How to Profit from Distressed Stocks: Investing in Struggling Companies

Discovering Opportunities in Low-Price Stocks

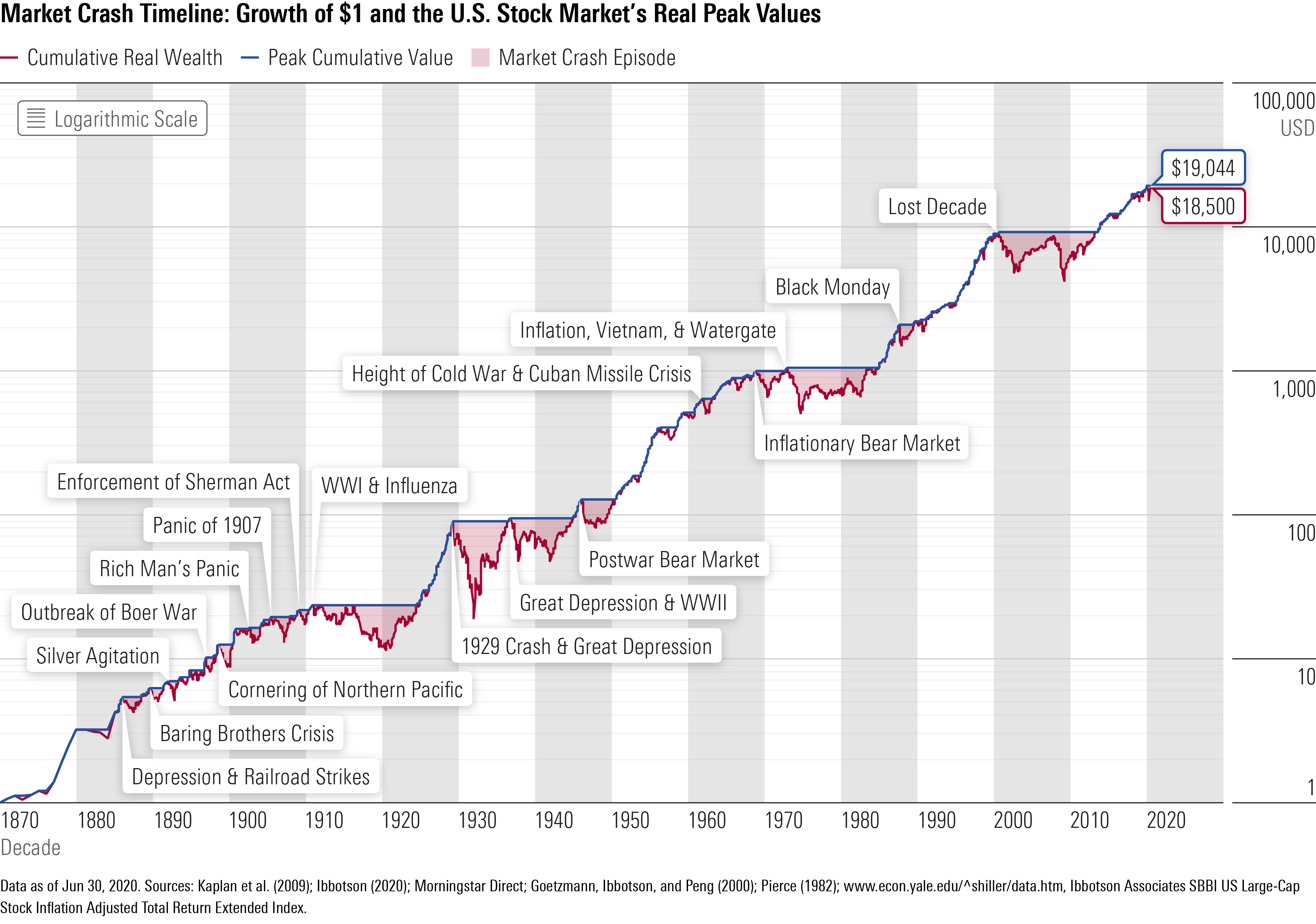

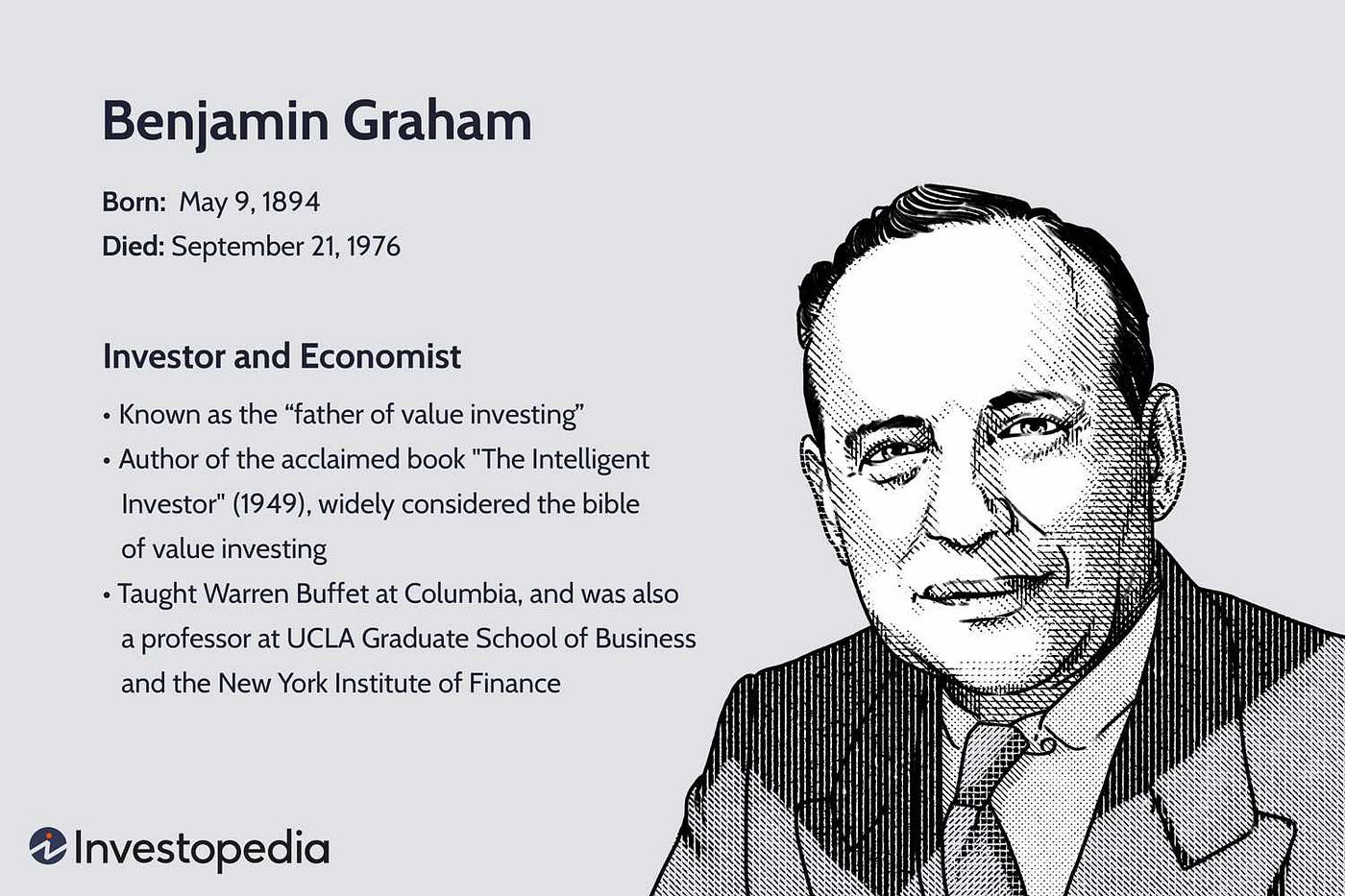

While most investors flee from financially troubled companies, savvy distressed stock investors see opportunity where others see only danger. This comprehensive guide reveals how legendary investors like Warren Buffett and Benjamin Graham built massive fortunes by investing in struggling companies that the market had abandoned.

Key Insight

Distressed investing isn’t about gambling on failing companies—it’s about identifying fundamentally sound businesses trading at deep discounts due to temporary challenges or market overreaction.

Understanding Distressed Stock Investing

Distressed investing is the practice of buying stocks or bonds of companies facing significant business problems, typically trading at very low multiples of earnings or net assets. These companies often trade below their intrinsic value due to temporary setbacks, market panic, or systematic investor bias against troubled firms.

Types of Financial Distress

Temporary Operational Challenges

Companies facing short-term issues like supply chain disruptions, regulatory changes, or cyclical downturns. These firms often have strong fundamentals but are experiencing temporary headwinds.

Cyclical Industry Pressures

Businesses in cyclical industries like commodities, real estate, or automotive that experience regular boom-bust cycles. Smart investors buy during the bust phase.

High Leverage Situations

Companies with heavy debt loads that face refinancing challenges or covenant violations. These situations require careful analysis of the debt structure and asset coverage.

“The time of maximum pessimism is the best time to buy, and the time of maximum optimism is the best time to sell.”

Why Most Investors Avoid Distressed Stocks

