Risk-to-Reward Ratio: The Magic Formula for Capital Sustainability in Trading

Whale Empire

Risk-to-Reward Ratio: The Magic Formula for Capital Sustainability in Trading

In the world of financial trading, success or failure can depend on simple decisions. Among the most important concepts that any trader must master is the risk-to-reward ratio. This ratio is not just a number, but the foundation upon which strategies for preserving and growing capital in the long term are built.

In this article, we will delve into understanding the risk-to-reward ratio and explore how this magic formula can become a protective shield for your capital and a bridge to sustainable success in the volatile and risky world of trading.

What is Risk-to-Reward Ratio?

The risk-to-reward ratio is a measure used in the trading world to compare potential risk with the expected gain from a particular trade. In other words, it’s the relationship between the amount you could lose and the amount you could gain in a single trade.

Simple Expression of the Ratio

The risk-to-reward ratio is typically expressed as “1:X”, where 1 represents the unit of risk, and X represents the units of potential return. For example, if the ratio is 1:3, it means you’re risking one unit of capital for a potential gain of three units.

The lower this ratio (meaning the higher the second number), the better it is for the trader. A 1:3 ratio is better than a 1:1 ratio because in the first case, you’re risking one dollar for a potential profit of three dollars, while in the second case, you’re risking one dollar for a potential profit of just one dollar.

Basic Concepts

- Risk: The amount you might lose if the market moves against your expectations and reaches your stop-loss point.

- Reward: The amount you might gain if the market moves according to your expectations and reaches your profit target.

- Entry Point: The price at which you buy or sell the asset.

- Stop-Loss: The price at which you decide to exit the trade to limit your loss.

- Profit Target: The price at which you plan to take profits.

How to Calculate Risk-to-Reward Ratio

Calculating the risk-to-reward ratio is a simple process that depends on identifying key points in the trade. Here are the basic steps:

1. Determine Entry Point

This is the price at which you will open your position, whether buying or selling.

2. Determine Stop-Loss Level

Identify the price at which you will close the trade if the market moves against your expectations. This determines the size of the risk.

3. Determine Profit Target

Identify the price at which you plan to take profits. This determines the potential reward.

4. Calculate Risk and Reward

Risk = |Entry Point – Stop-Loss Level| × Position Size

Reward = |Entry Point – Profit Target| × Position Size

5. Calculate the Ratio

Risk-to-Reward Ratio = Risk ÷ Reward

Illustrative Example of Calculating the Ratio

Scenario: Buying XYZ Company Stock

- Entry Point: $100

- Stop-Loss: $95

- Profit Target: $115

- Position Size: 100 shares

Risk Calculation:

(100 – 95) × 100 = 5 × 100 = $500

Potential Reward Calculation:

(115 – 100) × 100 = 15 × 100 = $1,500

Risk-to-Reward Ratio Calculation:

500 ÷ 1,500 = 1:3

This means you’re risking one dollar for a potential profit of 3 dollars.

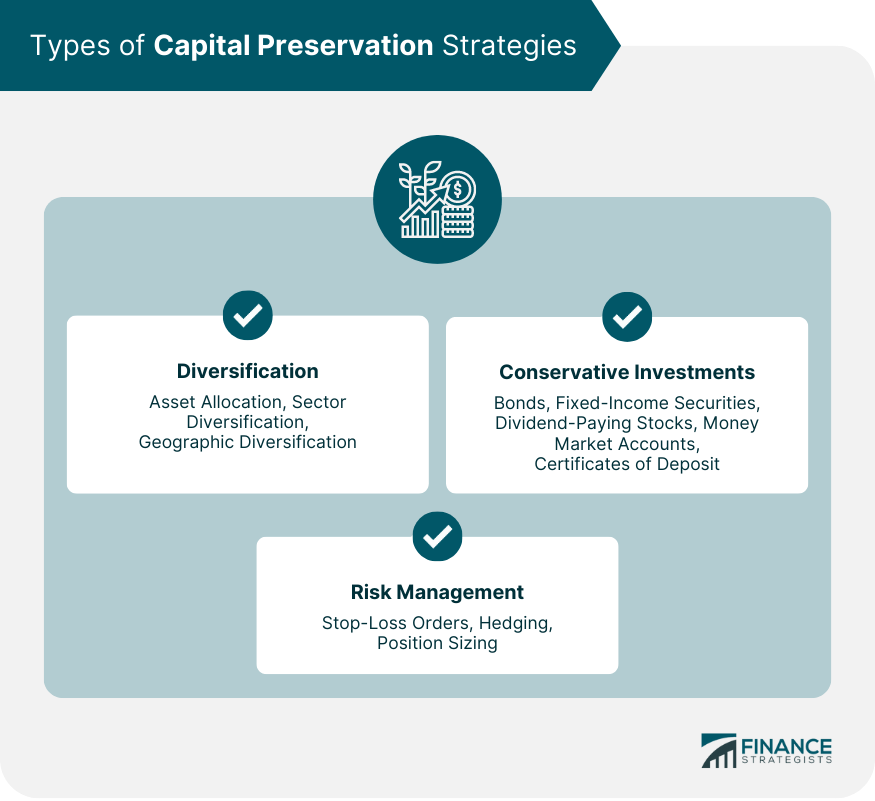

Importance of Risk-to-Reward Ratio in Capital Sustainability

The risk-to-reward ratio is one of the most important factors in sustaining capital over the long term. It’s not just about making profits, but about preserving capital and growing it sustainably.

