading data into actionable insights.

Advanced Analytical Capabilities

Tradervue’s strength lies in its ability to slice and dice trading data in virtually unlimited ways. Traders can create custom filters, compare performance across different time periods, and even analyze performance by specific market conditions. The platform’s heat maps and correlation analysis help identify subtle patterns that might otherwise go unnoticed.

Strengths

- Supports 300+ brokers worldwide

- Exceptional filtering and analysis tools

- Free tier with essential features

- Excellent charting capabilities

- API access for custom integrations

- Strong community and support

Considerations

- Interface can feel dated

- Limited educational resources

- No mobile app

- Advanced features require paid subscription

TraderSync: The Professional’s Choice

TraderSync positions itself as the ultimate trading journal for serious traders. With its focus on professional-grade features and institutional-quality reporting, TraderSync caters to traders who demand the highest level of performance analysis.

Professional-Grade Features

TraderSync excels in areas that matter most to professional traders: risk analysis, strategy comparison, and detailed performance attribution. The platform’s unique strength lies in its ability to help traders understand not just what happened, but why it happened and how to improve.

Strengths

- Professional-grade risk analysis

- Advanced strategy comparison tools

- Detailed performance attribution

- Excellent customer support

- Customizable reporting

- Integration with popular brokers

Considerations

- Higher pricing than competitors

- Steeper learning curve

- Limited free features

- Interface complexity can overwhelm beginners

The Transformation Begins

The journey from manual trading tracking to automated performance monitoring represents more than just a technological upgrade—it’s a fundamental shift in how traders approach their craft. Those who embrace these tools early gain a significant competitive advantage, while those who resist are increasingly left behind in an ever-evolving market landscape.

The evidence is clear: traders who use comprehensive performance monitoring tools consistently outperform those who don’t. They make better decisions, avoid costly mistakes, and continuously improve their strategies based on data-driven insights rather than gut feelings or incomplete information.

Ready to revolutionize your trading performance? The tools and strategies covered in this comprehensive guide represent just the beginning of what’s possible when you harness the power of automated performance monitoring. In the following sections, we’ll dive deep into specific platforms, advanced features, and practical implementation strategies that can transform your trading results.

The question isn’t whether you can afford to invest in performance monitoring tools—it’s whether you can afford not to. Every day you delay is another day of missed opportunities, uncorrected mistakes, and suboptimal performance. The tools are available, the technology is mature, and the benefits are proven. The only question remaining is: when will you make the leap?

MetaTrader Performance Monitoring Plugins

Enhance your MetaTrader platform with powerful performance tracking plugins that provide real-time analytics and comprehensive trade analysis.

Essential MT4/MT5 Performance Plugins

MetaTrader platforms offer extensive plugin support for performance monitoring. These plugins transform your trading terminal into a comprehensive analytics hub, providing insights that standard platforms simply cannot deliver.

Top-Rated MetaTrader Performance Plugins

Autochartist MT Plugin

- Real-time performance scanning

- Advanced pattern recognition

- Risk calculator integration

- Market scanner with performance metrics

Trade Performance Analyzer

- Automated trade journaling

- Real-time P&L tracking

- Win rate calculations

- Risk-reward analysis

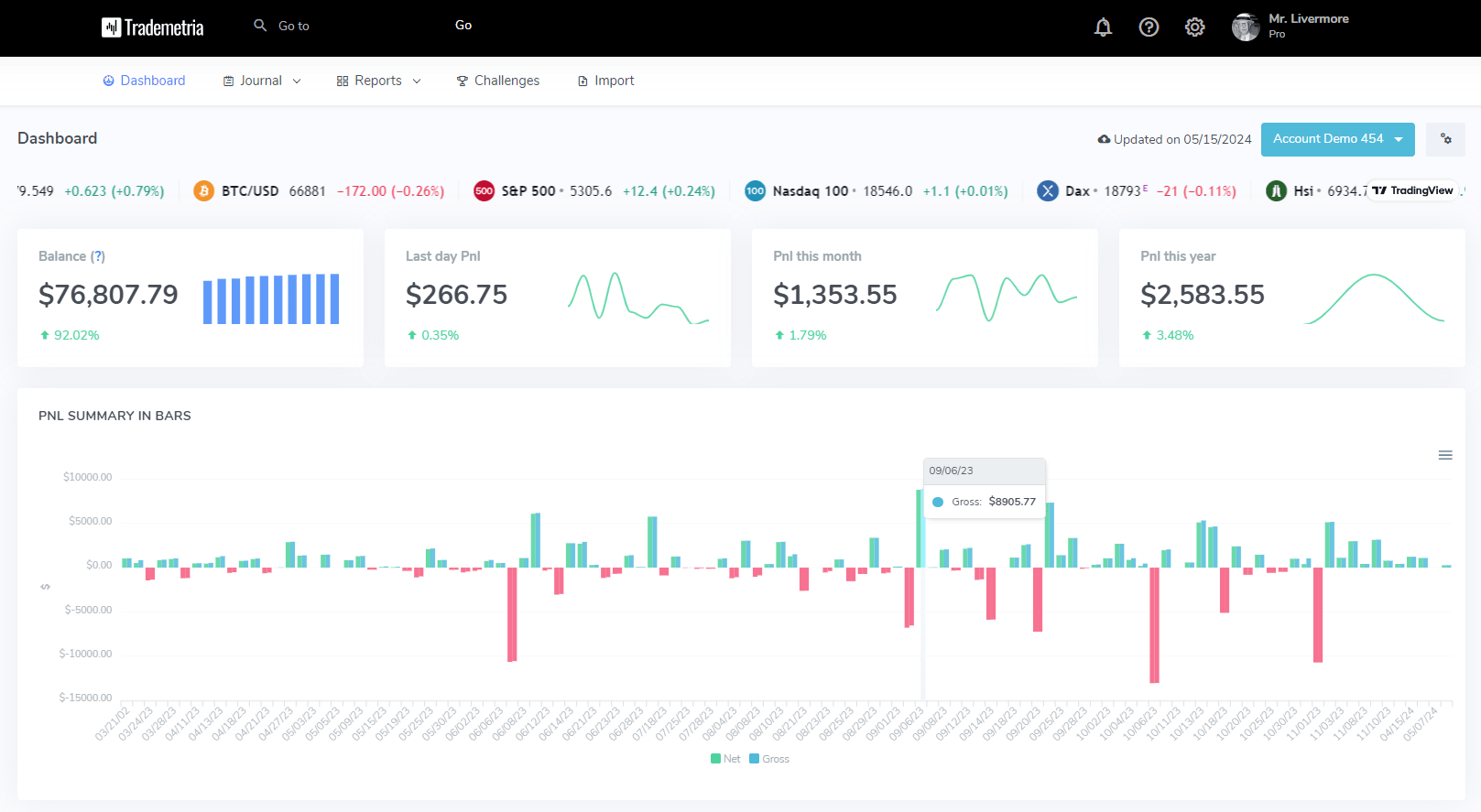

Advanced MetaTrader performance monitoring dashboard showing comprehensive analytics