Understanding why the majority of investors systematically avoid distressed stocks is crucial to grasping why opportunities exist in the first place. This avoidance creates the very market inefficiencies that skilled distressed investors exploit.

Psychological Barriers

- Loss Aversion: Investors fear losing money more than they desire gains, leading to premature selling of distressed positions

- Confirmation Bias: Bad news about troubled companies receives disproportionate attention, reinforcing negative sentiment

- Herding Behavior: Institutional investors often cannot afford to be wrong alone, leading to mass exodus from distressed names

- Career Risk: Professional money managers avoid distressed stocks to protect their careers from short-term underperformance

:max_bytes(150000):strip_icc()/stock-market-crash-of-2008-3305535-v4-5b61eb93c9e77c004fa0a4ad.png)

The Net Net Stocks Strategy: Benjamin Graham’s Secret Weapon

Net net stocks represent one of the most powerful distressed investing strategies ever developed. Created by Benjamin Graham, this approach focuses on companies trading below their net current asset value (NCAV), essentially buying businesses for less than their liquidation value.

Understanding Net Current Asset Value (NCAV)

NCAV Calculation Formula

NCAV = Current Assets – Total Liabilities

NCAV per Share = NCAV ÷ Shares Outstanding

Graham’s Rule: Buy when Stock Price ≤ (2/3 × NCAV per Share)

Graham’s Net Net Criteria

| Criteria | Requirement | Purpose |

|---|---|---|

| Stock Price | ≤ 67% of NCAV per Share | Ensure adequate margin of safety |

| Debt-to-Equity | < 30% | Minimize bankruptcy risk |

| Current Ratio | > 2.0 | Ensure liquidity |

| Earnings | Positive in last 10 years | Demonstrate business viability |

| Dividend | Paid in last 20 years | Show management shareholder focus |

“The purchaser of such shares, at two-thirds or less of their net current asset value, need have little to fear from unfavorable developments.”