“It’s not about how much you make, but how much you keep. Successful trading begins with preserving capital, not doubling it.”

Why is the Ratio Essential for Capital Preservation?

1. Recovery from Losses

Mathematically, the greater the loss percentage, the greater the profit percentage needed to recover. For example, if you lose 50% of your capital, you’ll need to achieve a 100% gain to recover your original capital. Therefore, using appropriate risk-to-reward ratios reduces the risk of large losses.

2. Long-term Profitability

Even with a low success rate, a trader can achieve long-term profitability if the risk-to-reward ratio is in their favor. For example, if your ratio is 1:3 and your success rate is only 40%, you’re still making a profit in the long run.

3. Reducing Psychological Pressure

When you’re confident that your strategy includes a good risk-to-reward ratio, you can better tolerate losses, which reduces psychological pressure and prevents you from making reckless decisions resulting from fear or greed.

Impact of Ratio on Capital Growth

| Risk-to-Reward Ratio | Break-even Success Rate |

|---|---|

| 1:1 | 50% |

| 1:2 | 33.3% |

| 1:3 | 25% |

| 1:4 | 20% |

| 1:5 | 16.7% |

The lower the risk-to-reward ratio, the lower the success rate needed to break even and start making profits.

Mathematical Reality

A series of consecutive losses can quickly destroy capital. If you risk 10% of your capital in each trade, 10 consecutive losses (which is possible) will result in losing about 65% of your original capital!

Optimal Risk-to-Reward Ratios

There is no perfect risk-to-reward ratio that suits all traders, all markets, and all trading strategies. However, there are some guidelines that can be relied upon.

Common and Recommended Ratios

1:2 Ratio

A moderate ratio that suits many trading styles and experience levels. It means you’re targeting a profit that is twice the amount you’re risking.

1:3 Ratio

An ideal ratio used by many professional traders. It provides a good margin for error as you can achieve profitability even with a success rate of 25%.

Higher Ratios (1:5 and above)

Suitable for strategies with low success rates, such as some breakout strategies or strategies aiming to capture large movements.

Statistics and Figures

According to studies conducted on successful traders, the majority of them use ratios ranging from 1:2 to 1:3, with a focus on applying strict risk management that does not exceed 1-2% of capital in a single trade.

Factors Affecting the Choice of Optimal Ratio

Market Type

Highly volatile markets may require higher ratios (such as 1:3 or more) to compensate for rapid movements, while lower ratios may be sufficient in more stable markets.

Trading Strategy

Trend-following strategies may benefit from higher ratios, while counter-trend trading strategies may need lower ratios with higher success rates.

Risk Tolerance

Conservative traders may prefer higher ratios (1:3 or more) to compensate for low success rates, while traders willing to take risks may accept lower ratios with higher success rates.

Time Frame

Short-term trading may use lower ratios (1:1.5 or 1:2) due to the nature of opportunities, while long-term trading strategies may target higher ratios (1:3 or more).

Practical Examples of Risk-to-Reward Ratio

Example 1: Stock Trading

Scenario: Buying a technology company’s stocks after price decline

- Current Stock Price (Entry Point): $50

- Stop-Loss: $45 (strong technical support)

- Profit Target: $65 (previous resistance)

- Position Size: 200 shares

Risk:

(50 – 45) × 200 = 5 × 200 = $1,000

Potential Reward:

(65 – 50) × 200 = 15 × 200 = $3,000

Risk-to-Reward Ratio:

1,000 ÷ 3,000 = 1:3

Analysis: This is an attractive trade with a 1:3 ratio, where the stop-loss aligns with a strong technical support level, and the profit target aligns with a previous resistance level.

Example 2: Currency Trading

Scenario: Selling EUR/USD after a bearish technical pattern breakout

- Selling Price (Entry Point): 1.1800

- Stop-Loss: 1.1850 (above the last peak)

- Profit Target: 1.1700 (previous support level)

- Position Size: 1 lot (100,000 units)

Risk:

(1.1850 – 1.1800) × 100,000 = 0.0050 × 100,000 = $500

Potential Reward:

(1.1800 – 1.1700) × 100,000 = 0.0100 × 100,000 = $1,000

Risk-to-Reward Ratio:

500 ÷ 1,000 = 1:2

Analysis: A 1:2 ratio is acceptable, especially if it’s part of a strategy with a high success rate (above 40%).

