The Persistent Silver Market Deficit: Supply and Demand Analysis for 2025

The global silver market will experience a deficit for the fifth consecutive year in 2025, reflecting a structural shift in the supply and demand dynamics of this precious metal. According to the latest reports from the Silver Institute, this deficit is expected to reach 117.6 million ounces in 2025, representing a 21% decrease from the previous year, yet still remaining at historically significant levels that reflect the continuing imbalance between supply and demand.

“The persistent deficit in the silver market for the fifth consecutive year indicates a structural shift in the market for this metal, driven by increased industrial and technological applications that exceed the ability of mines to increase production.”

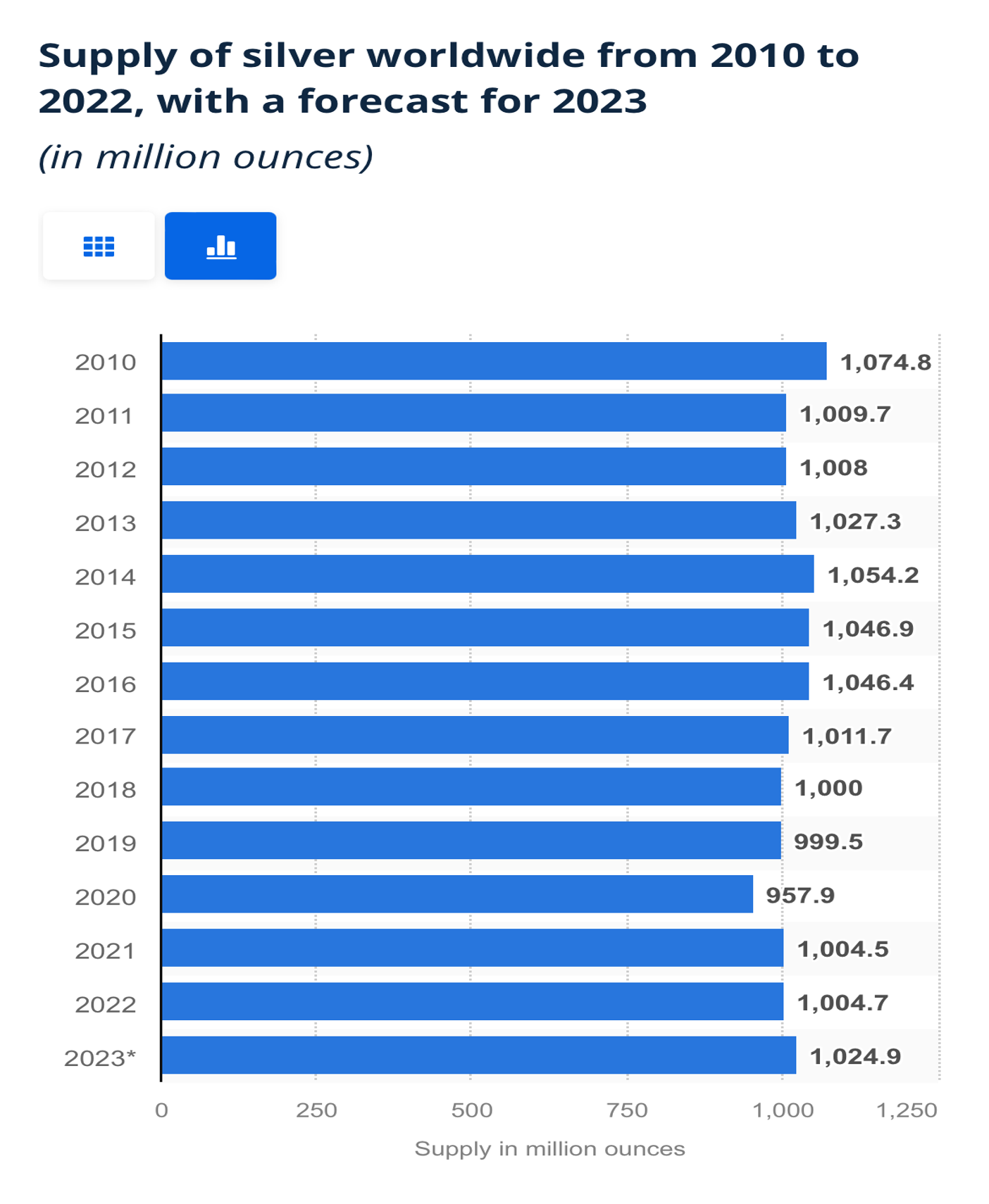

Supply and Demand Imbalance: Figures and Analysis

Analysis chart of supply and demand in the silver market and the deficit expected to continue in 2025