Historical Performance of Net Net Stocks

Academic studies have consistently shown that net net stocks deliver exceptional returns. Research spanning decades indicates that portfolios of net net stocks have generated annual returns of 20-30%, significantly outperforming broader market indices.

Warren Buffett’s “Cigar Butt” Investment Philosophy

Before evolving into the quality-focused investor we know today, Warren Buffett built his early fortune using a distressed investing strategy he colorfully termed “cigar butt” investing. This approach involved finding companies so cheap that even if they were nearly worthless, you could still extract one last profitable “puff” from them.

:max_bytes(150000):strip_icc()/buffetts-road-to-riches-05f95062a9554d688bab91b1c3515a5d.png)

The Cigar Butt Philosophy Explained

Deep Value Focus

Look for companies trading at significant discounts to their tangible book value, often selling for less than their working capital alone.

Short-Term Horizon

Unlike buy-and-hold strategies, cigar butt investing often involves shorter holding periods, typically 1-3 years until value is realized.

Margin of Safety

Purchase stocks at such low prices that even if the business deteriorates further, the downside risk is limited while upside potential remains substantial.

Buffett’s Early Success Stories

During his partnership years (1957-1969), Buffett consistently generated annual returns exceeding 25% by applying cigar butt principles. Some of his most profitable investments included:

- Sanborn Map Company (1958-1960): Bought at $45, sold at $65+ when the company distributed valuable securities

- Dempster Mill Manufacturing (1961-1963): Acquired controlling interest in a struggling farm equipment company, improved operations, and realized significant gains

- Berkshire Hathaway (1962-1965): Initially a cigar butt textile investment that became his holding company platform

“A cigar butt found on the street that has only one puff left in it may not offer much of a smoke, but the ‘bargain purchase’ will make that puff all profit.”

Contrarian Investing: Profiting from Market Pessimism

Contrarian investing forms the philosophical backbone of successful distressed stock investing. This approach involves deliberately going against prevailing market sentiment, buying when others are selling, and maintaining conviction when popular opinion suggests otherwise.

Core Contrarian Principles

Identifying Contrarian Opportunities

Negative Media Coverage

Companies facing intense negative media scrutiny often present contrarian opportunities, especially when the issues are temporary or overblown.

Extreme Valuation Discounts

Stocks trading at historically low multiples relative to earnings, book value, or sales often indicate oversold conditions.

Institutional Selling

Heavy institutional selling pressure can create temporary price distortions unrelated to fundamental business value.

Sector-Wide Pessimism

When entire industries fall out of favor, quality companies within those sectors can be purchased at significant discounts.

Contrarian Investment Checklist

- Strong balance sheet with low debt levels

- Temporary rather than permanent business challenges

- Competent management with aligned incentives

- Trading below intrinsic value despite negative sentiment

- Clear catalyst for value realization

Essential Tools and Resources for Distressed Investing

Successful distressed investing requires access to specialized screening tools, research platforms, and analytical resources. Here are the essential tools used by professional distressed investors:

Stock Screening Platforms

Net Net Hunter

Specialized platform for finding net net stocks worldwide. Offers comprehensive screening tools based on Benjamin Graham’s criteria.

Visit Net Net HunterGuruFocus

Professional platform offering Graham-style NCAV screening, financial strength analysis, and valuation tools.

Explore GuruFocusFinviz

Powerful stock screener with filters for distressed situations including low P/E, P/B ratios, and financial distress indicators.

Access FinvizEDGAR Database

SEC’s official database for accessing company filings, essential for analyzing distressed companies’ financial statements and legal proceedings.

Browse EDGARResearch and Analysis Resources

- Morningstar: Comprehensive financial data and analysis tools for fundamental research

- Value Line: Independent investment research with focus on valuation metrics

- Bloomberg Terminal: Professional-grade platform for real-time data and analysis

- S&P Capital IQ: Institutional research platform with extensive financial databases

- Seeking Alpha: Community-driven research platform with diverse analytical perspectives

Educational Resources

“Security Analysis” by Graham & Dodd

The foundational text for value and distressed investing, essential reading for serious practitioners.

Buy on AmazonColumbia Business School Value Investing Program

Prestigious program following Graham’s teachings, offering comprehensive education in value investing principles.

Learn MoreRisk Management in Distressed Investing

While distressed investing offers exceptional return potential, it requires sophisticated risk management techniques to protect capital and maximize long-term success. Understanding and mitigating risks is crucial for sustainable performance.

Key Risk Categories

Bankruptcy Risk

The ultimate risk in distressed investing—total loss of capital if the company fails. Mitigate through careful balance sheet analysis and diversification.

Liquidity Risk

Distressed stocks often have low trading volumes, making position exits challenging. Plan for longer holding periods and gradual position building.

Value Trap Risk

Stocks that appear cheap but continue declining due to deteriorating fundamentals. Focus on companies with genuine turnaround potential.

Timing Risk

Value realization may take longer than expected. Maintain adequate diversification and avoid over-concentration in any single position.