Installation and Configuration Process

Setting up performance monitoring plugins in MetaTrader requires careful configuration to ensure optimal functionality:

Professional Tip

Many professional traders use multiple MetaTrader plugins simultaneously. The TakeProfit Tech suite offers integrated solutions that work seamlessly together, providing comprehensive performance monitoring without plugin conflicts.

Advanced MT Plugin Features

Modern MetaTrader performance plugins offer sophisticated features that rival standalone analytics platforms:

Plugin Integration Capabilities

Advanced MetaTrader plugins can integrate with external systems for enhanced functionality:

- Excel RTD Integration: Real-time data feeds to Excel for custom analysis

- API Connections: Connect with third-party analytics platforms

- Database Storage: Automatic backup of performance data

- Cloud Synchronization: Access your data from anywhere

- Mobile Notifications: Real-time alerts on performance milestones

TradingView Advanced Performance Indicators

Leverage TradingView’s powerful scripting language and community-driven indicators for sophisticated performance tracking and analysis.

Custom Performance Tracking Scripts

TradingView offers one of the most advanced platforms for creating custom performance indicators using Pine Script. These custom scripts can track complex performance metrics that aren’t available in standard platforms.

TradingView advanced performance dashboard with custom indicators

Essential TradingView Performance Indicators

The TradingView community has developed sophisticated performance tracking indicators:

Top Community Performance Indicators

Performance Table Indicator

Displays comprehensive performance metrics directly on your charts, including win rates, profit factors, and drawdown statistics.

- Real-time P&L calculations

- Risk-reward ratios

- Monthly/weekly performance breakdowns

- Customizable display options

Strategy Performance Monitor

Advanced backtesting results visualization with detailed performance analytics and risk management insights.

- Equity curve analysis

- Drawdown periods tracking

- Sharpe ratio calculations

- Monte Carlo simulations

Performance Strategy Templates

TradingView’s strategy testing feature provides comprehensive performance analysis for automated trading systems:

| Performance Metric | TradingView Standard | Premium Features | Professional Use |

|---|---|---|---|

| Backtesting Period | Limited historical data | Full market history | Tick-by-tick analysis |

| Performance Reports | Basic metrics | Detailed analytics | Custom report generation |

| Risk Analysis | Simple calculations | Advanced risk metrics | Portfolio-level analysis |

| Export Options | Screenshot only | Data export | API integration |

AI-Powered Performance Analysis

TradingView’s latest features include AI-powered performance analysis that can identify patterns in your trading behavior and suggest improvements:

Important Consideration

While TradingView’s performance analysis is comprehensive, it’s primarily designed for strategy backtesting rather than live trade tracking. For real-time performance monitoring of live trades, you’ll need to integrate with external platforms or use TradingView’s webhook functionality to send trade signals to performance tracking services.

Integration with External Performance Trackers

Professional traders often combine TradingView’s analytical power with dedicated performance tracking platforms:

- Webhook Integration: Send trade signals directly to platforms like TradersPost for automated execution and tracking

- CSV Export: Export backtesting results to external analytics platforms

- API Connections: Connect custom scripts with performance databases

- Alert System: Set up performance-based alerts for risk management

NinjaTrader and cTrader Performance Solutions

Explore the built-in and third-party performance monitoring solutions available for NinjaTrader and cTrader platforms.

NinjaTrader Performance Analysis

NinjaTrader offers some of the most comprehensive built-in performance analysis tools in the industry. The platform’s Trade Performance window and Strategy Analyzer provide institutional-grade analytics.

NinjaTrader’s comprehensive performance analysis dashboard

NinjaTrader’s Built-in Performance Features

NinjaTrader’s performance analysis capabilities are among the most advanced available:

Key Performance Analysis Components

- Trade Performance Window: Real-time analysis of executed trades with filtering and grouping options

- Strategy Analyzer: Comprehensive backtesting with Monte Carlo analysis and walk-forward optimization

- Performance Displays: Multiple view formats including summary, analysis, and graphical representations

- Risk Management Tools: Position sizing, risk-reward calculations, and drawdown analysis

- Custom Performance Indicators: Create your own performance metrics using NinjaScript

Professional Insight

NinjaTrader’s Trade Performance window can be configured to show real-time performance metrics in separate monitor windows. Professional traders often use this feature to maintain constant awareness of their performance statistics while actively trading, helping them make better risk management decisions.

cTrader Performance Monitoring

cTrader has evolved significantly in its performance monitoring capabilities, particularly with the introduction of cTrader Analyze and third-party solutions from platforms like ClickAlgo.

cTrader’s advanced performance monitoring and analysis tools

cTrader Analyze Features

cTrader’s built-in Analyze feature provides comprehensive performance tracking from multiple perspectives:

cTrader Analyze Capabilities

Performance Overview

- Total return and ROI calculations

- Win/loss ratios and percentages

- Average trade duration analysis

- Risk-adjusted return metrics

Advanced Analytics

- Time-based performance breakdowns

- Symbol and strategy comparisons

- Drawdown period analysis

- Correlation studies

Third-Party cTrader Solutions

The cTrader ecosystem includes powerful third-party performance monitoring solutions:

Platform Comparison: NinjaTrader vs cTrader

Both platforms offer unique advantages for performance monitoring, depending on your trading style and requirements:

NinjaTrader Advantages

- More comprehensive built-in analytics

- Advanced backtesting capabilities

- Extensive customization options

- Larger third-party ecosystem

- Professional-grade reporting tools

cTrader Advantages

- More intuitive user interface

- Better mobile integration

- Faster execution speeds

- More modern technology stack

- Better multi-broker support

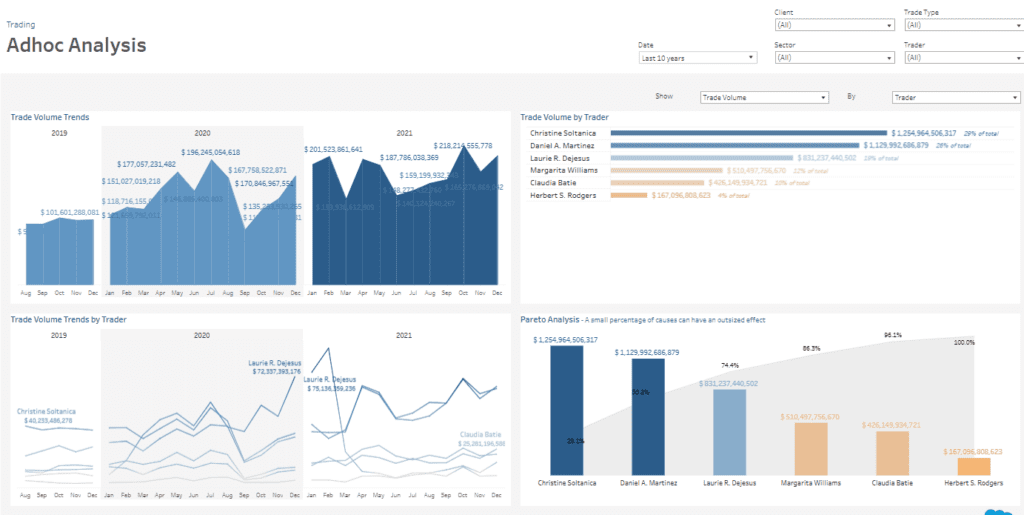

Advanced Automated Analysis Platforms

Discover cutting-edge automated analysis platforms that use artificial intelligence and machine learning for sophisticated performance monitoring.

AI-Powered Performance Analysis

The latest generation of performance monitoring tools leverages artificial intelligence to provide insights that were previously impossible to obtain manually. These platforms can identify subtle patterns in trading behavior and market conditions that affect performance.

Advanced AI-powered trading analytics dashboard with automated insights

Leading AI-Powered Platforms

Several platforms are pioneering the use of AI in trading performance analysis:

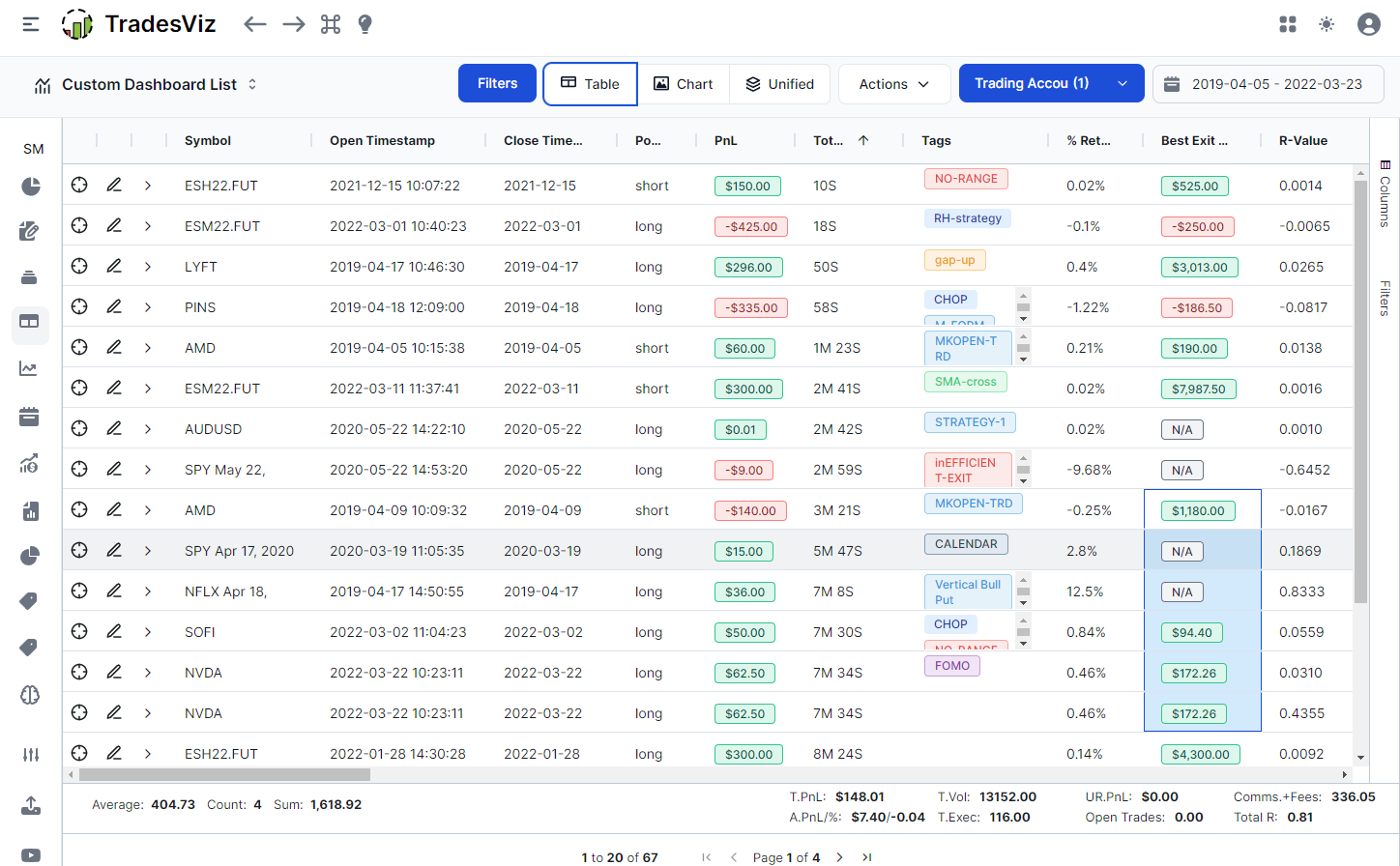

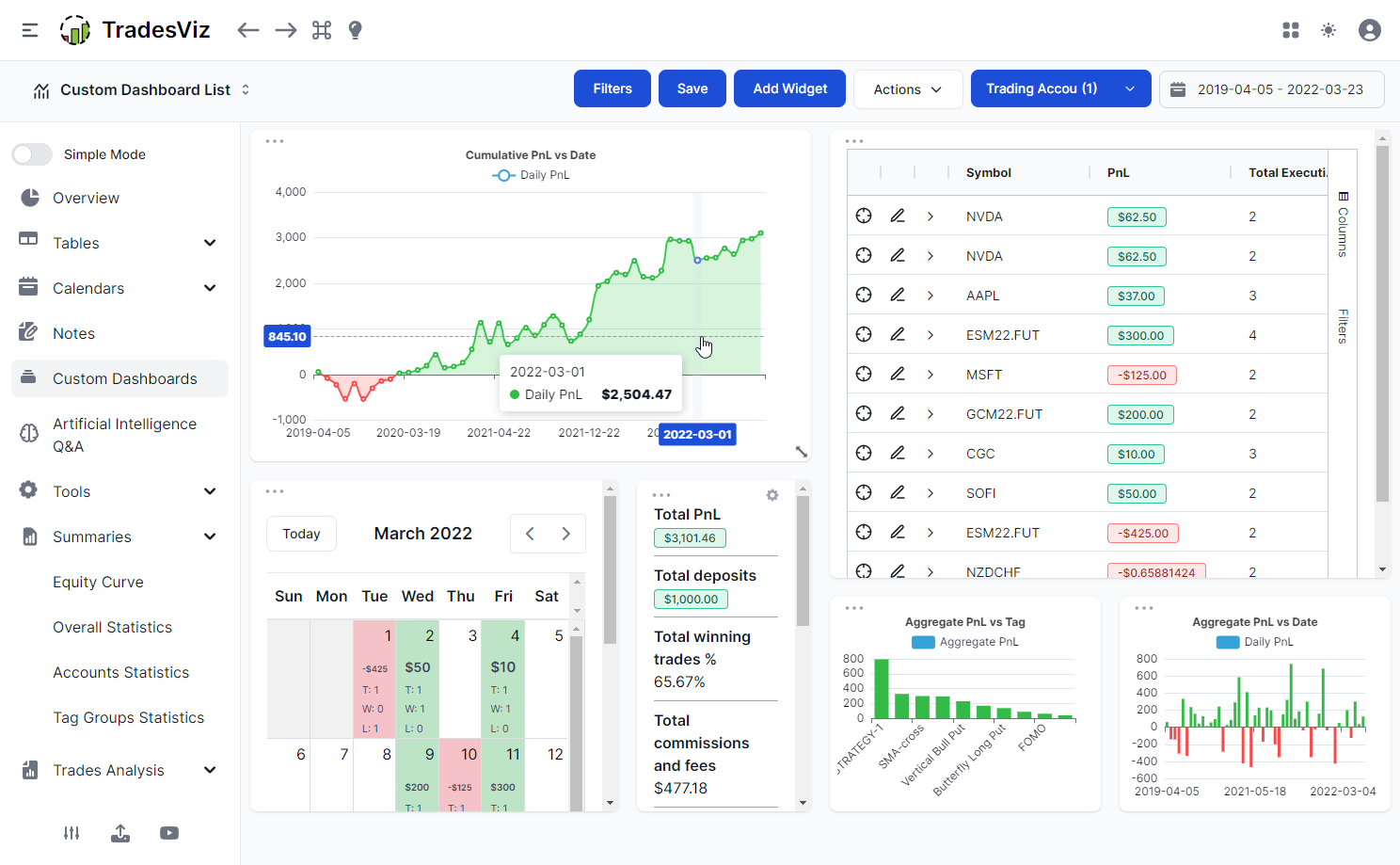

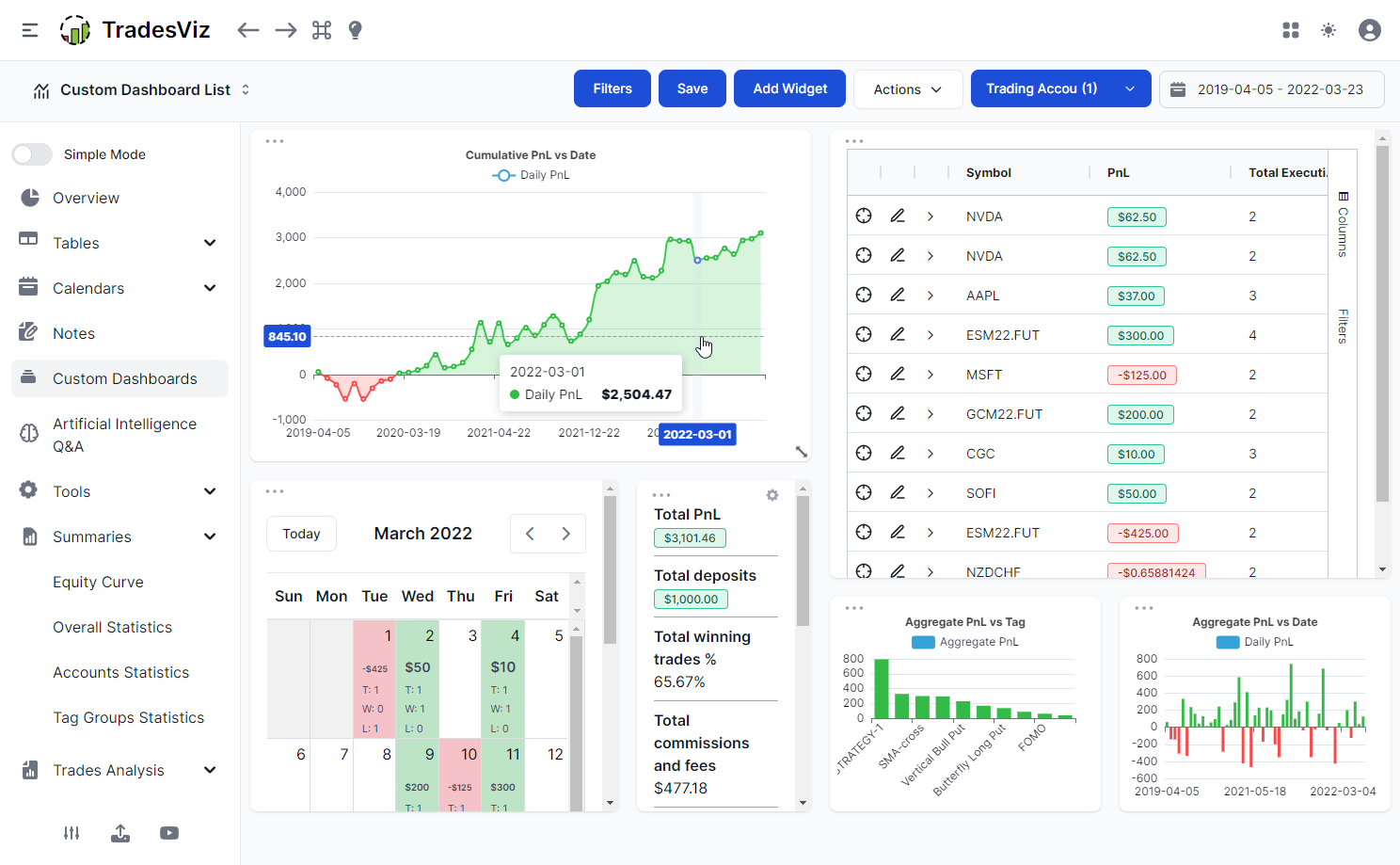

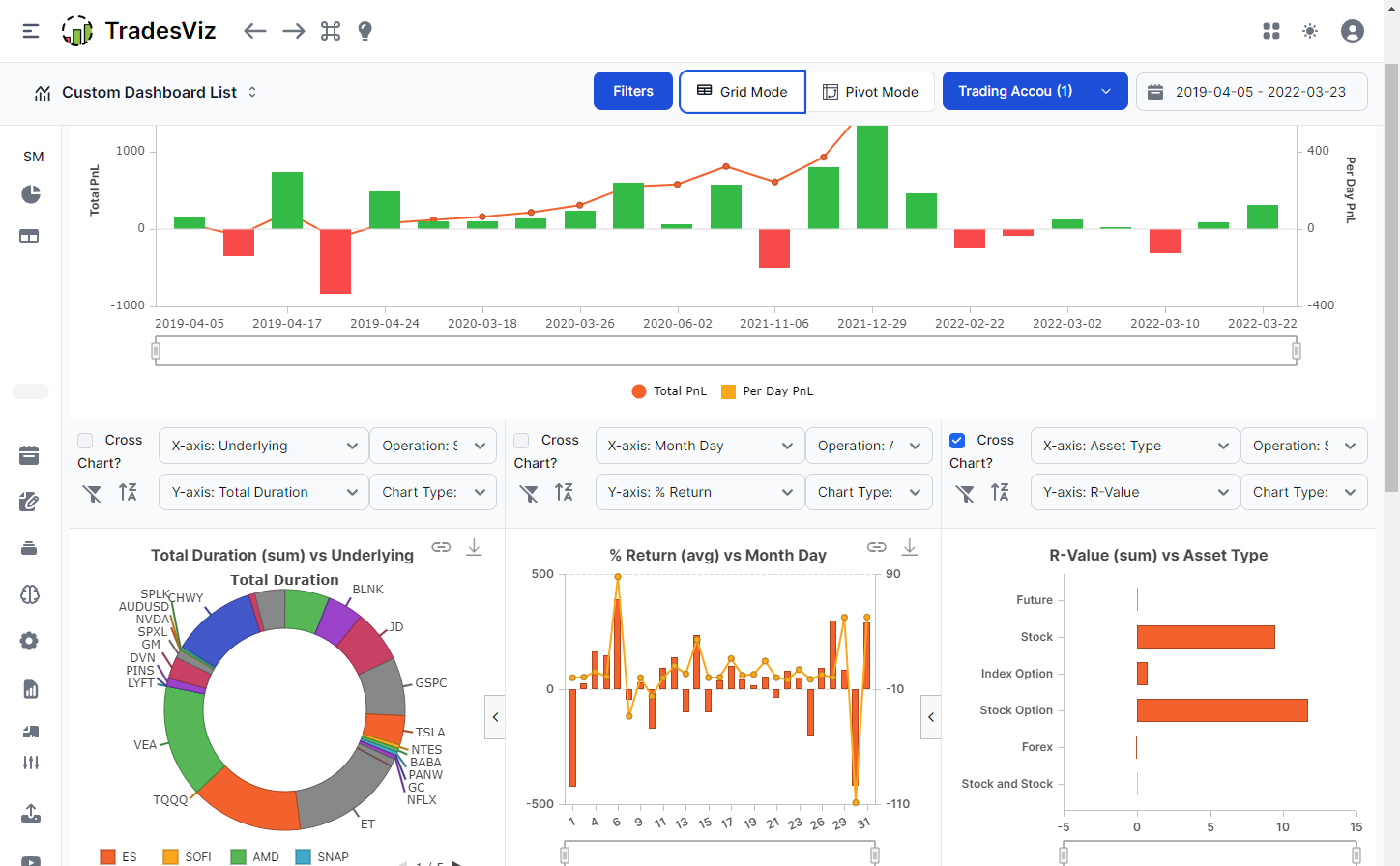

TradesViz

AI-powered journal with automated pattern recognition and performance optimization suggestions.

TrendSpider

All-in-one platform with automated technical analysis and strategy backtesting.

FOREX.com Analytics

Performance analytics with psychological insights and behavioral analysis.

Advanced Automation Features

Modern automated analysis platforms offer sophisticated features that go beyond traditional performance tracking:

- Behavioral Pattern Recognition: AI identifies recurring patterns in your trading decisions that lead to losses

- Market Condition Analysis: Correlates your performance with specific market conditions and volatility levels

- Predictive Analytics: Uses machine learning to predict likely outcomes of current positions

- Automated Optimization: Suggests specific changes to improve performance based on historical data

- Risk Prediction: Real-time assessment of portfolio risk based on current positions and market conditions

Integration and Automation Workflows

The most powerful setups combine multiple platforms in automated workflows that provide comprehensive performance monitoring without manual intervention:

Professional Workflow Example

Many institutional traders use a workflow where trading platforms automatically send trade data to performance analytics platforms via APIs, which then process the data using AI algorithms and send alerts and reports to mobile devices and email. This creates a completely automated performance monitoring system that requires no manual input.