According to the latest World Silver Survey, global silver supply is expected to reach about 1.031 billion ounces in 2025, compared to a total demand estimated at around 1.148 billion ounces, resulting in a deficit estimated at 117.6 million ounces. This deficit, despite decreasing by 21% from 2024, represents the fifth consecutive year in which the market has experienced a supply shortage.

Global Silver Market Forecast for 2025

- Total Supply: 1.031 billion ounces (2% increase from 2024)

- Total Demand: 1.148 billion ounces (1% decrease from 2024)

- Expected Deficit: 117.6 million ounces (21% decrease from 2024)

- Expected Price: Increase to between $35-40 per ounce by the end of 2025

This persistent deficit is considered one of the key factors expected to support higher silver prices in the medium term, with some estimates suggesting the price per ounce could reach $40 by the third quarter of 2025, representing a 17% increase from October 2024 levels.

Silver price trends and bullish patterns expected as a result of the continued supply deficit

Demand Growth Factors

- Record growth in industrial applications, with industrial demand reaching a historic level of 680.5 million ounces in 2024

- Increased use of silver in renewable energy technologies, especially photovoltaic solar panels

- Artificial intelligence applications and advanced electronics requiring increasing amounts of silver

- Improved investment demand for coins and bars by 7% in 2025 after a 22% decline in 2024

- Increased demand in emerging markets, especially India and China

Supply Side Challenges

- Limited growth in mine production due to declining ore grades and lack of new investments

- Reduced silver production as a byproduct from copper, lead, and zinc mines

- Geopolitical challenges in some major producing countries such as Mexico and Peru

- Rising mining costs due to inflation and increasing environmental constraints

- Declining recycling rates as a source of supply compared to growing demand

Growing Industrial Demand: The Main Driver of the Silver Market

The growing role of silver in electronics manufacturing and advanced technology

Industrial demand for silver has seen record growth, reaching an unprecedented level of 680.5 million ounces in 2024, driven by technological developments and the global shift towards a green economy. Forecasts indicate this growth will continue in 2025, with increasing use of silver in a variety of industrial applications that require its unique properties of excellent electrical and thermal conductivity and corrosion resistance.

“Silver is not just a precious metal or investment tool, but a fundamental raw material for the technological revolution and the transition to clean energy. This dual role makes it unique among precious metals and determines its price future.”

Solar Energy

The solar panel industry consumes large quantities of silver in electrode paste, with each solar cell using approximately 1/3 gram of silver. With the global expansion of renewable energy projects, demand in this sector is expected to double.

Electric Vehicles

An electric vehicle contains two to three times more silver than a conventional car, used in conductors, batteries, and various electronic systems. With the global acceleration towards electric vehicles, demand for silver in this sector is growing.

Artificial Intelligence Applications

The expansion of AI systems and advanced computing requires high-performance electronic components that use silver extensively in integrated circuits, cooling systems, graphics processing units (GPUs), and big data infrastructure.

Other Industrial Uses of Silver

Medical Applications

- Antibacterial bandages and products used in wound care

- Coating medical devices to prevent the spread of infection

- Water purification systems using silver’s antimicrobial properties

- Increasing uses in advanced medical technologies and wearable devices

Electronics and Communications

- Multi-layer capacitors and electrical switches

- Fifth generation (5G) technologies and wearable devices

- Printed electronics and conductive inks

- Advanced mirrors and low-emissivity glass in smart buildings

Silver Production Challenges and Limited Supply

Analysis of silver supply trends and expected deficit in the global market during 2025

Mine Production Limitations

Despite rising silver prices, mine production still faces significant challenges that limit its ability to meet growing demand. Global mine production is expected to increase by a modest 2-3% in 2025, and this limited growth is insufficient to cover the increase in industrial demand.