Portfolio Construction Guidelines

| Risk Level | Position Size | Portfolio Allocation | Holding Period |

|---|---|---|---|

| Low Risk Net Nets | 3-5% | 30-40% | 1-3 years |

| Medium Risk Turnarounds | 2-4% | 20-30% | 2-4 years |

| High Risk Distressed | 1-2% | 10-15% | 1-2 years |

| Cash/Safe Assets | – | 15-25% | Flexible |

Risk Management Best Practices

- Never invest more than 5% of portfolio in any single distressed stock

- Maintain at least 20-30 positions for adequate diversification

- Set stop-loss levels based on fundamental deterioration, not price action

- Keep 15-25% in cash for new opportunities during market dislocations

- Regular portfolio rebalancing to maintain target allocations

Legendary Success Stories in Distressed Investing

Learning from the masters of distressed investing provides invaluable insights into successful strategies and common pitfalls. Here are some of the most instructive cases from legendary investors.

Charlie Munger’s Tenneco Investment

In the late 1990s, auto parts supplier Tenneco faced severe operational challenges. Revenue stagnated while costs and interest expenses soared, causing operating income to plummet from $395 million in 1997 to just $92 million in 2001.

Munger’s Analysis

While others saw only a failing company, Munger recognized that Tenneco’s bonds were trading at 40 cents on the dollar, while the stock had fallen from $10 to under $2. The company wasn’t required to repay bondholders until 2009, providing time for recovery.

The Strategy

Munger bought both bonds and stocks. If liquidation occurred, the bonds would provide adequate returns. If recovery happened, both positions would benefit significantly from the turnaround.

The Outcome

Tenneco successfully restructured and returned to profitability in 2003. The stock price recovered to approximately $15, generating nearly $80 million in profits for Munger—almost 15 times his initial investment.

Carl Icahn’s Tappan Investment

In 1977, cooking appliance manufacturer Tappan faced severe challenges during a housing market downturn. The company posted its first loss in years, causing the stock to collapse to one-third of its book value of $20 per share.

- The Opportunity: Icahn identified Tappan as fundamentally sound but temporarily distressed

- The Action: Accumulated large position at depressed prices and gained board representation

- The Result: Competitor acquired Tappan for $18 per share, generating $2.7 million profit

“In distressed investing, you get paid for taking the risk that others won’t. The key is distinguishing between temporary problems and permanent impairment.”

Advanced Distressed Investing Strategies

Beyond basic value investing principles, sophisticated distressed investors employ advanced strategies to maximize returns while minimizing risks. These techniques require deeper analysis and understanding of corporate finance.

Option-Based Valuation for Leveraged Companies

When companies have significant debt relative to asset values, equity can be valued as a call option on the company’s assets. This framework helps determine whether highly leveraged stocks offer attractive risk-adjusted returns.

Option Valuation Framework

Key Variables:

• Stock Price = Current equity value

• Strike Price = Total debt obligations

• Underlying Asset = Company’s total assets

• Time to Expiration = Debt maturity

• Volatility = Business/asset volatility

Special Situations Investing

Merger Arbitrage

Profiting from announced mergers involving distressed companies, where price discrepancies often persist due to execution risk concerns.

Spin-off Situations

Distressed companies often spin off valuable divisions, creating opportunities to acquire quality businesses at discounted prices.

Bankruptcy Investing

Investing in the securities of companies already in bankruptcy proceedings, requiring specialized knowledge of bankruptcy law and restructuring processes.

Asset-Based Investments

Focusing on companies trading below the value of their tangible assets, particularly real estate, natural resources, or other hard assets.

Catalyst Identification

Successful distressed investing often requires identifying specific catalysts that will unlock value. Without catalysts, even undervalued stocks may remain cheap indefinitely.

- Management Changes: New leadership with turnaround experience

- Asset Sales: Divestiture of non-core or valuable assets

- Debt Restructuring: Refinancing or debt reduction initiatives

- Activist Involvement: Pressure from activist investors or shareholders

- Industry Recovery: Cyclical improvement in sector conditions

- Regulatory Changes: Favorable shifts in regulatory environment

Mastering the Art of Distressed Investing

Distressed investing represents one of the most challenging yet potentially rewarding investment strategies available to skilled practitioners. Success requires a unique combination of analytical rigor, emotional discipline, and contrarian thinking that few investors possess.

Key Success Factors

- Rigorous Analysis: Deep fundamental research and financial statement analysis

- Emotional Discipline: Ability to buy when others are selling and maintain conviction

- Risk Management: Proper position sizing and portfolio diversification

- Patience: Willingness to wait for value realization over extended periods

- Continuous Learning: Staying informed about market developments and new opportunities

Final Thoughts

Distressed investing is not suitable for all investors, but for those with the temperament, skills, and patience required, it offers a pathway to exceptional long-term returns. Remember that trouble creates opportunity, and fortune favors the prepared mind.

“The stock market is a voting machine in the short run, but a weighing machine in the long run. For distressed investors, this distinction is everything.”

Advanced Analysis Techniques for Distressed Companies

Moving beyond basic screening, successful distressed stock investing requires sophisticated analysis techniques that can differentiate between companies with genuine turnaround potential and those headed for permanent decline.