Automated Workflow Components

Data Collection

- API integrations with brokers

- Automated trade imports

- Real-time market data feeds

- Economic calendar integration

Data Processing

- AI-powered analysis

- Statistical calculations

- Risk metric computations

- Performance comparisons

Automated Actions

- Alert notifications

- Report generation

- Dashboard updates

- Backup procedures

Security and Reliability Considerations

When implementing automated performance monitoring systems, security and reliability are paramount:

Critical Security Measures

- API Key Management: Use secure storage and rotation for API credentials

- Data Encryption: Ensure all data transmission and storage is encrypted

- Access Controls: Implement role-based access to performance data

- Backup Systems: Maintain redundant data storage and processing systems

- Audit Trails: Keep detailed logs of all automated actions and data changes

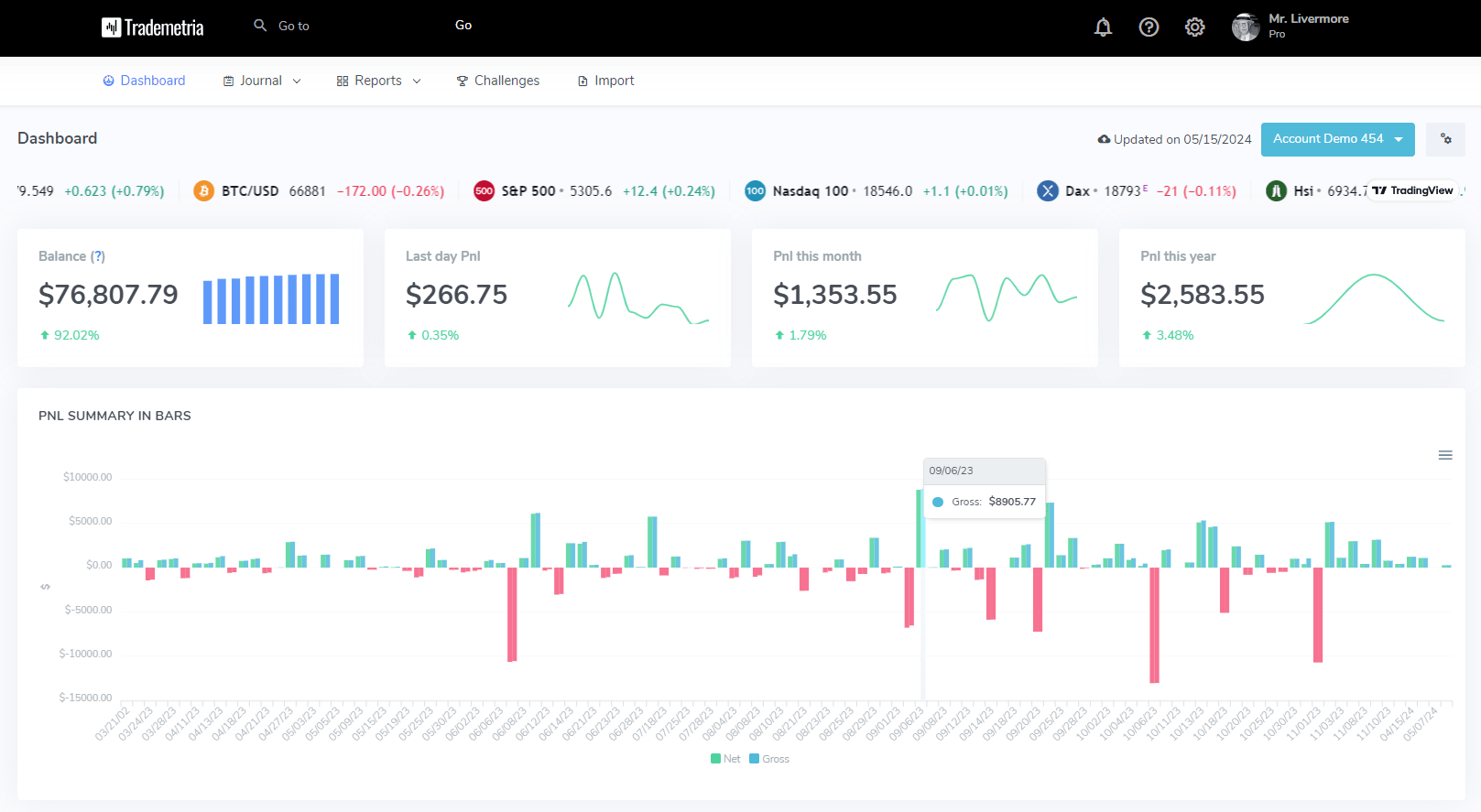

Real-Time Performance Dashboards

Advanced platforms now offer sophisticated real-time dashboards that provide instant insights into trading performance:

Professional real-time trading performance dashboard with comprehensive metrics

Key Dashboard Features

Modern performance dashboards include sophisticated visualization and analysis tools:

| Dashboard Element | Basic Features | Advanced Features | Enterprise Features |

|---|---|---|---|

| Performance Metrics | P&L, Win Rate | Sharpe Ratio, Drawdown | Risk-adjusted returns, Alpha/Beta |

| Visualization | Basic charts | Interactive graphs | 3D analytics, heatmaps |

| Alerts | Email notifications | SMS, mobile push | Integrated team messaging |

| Customization | Theme options | Custom layouts | White-label solutions |

Mobile-First Design

Leading performance monitoring platforms now prioritize mobile accessibility, recognizing that traders need access to their performance data regardless of location. Features include:

- Responsive dashboard design

- Native mobile applications

- Offline data synchronization

- Touch-optimized interface

- Voice command integration

Comprehensive Platform Comparison Analysis

Choosing the right performance monitoring tool can make the difference between trading success and failure. Each platform offers unique strengths, and understanding these differences is crucial for making an informed decision that aligns with your trading style and requirements.