- Declining silver concentration grades in extracted ores

- Rising extraction and operational costs

- Increasing environmental restrictions on mining activities

- Lack of new investments in exploration and mine development

Global Production Structure

More than 70% of global silver production comes as a byproduct from mines primarily targeting other metals such as gold, copper, lead, and zinc. This means that silver production is largely tied to the production of these other metals, which limits the flexibility of supply in responding to rising prices.

Largest Silver Producing Countries (2024):

- Mexico: 198.5 million ounces (23% of global production)

- Peru: 136.2 million ounces (16% of global production)

- China: 118.7 million ounces (14% of global production)

- Russia: 43.5 million ounces (5% of global production)

- Poland: 40.3 million ounces (5% of global production)

Declining Role of Recycling as a Supply Source

2024 saw a decline in silver supplies from recycling, and these trends are expected to continue in 2025. Despite higher prices, the quantities available for recycling are limited as many industrial silver applications consume small amounts in each product, making recovery economically unfeasible.

Silver supplies from recycling decreased by 15% in 2023 and increased slightly by only 2% in 2024. They are expected to remain stable in 2025 at around 170 million ounces, which represents only about 17% of the total global supply.

Comparison between supply and demand in the silver market and the persistent supply shortage

Silver Price Outlook and Investment Opportunities in 2025

Silver price forecasts and potential increase during 2025

With the persistent supply deficit, analyst forecasts point toward further increases in silver prices during 2025. According to a report by WisdomTree, the price per ounce is expected to reach $40 by the third quarter of 2025, a 17% increase from October 2024 levels.

“Silver may finally be a better investment opportunity than gold in 2025, especially with the continued structural deficit in the market and the expanding range of growing industrial applications.”

Some analysts point to the possibility of silver prices reaching new record levels exceeding $50 per ounce in the coming years, driven by the ongoing supply deficit and increasing demand from emerging technology sectors, particularly in clean energy and artificial intelligence.

Short-Term Outlook

- Continued upward momentum with price volatility

- Potential move towards $35 per ounce in the first half of 2025

- Prices affected by global economic factors and central bank policies

- Improvement in the Gold-to-Silver Ratio in favor of silver

Medium-Term Outlook

- Strengthening price gains with continued supply deficit

- Increased investment demand as investors become aware of the opportunity

- Potential reach to $40-45 per ounce by the end of 2025

- Increasing pressure on globally available silver inventories

Long-Term Outlook

- Potential to exceed the historic level of $50 per ounce after 2026

- Permanent structural shift in the silver market towards chronic supply shortage

- Increasing strategic importance of silver as an essential industrial metal

- Potential concerns about silver availability for certain industrial applications

Investment Opportunities in the Silver Market

Direct Silver Investment

- Physical silver bars and coins as a store of value

- Exchange-Traded Funds (ETFs) backed by physical silver

- Futures and options contracts for experienced investors

- Allocated silver accounts with specialized companies

Indirect Investment

- Shares of leading silver mining companies

- Diversified mining funds that include silver

- Companies specializing in industrial silver applications

- Solar energy technology companies with high silver consumption

Risks and Challenges That May Affect Silver Market Forecasts

Economic Risks

A slowdown in global economic growth could reduce industrial demand for silver, particularly in manufacturing and technology sectors. Higher interest rates for extended periods may also negatively affect silver’s attractiveness as an investment.

Technological Development

Technological developments may reduce the amount of silver used in some industrial applications, such as reducing silver content in solar cells or finding less expensive alternatives in some uses, especially as prices rise.

Production Increase

Higher prices may encourage new investments in silver exploration and mine development, which could lead to increased supply in the future. Advances in mining technologies may also allow for the economical extraction of lower-grade ores.

Long-term technical analysis of silver price shows the potential for a bullish pattern breakout in 2025-2026

Critical Factors That Will Determine Market Direction in 2025

- Central Bank Policies: Interest rate trends and their impact on the US dollar and precious metals

- Industrial Demand Growth: Especially in renewable energy and artificial intelligence sectors

- Return of Silver Investment: Extent of recovery in demand for silver coins and bars

- Geopolitical Stability: In key producing countries such as Mexico and Peru

- Global Inflation: Its effect on silver as a safe haven and on production costs

- Pace of Global Energy Transition: Government policies worldwide and their impact on demand

- Gold Price Movements: The historical relationship between the two metals and the gold-to-silver ratio

- Production Technology Evolution: Improvements in silver usage efficiency in industrial applications