The foundation of distressed company analysis lies in understanding the nuances hidden within financial statements. Unlike healthy companies where standard metrics suffice, distressed firms require specialized analytical approaches:

Predicts bankruptcy probability within 2 years

Measures ability to service debt obligations

Evaluates liquidity and asset reliability

Monthly cash consumption rate

Pro Tip: Look Beyond the Numbers

When analyzing distressed companies, focus on cash flow statements rather than income statements. Accounting tricks can manipulate earnings, but cash flow tells the real story of operational health.

Quantitative analysis alone cannot capture the full picture. Several qualitative factors often determine whether a distressed company can successfully turn around:

- Management Quality: Has the company brought in experienced turnaround specialists or retained the same leadership that led to distress?

- Industry Cyclicality: Is the distress cyclical (temporary) or structural (permanent)?

- Competitive Position: Does the company maintain unique assets, market position, or intellectual property?

- Regulatory Environment: Are regulatory changes creating headwinds or tailwinds?

- Stakeholder Support: Do creditors, suppliers, and customers remain supportive during restructuring?

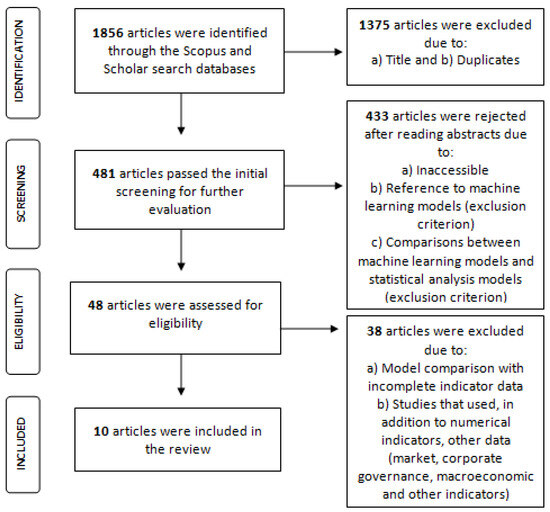

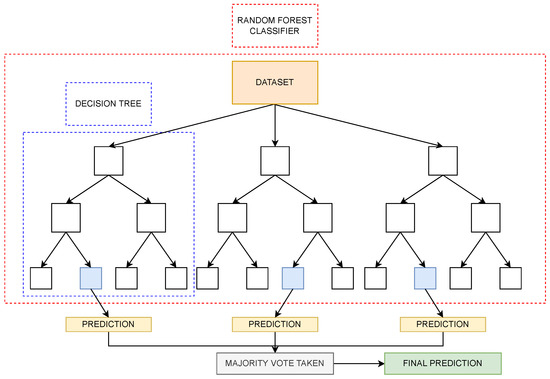

Modern Bankruptcy Prediction Models

While Benjamin Graham relied on simple balance sheet metrics, today’s investors have access to sophisticated prediction models powered by machine learning and artificial intelligence.

Modern bankruptcy prediction leverages advanced algorithms that can process hundreds of variables simultaneously. Key platforms and tools include:

AI-Powered Platforms

- • Moody’s RiskCalc – Credit risk assessment

- • Z-Score Analytics – Advanced Altman Z-Score

- • CreditModel – Probability of default modeling

- • Kamakura Corporation – Risk intelligence

Traditional Models

- • Altman Z-Score (1968)

- • Ohlson O-Score (1980)

- • Zmijewski Model (1984)

- • Sherrod Score (1987)

In 2019, machine learning models identified Hertz Corporation as high bankruptcy risk 18 months before its 2020 Chapter 11 filing. Key indicators included:

- Deteriorating Z-Score from 1.8 to 0.3 over 24 months

- Increasing debt-to-equity ratio beyond sustainable levels

- Declining cash conversion cycle efficiency

- Management guidance becoming increasingly optimistic despite worsening fundamentals

Investors who recognized these signals and shorted the stock or avoided the investment saved significant capital.

Professional investors often develop proprietary screening models. Here’s a framework for building an effective distressed stock screening system:

Step 1: Data Sources

Step 2: Key Metrics

- • Current Ratio < 1.5

- • Debt/Equity > 100%

- • Negative Operating Cash Flow

- • Z-Score < 1.8

Step 3: Tools

Risk Management and Portfolio Construction

Distressed investing is inherently risky. The difference between successful distressed investors and casualties lies in systematic risk management and proper portfolio construction.

Never bet the farm on any single distressed stock. Professional distressed investors follow strict position sizing rules:

The 2-20-60 Rule

- 2%: Maximum position size in any single distressed stock

- 20%: Maximum allocation to distressed investments as a category

- 60%: Minimum diversification across different industries/sectors

Risk Mitigation Strategies

- • Diversification: 20-30 positions minimum

- • Industry Spread: No more than 30% in one sector

- • Time Diversification: Stagger entry points

- • Hedge Positions: Use options for downside protection

- • Stop Losses: Systematic exit rules

Common Risk Mistakes

- • Concentrating in single positions

- • Ignoring correlation during crises

- • Falling in love with a story

- • Using excessive leverage

- • Poor liquidity management

The Kelly Criterion helps determine optimal position sizes based on probability of success and potential returns:

Kelly Formula for Position Sizing

f* = Fraction of capital to bet

b = Odds of winning (decimal)

p = Probability of winning

q = Probability of losing (1-p)

Consider a distressed stock with:

- 40% probability of 200% return (successful turnaround)

- 60% probability of 80% loss (bankruptcy)

Calculation: f* = (2.0 × 0.4 – 0.6) / 2.0 = 0.1 or 10%

However, given the high risk of distressed investing, most professionals use half-Kelly (5%) or quarter-Kelly (2.5%) for conservative positioning.