Advanced trading analytics dashboard showing comprehensive performance metrics

Head-to-Head Platform Analysis

| Platform | Best For | Key Strengths | Automation Level | Price Range |

|---|---|---|---|---|

| TradeZella | Comprehensive Analysis | 50+ reports, Trade replay, Zella Score | Highly Automated | $29-99/month |

| Tradervue | Professional Traders | 80+ broker integrations, Advanced filtering | Fully Automated | $39-79/month |

| TraderSync | Pattern Recognition | AI-powered insights, Setup identification | Semi-Automated | $49-149/month |

| TradesViz | Visual Analytics | Custom dashboards, Pivot tables | Manual + Auto | Free-$29/month |

| MetaTrader Plugins | Platform Integration | Real-time monitoring, Native integration | Platform-Dependent | $50-300 one-time |

Platform Ranking by Use Case

🏆 Best Overall: TradeZella

Offers the most comprehensive feature set with excellent automation and user experience. Perfect for serious traders who want detailed analytics without manual work.

💼 Best for Professionals: Tradervue

Extensive broker support and advanced reporting make it ideal for professional traders and trading firms requiring detailed performance analysis.

🎯 Best for Beginners: TradesViz

Free tier available with intuitive interface. Great for new traders learning to analyze their performance without significant investment.

🔧 Best for Customization: MetaTrader Plugins

Direct platform integration allows for real-time monitoring and custom solutions tailored to specific trading strategies.

Advanced Optimization Strategies

Simply using a performance monitoring tool isn’t enough – you need to optimize your approach to extract maximum value. Here are proven strategies used by successful traders to transform their performance analysis into actionable improvements.

Advanced trading journal interface showing optimization features

The 5-Phase Optimization Framework

Phase 1: Data Collection Automation

- Set up automatic trade imports from all brokers

- Configure real-time sync for immediate analysis

- Implement backup data collection methods

- Standardize data formats across platforms

Phase 2: Metric Prioritization

- Focus on 5-7 key performance indicators

- Establish baseline measurements for comparison

- Create custom dashboards for quick insights

- Set up alerts for critical thresholds

Phase 3: Pattern Recognition

- Use AI-powered tools to identify winning patterns

- Analyze time-based performance variations

- Track emotional states during trades

- Identify market condition preferences

Phase 4: Systematic Improvement

- Implement weekly performance reviews

- Create action plans for identified weaknesses

- Test strategy modifications systematically

- Document all changes and their outcomes

Pro Tip: The 80/20 Rule for Performance Analysis

Focus 80% of your analysis time on the 20% of factors that have the biggest impact on your performance. Most traders waste time analyzing irrelevant metrics instead of focusing on what truly matters for their success.

Smart Selection Criteria and Decision Framework

Selecting the right performance monitoring solution requires a systematic approach. Use this comprehensive framework to evaluate tools based on your specific needs, trading style, and growth objectives.

Customizable trading dashboard showing selection criteria interface

The SMART Selection Matrix

Evaluation Categories (Rate 1-10 for each tool):

📊 Data Integration (25%)

- Number of supported brokers

- Automatic import capabilities

- Real-time sync reliability

- Historical data handling

📈 Analysis Depth (25%)

- Number of available reports

- Customization options

- Advanced filtering capabilities

- AI-powered insights

🚀 Ease of Use (20%)

- Interface intuitiveness

- Learning curve steepness

- Mobile accessibility

- Customer support quality

💰 Value Proposition (20%)

- Pricing vs. features ratio

- Scalability options

- Money-back guarantees

- Hidden costs evaluation

🔮 Future-Proofing (10%)

- Development roadmap

- Company stability

- Integration possibilities

- Technology stack modernity

Trader Profile Matching Guide

| Trader Profile | Recommended Tool | Key Features to Prioritize | Budget Range |

|---|---|---|---|

| Beginner Trader (<1 year experience) | TradesViz or TradeZella Basic | Simple interface, educational resources, basic metrics | $0-30/month |

| Intermediate Trader (1-3 years experience) | TradeZella Pro or Tradervue | Advanced analytics, pattern recognition, automation | $30-80/month |

| Professional Trader (3+ years experience) | TraderSync or Tradervue Premium | AI insights, custom reports, multi-account support | $80-150/month |

| Prop Firm Trader | Tradervue or TradeZella Enterprise | Risk management, compliance tracking, team features | $100-300/month |

| High-Frequency Trader | Custom MT4/5 Plugins | Real-time monitoring, low latency, custom metrics | $500-2000 setup |

Common Selection Mistakes to Avoid

- Choosing based on price alone without considering feature needs

- Selecting overly complex tools that won’t be fully utilized

- Ignoring integration capabilities with existing trading setup

- Not testing free trials before committing to paid plans

- Overlooking customer support quality and response times

Expert Recommendations and Best Practices

Based on extensive analysis and feedback from professional traders, here are the industry’s best practices for implementing and maximizing performance monitoring systems.

Professional trading performance analysis interface showing expert recommendations

The Master Trader’s Implementation Checklist

🎯 Week 1: Foundation Setup

- Install and configure your chosen platform

- Connect all trading accounts and brokers

- Import 3-6 months of historical data

- Set up basic dashboards and alerts

- Complete initial performance baseline

📊 Week 2-3: Customization

- Create custom tags for trade categories

- Design strategy-specific reports

- Configure automated email summaries

- Set up mobile notifications

- Integrate with existing trading tools

🚀 Week 4+: Optimization

- Analyze first month of data

- Identify top 3 improvement areas

- Create action plans for each area

- Implement weekly review routines

- Fine-tune monitoring parameters

Platform-Specific Recommendations

🏆 For TradeZella Users:

- Utilize the Zella Score for quick performance assessment

- Take advantage of trade replay features for execution analysis

- Join their educational bootcamps for platform mastery

- Use calendar view to identify time-based patterns

- Leverage the notebook feature for trading plan documentation

Best for: Traders who want comprehensive analysis with minimal manual input. Excellent for those who value detailed visual reports and educational resources.

💼 For Tradervue Users:

- Take advantage of the extensive broker integration library

- Use advanced filtering to drill down into specific scenarios

- Implement the P&L calendar for daily performance tracking

- Utilize comparison reports for strategy evaluation

- Export data for additional analysis in Excel or other tools

Best for: Professional traders and firms requiring robust data analysis capabilities and extensive broker support.

🎯 For TraderSync Users:

- Focus on the AI-powered pattern recognition features

- Use setup identification to refine entry strategies

- Implement the emotional tracking features

- Leverage the detailed execution analysis tools

- Take advantage of the comprehensive risk analysis reports

Best for: Traders who want to identify and perfect their best trading setups through pattern recognition and AI insights.