Example 3: Futures Trading

Scenario: Buying gold futures contracts after a bullish reversal pattern

- Purchase Price (Entry Point): $1,850

- Stop-Loss: $1,830 (strategic support)

- Profit Target: $1,905 (major resistance)

- Position Size: 2 contracts (200 ounces)

Risk:

(1,850 – 1,830) × 200 = 20 × 200 = $4,000

Potential Reward:

(1,905 – 1,850) × 200 = 55 × 200 = $11,000

Risk-to-Reward Ratio:

4,000 ÷ 11,000 = 1:2.75 (approximately 1:2.8)

Analysis: A good ratio close to 1:3, with a logical stop-loss and a target level that aligns with sound technical analysis.

Analysis and Lessons Learned

When reviewing the previous examples, we notice some important points:

- Placing stop-losses at logical technical levels (support/resistance) rather than arbitrarily

- Setting profit targets based on clear technical levels

- Choosing risk-to-reward ratios ranging from 1:2 to 1:3 for balance between profitability and realism

- Adjusting position size to match acceptable risk from capital (1-2%)

Strategies for Implementing Risk-to-Reward Ratio in Trading

1. Search for High-Ratio Opportunities

Systematic search for trading opportunities that offer high risk-to-reward ratios (1:3 or better) can significantly improve your portfolio performance.

Implementation Steps:

- Develop a checklist for potential trades

- Identify key support and resistance levels in advance

- Determine ideal entry zones near support/resistance levels

- Calculate the ratio before entering any trade

- Reject trades with unfavorable ratios (less than 1:2)

2. Apply the 2% Rule

Never risk more than 2% of your capital in any single trade, no matter how attractive the opportunity, to ensure capital sustainability.

Implementation Steps:

- Determine the allowable risk amount (2% of capital)

- Calculate position size based on the distance between entry point and stop-loss

- Adjust position size when market conditions change

- Reduce risk percentage to 1% during periods of high volatility

- Review and adjust risk after a series of losses

3. Adapt Ratios According to Market

Adjust target risk-to-reward ratio based on current market conditions, time frame, and trading strategy.

Implementation Steps:

- Use higher ratios (1:3 or more) in markets with clear trends

- Settle for lower ratios (1:1.5) in oscillating markets

- Increase ratios in longer time frames

- Adapt ratios to the nature of traded assets

- Record and analyze the most successful ratios in different market types

4. Trailing Stop Strategy

Improve risk-to-reward ratio by moving the stop-loss as the price moves in the direction of profit, increasing potential reward and reducing risk.

- Identify key points to move stop-loss

- Secure profits gradually

- Reduce risk as the trade progresses

- Dynamically increase risk-to-reward ratio

5. Multiple Exit Strategy

Improve risk-to-reward ratio by dividing the exit from the trade into several stages, ensuring some profits while continuing to target larger returns.

Example:

Position size of 300 shares with entry at $50 and stop-loss at $45:

- First exit: 100 shares at $55 (1:1 ratio)

- Second exit: 100 shares at $60 (1:2 ratio)

- Third exit: 100 shares at $70 (1:4 ratio)

- Move stop-loss to breakeven after first exit

Risk-to-Reward Ratio Tracking Log

One of the most important strategies for implementing risk-to-reward ratio is documenting and analyzing the performance of different ratios in your trades

| Period | Number of Trades | Risk-to-Reward Ratio | Success Rate | Net Return |

|---|---|---|---|---|

| Q1 2023 | 42 | 1:2 | 45% | +12.6% |

| Q2 2023 | 38 | 1:3 | 35% | +15.2% |

| Q3 2023 | 52 | 1:2.5 | 42% | +17.8% |

| Q4 2023 | 45 | 1:2.8 | 38% | +14.5% |

Example of a tracking log showing the impact of different risk-to-reward ratios on portfolio performance

Conclusion

The risk-to-reward ratio is not just a theoretical concept, but a practical and effective tool that forms the cornerstone of successful trading strategies. Understanding and correctly applying this ratio can make a fundamental difference in your portfolio’s performance over the long term.

Key Points:

- The ideal risk-to-reward ratio ranges from 1:2 to 1:3 for most traders

- Using the 1-2% rule to limit risk in each trade ensures capital sustainability

- Adapting the ratio according to market conditions, trading strategy, and time frame

- Documenting and analyzing the performance of different ratios helps improve strategy over time

- Discipline and commitment to predetermined ratios is critical for long-term success

Finally, remember that the risk-to-reward ratio is part of an integrated risk management system. It works alongside appropriate position sizing, capital management rules, and adherence to a trading plan. When these elements come together, they form a protective shield that safeguards your capital and ensures its sustainability in the long trading journey.

“It’s not about how much you make in winning trades, but how much you lose in losing trades. Risk management is what distinguishes successful traders from others in the long run.”

Practical Steps to Get Started

- Analyze your previous trades and calculate actual risk-to-reward ratios

- Determine the ideal ratio that suits your trading style

- Develop a checklist to evaluate each potential trade from a ratio perspective

- Determine position size in accordance with the 1-2% rule of capital

- Create a log to track the performance of different ratios and analyze them

- Review and adjust your strategy periodically based on collected data