Professional Screening Tools and Resources

Success in distressed investing requires access to professional-grade tools and information sources. Here’s a comprehensive guide to the platforms used by institutional investors.

Free Tools

-

Finviz.com

Advanced stock screener with debt ratios, P/B filters

-

Yahoo Finance Screener

Basic screening with fundamental metrics

-

SEC EDGAR

Primary source for financial filings and reports

-

GuruFocus

Warren Buffett-style value screening tools

Premium Tools ($50-200/month)

-

Stock Rover

Advanced screening with bankruptcy prediction models

-

Morningstar Premium

In-depth fundamental analysis and fair value estimates

-

Value Line

Time-tested research platform with distress indicators

-

Zacks Premium

Analyst revisions and earnings estimate models

High-End Professional Tools

These platforms are used by hedge funds and institutional investors. Costs range from $2,000-$50,000+ annually:

- • Bloomberg Terminal – The gold standard ($2,000+/month)

- • Refinitiv Eikon – Comprehensive financial data platform

- • FactSet – Institutional research and analytics

- • S&P Capital IQ – Private equity and credit analysis

For serious distressed investors, specialized resources provide unique insights:

News & Research

Court Filings

Trading Platforms

Building Your Own Tools

Many successful distressed investors build proprietary screening tools using programming languages:

- • Python with libraries like Pandas, NumPy for data analysis

- • R Programming for statistical modeling and backtesting

- • yfinance API for accessing Yahoo Finance data

- • Alpha Vantage for real-time financial data

Detailed Case Studies and Practical Examples

Learning from real-world examples is crucial for developing expertise in distressed investing. Let’s examine several detailed case studies that illustrate both successes and failures in this challenging field.

The Crisis (2008-2009)

- • Chapter 11 bankruptcy filing June 2009

- • $82 billion in liabilities

- • Massive pension obligations

- • Declining market share (24% to 18%)

- • Legacy cost structure problems

The Turnaround

- • New IPO in November 2010 at $33

- • Streamlined operations (-40% workforce)

- • Closed underperforming brands

- • Focused on profitable models

- • Government backing provided confidence

Investment Results

Investors who bought GM stock at the 2010 IPO price of $33 and held until 2013 saw returns of 80%+ as the stock reached $40+. Key success factors included government support, successful restructuring, and improved operational efficiency.

Warning Signs Ignored

- • Excessive leverage from 2005 LBO

- • $5.2 billion debt burden

- • Declining same-store sales

- • Amazon competition intensifying

- • Failed digital transformation

The Collapse

- • Chapter 11 filing September 2017

- • Liquidation announced March 2018

- • 33,000 jobs lost

- • Bondholders recovered ~25 cents/$1

- • Equity investors lost everything

Lessons Learned

This case highlights the danger of structural industry changes combined with excessive leverage. Unlike cyclical distress, fundamental business model disruption often leads to complete loss. E-commerce disruption was irreversible.

The energy sector provides numerous current examples of distressed investing opportunities:

Cyclical Distress

- • Oil price volatility

- • Temporary demand shocks

- • Strong asset base

- • Potential for recovery

Structural Challenges

- • ESG investment pressure

- • Renewable energy transition

- • Stranded asset risks

- • Regulatory headwinds

Investment Approach

- • Focus on low-cost producers

- • Strong balance sheets

- • Diverse revenue streams

- • Transition strategies

Based on these case studies, successful distressed investors follow a systematic approach:

Due Diligence Checklist

- ☐ Analyze root cause of distress

- ☐ Assess management capability

- ☐ Evaluate asset quality and liquidity

- ☐ Review debt structure and covenants

- ☐ Study industry dynamics

- ☐ Model various scenarios

- ☐ Identify potential catalysts

- ☐ Calculate risk-adjusted returns

Monitoring Framework

- ☐ Monthly financial updates

- ☐ Management guidance tracking

- ☐ Industry trend analysis

- ☐ Competitor performance

- ☐ Regulatory changes

- ☐ Credit rating updates

- ☐ News flow analysis

- ☐ Technical chart patterns

Advanced Tips and Strategic Insights

As we conclude this comprehensive guide to distressed stock investing, here are advanced strategies and insights that separate professional investors from amateurs in this challenging field.

Understanding market psychology is crucial for successful distressed investing. The best opportunities often arise when:

Optimal Entry Points

- • Earnings disappointments: When quarterly results miss expectations

- • Credit downgrades: Immediate selling pressure from institutional investors

- • Management changes: Uncertainty creates temporary undervaluation

- • Industry crises: Sector-wide selling regardless of individual merit

- • Market volatility: General market stress amplifies distressed stock movements

Avoid These Traps

- • Falling knife syndrome: Buying too early in the decline

- • Value trap investing: Cheap stocks that stay cheap forever

- • Confirmation bias: Seeing only positive signals

- • Sunk cost fallacy: Holding losing positions too long

- • Herd mentality: Following crowded trades

Mental preparation is as important as financial analysis. Successful distressed investors develop specific psychological traits:

Contrarian Thinking

Ability to see opportunity where others see disaster

Patience

Turnarounds take time, often 2-5 years

Discipline

Sticking to systematic approach regardless of emotions

Create a systematic process that you can follow consistently:

The 5-Step Distressed Investment Process

Screen

Identify potential candidates using quantitative filters

Research

Deep fundamental and qualitative analysis

Size

Determine appropriate position size using Kelly Criterion

Monitor

Track progress and adjust thesis as needed

Exit

Systematic profit-taking or loss-cutting rules

Final Key Insights

- • Start small: Begin with 1-2% positions until you develop expertise

- • Focus on learning: Each investment teaches valuable lessons

- • Network actively: Connect with other distressed investors

- • Read continuously: Stay updated on industry trends and new techniques

- • Track performance: Maintain detailed records of wins and losses

- • Stay humble: The market will teach you humility regularly

Ready to Master Distressed Stock Investing?