Expert Secret: The Compound Analysis Method

Don’t rely on a single tool. Top traders use a primary platform for daily monitoring and supplement it with specialized tools for deep-dive analysis. For example: TradeZella for daily tracking + custom Excel models for strategy backtesting + MT4 plugins for real-time monitoring.

Implementation Roadmap and Success Metrics

Success with performance monitoring tools requires a structured approach. Follow this proven roadmap to ensure maximum return on your investment and continuous improvement in your trading performance.

Trading performance implementation showing replay and analysis features

The 90-Day Transformation Plan

Days 1-30: Foundation Building

Goal: Establish baseline and basic tracking

- Complete platform setup and data integration

- Generate first comprehensive performance report

- Identify top 3 areas needing improvement

- Establish daily/weekly review routines

Success Metric: 100% trade capture rate with basic analysis completed

Days 31-60: Pattern Recognition

Goal: Identify profitable patterns and problem areas

- Analyze winning vs. losing trade characteristics

- Identify best performing time periods

- Document emotional patterns and triggers

- Refine strategy based on data insights

Success Metric: 15% improvement in win rate or average profit per trade

Days 61-90: Optimization and Scaling

Goal: Implement systematic improvements

- Implement strategy modifications based on analysis

- Automate alerts and monitoring systems

- Create custom dashboards for quick insights

- Establish long-term improvement goals

Success Metric: 25% improvement in overall profitability or risk-adjusted returns

Key Performance Indicators to Track

| Category | Primary Metric | Target Range | Review Frequency |

|---|---|---|---|

| Profitability | Net P&L, ROI, Sharpe Ratio | Positive trend, >1.5 Sharpe | Daily |

| Risk Management | Max Drawdown, Risk per Trade | <10% drawdown, 1-2% risk | Daily |

| Consistency | Win Rate, Consecutive Losses | >50% win rate, <5 losses | Weekly |

| Efficiency | Profit Factor, Average Trade | >1.5 factor, Positive average | Weekly |

| Psychological | Emotional State Scores | Stable patterns | Monthly |

Time Investment Requirements

Initial Setup: 4-8 hours for comprehensive platform configuration

Daily Maintenance: 10-15 minutes for review and updates

Weekly Analysis: 30-60 minutes for detailed performance review

Monthly Deep Dive: 2-3 hours for comprehensive analysis and strategy adjustments

Advanced Techniques and Future Trends

Stay ahead of the curve by implementing cutting-edge performance monitoring techniques and preparing for emerging trends in trading analytics. These advanced strategies are used by top-tier professional traders and institutional firms.

Advanced pivot table analysis showing sophisticated trading performance metrics

Emerging Technologies in Performance Monitoring

🤖 AI-Powered Analysis

- Machine learning pattern recognition

- Predictive performance modeling

- Automated strategy optimization

- Natural language processing for news impact

Available in: TraderSync, advanced TradeZella features

📱 Mobile-First Analytics

- Real-time performance notifications

- Voice-activated trade logging

- Augmented reality chart analysis

- Cross-platform synchronization

Leaders: TradeZella mobile, Tradervue apps

🔗 Blockchain Integration

- Immutable trade record keeping

- Decentralized performance verification

- Smart contract-based alerts

- Crypto trading specialized metrics

Emerging in: Specialized crypto platforms

🌐 Cloud-Native Solutions

- Unlimited data storage and processing

- Global accessibility and redundancy

- Automatic scaling and updates

- Enhanced security and compliance

Standard in: All major platforms

Professional Integration Strategies

Multi-Tool Ecosystem Approach

Professional traders don’t rely on single solutions. Here’s how to build a comprehensive monitoring ecosystem:

Core Platform (Primary)

- TradeZella or Tradervue for main analysis

- Daily performance tracking

- Automated report generation

- Historical data management

Real-Time Monitoring (Secondary)

- MT4/5 plugins for live tracking

- TradingView alerts and indicators

- Custom dashboard solutions

- Risk management overlays

Specialized Analysis (Tertiary)

- Excel models for custom calculations

- R or Python for statistical analysis

- Specialized sector analysis tools

- Economic calendar integrations

Future-Proofing Your Setup

Choose platforms that invest heavily in R&D and have clear development roadmaps. Look for API access, webhook support, and integration capabilities. The most successful traders adapt to new technologies quickly while maintaining consistent monitoring practices.

Conclusion and Final Recommendations

Performance monitoring is not just about tracking numbers – it’s about transforming your trading from guesswork into a data-driven, profitable business. The right tools and strategies can dramatically accelerate your path to consistent profitability.

🎯 The Ultimate Action Plan

Immediate Actions (This Week)

- Evaluate your current tracking methods

- Sign up for free trials of top 3 platforms

- Import your last 3 months of trading data

- Generate your first comprehensive report

Short-term Goals (Next Month)

- Choose and fully implement your primary platform

- Establish daily and weekly review routines

- Identify your top 3 improvement areas

- Create action plans for each area

Long-term Vision (Next Quarter)

- Achieve 25% improvement in key metrics

- Implement advanced automation features

- Build your complete monitoring ecosystem

- Share insights with trading community

Final Platform Recommendations by Trader Level

🌱 New Trader (0-1 year)

Recommended: TradesViz (Free tier) or TradeZella Basic

Focus: Learn the basics of performance analysis without overwhelming complexity

Budget: $0-30/month

📈 Developing Trader (1-3 years)

Recommended: TradeZella Pro or Tradervue Premium

Focus: Advanced analytics, pattern recognition, and strategy refinement

Budget: $30-80/month

🏆 Professional Trader (3+ years)

Recommended: TraderSync or Multi-platform ecosystem

Focus: AI insights, custom solutions, and comprehensive optimization

Budget: $80-200/month

Remember: Tools Don’t Make Traders

The most sophisticated monitoring platform in the world won’t make you profitable if you don’t act on the insights it provides. Success comes from consistent analysis, disciplined implementation of improvements, and unwavering commitment to data-driven decision making.

The Master Trader’s Final Secret

The difference between struggling and successful traders isn’t just skill – it’s the systematic approach to improvement. Performance monitoring tools provide the data, but your commitment to acting on that data determines your success. Start today, stay consistent, and let the compound effect of small improvements transform your trading career.