Continue your journey with Part 3, where we’ll explore real-time market opportunities, build complete case studies, and provide actionable investment strategies you can implement immediately.

Legendary Success Stories: Learning from the Masters

The Berkshire Hathaway Transformation

How Buffett and Munger turned a failing textile company into a $700 billion empire through distressed investing principles.

Initial Investment

$8.6/share

1962 Purchase Price

Current Value

$500,000+

Per Original Share

Annual Return

20.1%

Over 60+ Years

Key Lessons from the Berkshire Success

- Look Beyond the Surface: Berkshire was a failing textile company, but it had strong cash flows and competent management.

- Management Quality Matters: Even distressed companies can succeed with the right leadership and vision.

- Transformation Potential: Sometimes distressed companies can pivot into entirely different, more profitable businesses.

- Patient Capital: The best returns often require decades of holding and reinvestment.

:max_bytes(150000):strip_icc()/charlie-munger-63b2f35eeae849ddba3869067f567c64.png)

Charlie Munger’s Tenneco Masterclass

A textbook example of distressed bond and equity investing that generated nearly 1,500% returns in just two years.

The Tenneco Situation (1999-2001)

The Crisis:

- • Operating income fell from $395M to $92M

- • Auto industry downturn

- • High debt-to-equity ratio (500%)

- • Stock crashed from $10 to $2

Munger’s Analysis:

- • Bonds trading at 40 cents on dollar

- • Debt maturity not until 2009

- • Strong market position in auto parts

- • Cyclical downturn, not structural decline

Total Return

$80 Million Profit

Nearly 15x Return in 2 Years

The Psychology of Distressed Investing: When to Buy and Sell

Optimal Buying Signals

Maximum Pessimism Indicator

Buy when negative news dominates headlines but fundamentals remain intact. Look for:

- • Media declaring company “dead”

- • Analyst downgrades to “sell”

- • Insider buying increasing

- • Short interest above 20%

Technical Confirmation

- • Trading below net current asset value

- • Price-to-book ratio under 0.67

- • Declining trading volume (capitulation)

- • Support level testing multiple times

Strategic Exit Points

50% Profit Rule

Benjamin Graham’s classic rule: Sell when you achieve 50% profit OR after 2 years, whichever comes first.

Modern Exit Strategies

- • Return to fair value (P/B ratio 1.0+)

- • Takeover interest emerges

- • Management announces turnaround plan

- • Debt restructuring completed

- • Analyst coverage returns positive

The Patience Paradox in Distressed Investing

Successful distressed investing requires a unique psychological profile that combines:

Emotional Resilience

Ability to withstand paper losses and negative sentiment

Analytical Rigor

Deep research to distinguish temporary from permanent problems

Strategic Patience

Willingness to wait years for markets to recognize value

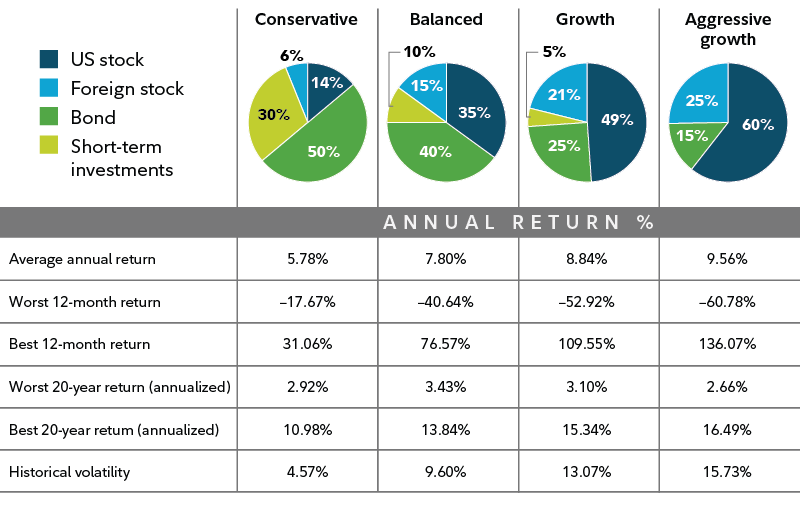

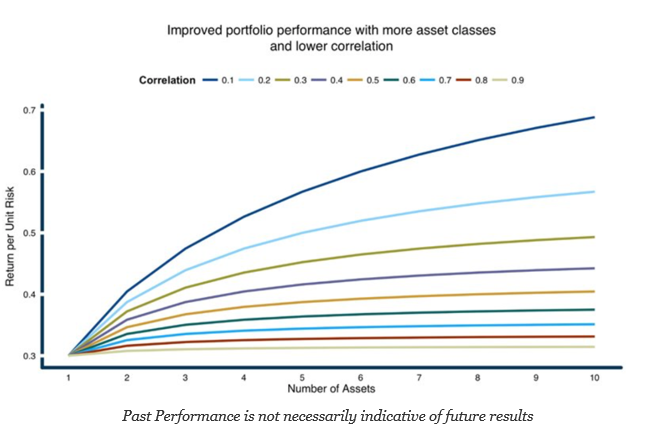

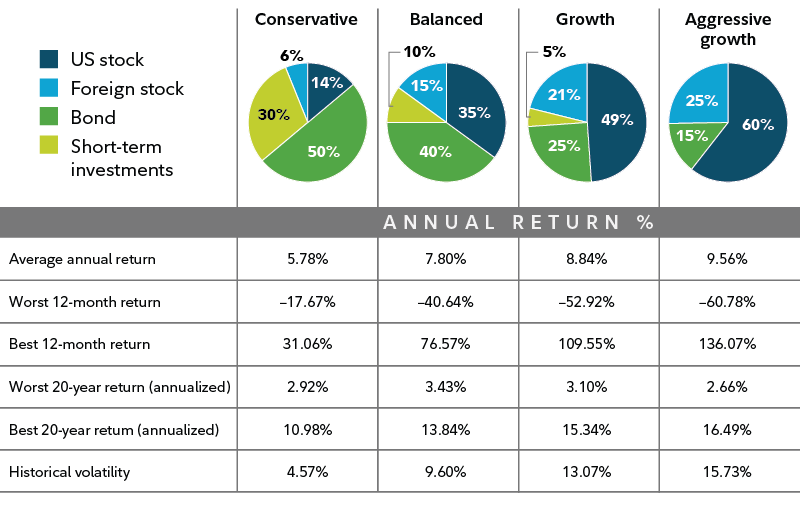

Building Your Distressed Stock Portfolio

Optimal Portfolio Structure

Risk-Adjusted Allocation

Diversification Rules

Geographic Spread

- • 60% Domestic markets

- • 25% Developed international

- • 15% Emerging markets

Sector Distribution

- • Maximum 25% in any single sector

- • Focus on cyclical industries

- • Avoid rapidly changing tech sectors

- • Prefer asset-heavy businesses

Position Sizing

- • 20-30 total positions minimum

- • Maximum 5% per single stock

- • Equal weighting preferred

- • Quarterly rebalancing

Fatal Mistakes and How to Avoid Them

Mistake #1: Falling for Value Traps

The Error: Buying stocks that appear cheap but have permanently impaired business models.

How to Avoid:

- • Analyze competitive moats

- • Check for technological disruption

- • Verify management competence

- • Assess capital allocation history

Mistake #2: Inadequate Position Sizing

The Error: Concentrating too much capital in individual distressed positions.

How to Avoid:

- • Never exceed 5% per position

- • Build positions gradually

- • Use stop-losses at -50%

- • Maintain cash reserves

Mistake #3: Ignoring Debt Structures

The Error: Overlooking complex debt arrangements that can wipe out equity holders.

How to Avoid:

- • Study debt maturity schedules

- • Analyze covenant restrictions

- • Check for convertible securities

- • Monitor credit ratings

Mistake #4: Emotional Decision Making

The Error: Letting fear and greed override systematic analysis and patience.

How to Avoid:

- • Follow predetermined rules

- • Maintain investment journals

- • Set calendar reminders

- • Use mechanical selling rules

The Professional’s Checklist

Before investing in any distressed situation, ensure you can answer “YES” to these questions:

Financial Health:

- ☐ Can the company survive 2+ years of losses?

- ☐ Is the debt load manageable?

- ☐ Are there hidden assets on the balance sheet?

- ☐ Is cash flow from operations positive?

Business Quality:

- ☐ Does the business have recurring revenue?

- ☐ Are the problems cyclical, not structural?

- ☐ Is management aligned with shareholders?

- ☐ Could a competitor acquire this at a premium?

Professional Tools for Distressed Analysis

Screening Tools

Analysis Platforms

Essential Reading

Continuing Education Resources

Online Courses:

- • Wharton Distressed Asset Investing

- • London Business School Program

- • Columbia Business School Value Investing

Professional Networks:

- • Distressed Debt Investors Association

- • International Association of Restructuring

- • CFA Institute Special Interest Groups

- • Value Investing Congress

Your Roadmap to Distressed Investing Success

The 90-Day Implementation Plan

Days 1-30: Foundation

- • Complete educational reading

- • Set up screening tools

- • Define investment criteria

- • Paper trade 10 positions

Days 31-60: Practice

- • Begin with small positions

- • Analyze 50+ companies

- • Join investor communities

- • Track performance metrics

Days 61-90: Scale

- • Build 20+ position portfolio

- • Implement systematic approach

- • Develop exit strategies

- • Plan for long-term success

Expected Performance Trajectory

Year 1

-5% to +15%

Learning curve period

Year 2-3

+15% to +25%

Skill development

Year 4-5

+20% to +30%

Mastery phase

Long-term

+25%+ Annual

Professional level

The Distressed Investor’s Creed

“In the midst of crisis lies great opportunity. When others flee in panic, the prepared investor finds fortune. Through rigorous analysis, disciplined execution, and unwavering patience, we transform market despair into lasting wealth.”

Distressed investing is not for everyone, but for those who master its principles, it offers one of the few remaining paths to truly exceptional returns in modern markets. The strategies outlined in this guide represent decades of wisdom from the world’s most successful value investors.