Real-World Case Studies: 100-Pip Strategies in Action

Theory without practical application remains just academic knowledge. To truly master the 100-pip daily strategy, you need to understand how these concepts work in real market conditions. Let’s examine specific examples of successful trades that demonstrate the principles we’ve covered.

Reality Check: The examples shown here represent ideal scenarios. Real trading involves losses, partial fills, and market noise. Success comes from consistent application of proven principles over time, not from expecting perfect trades every day.

Case Study 1: GBP/USD Support Level Bounce

Setup: GBP/USD approaching major daily support at 1.2650

Confluence Factors:

- Previous support level tested 3 times over 2 weeks

- RSI showing oversold conditions (below 30)

- Pin bar formation at support level

- 200 EMA providing additional support

Entry: Long at 1.2655 (5 pips above support)

Stop Loss: 1.2620 (35 pips risk)

Target: 1.2725 (70 pips profit – 2:1 risk-reward)

Result: Target reached in 6 hours during London session

Additional Profit: Extended to 1.2780 using trailing stop (+125 pips total)

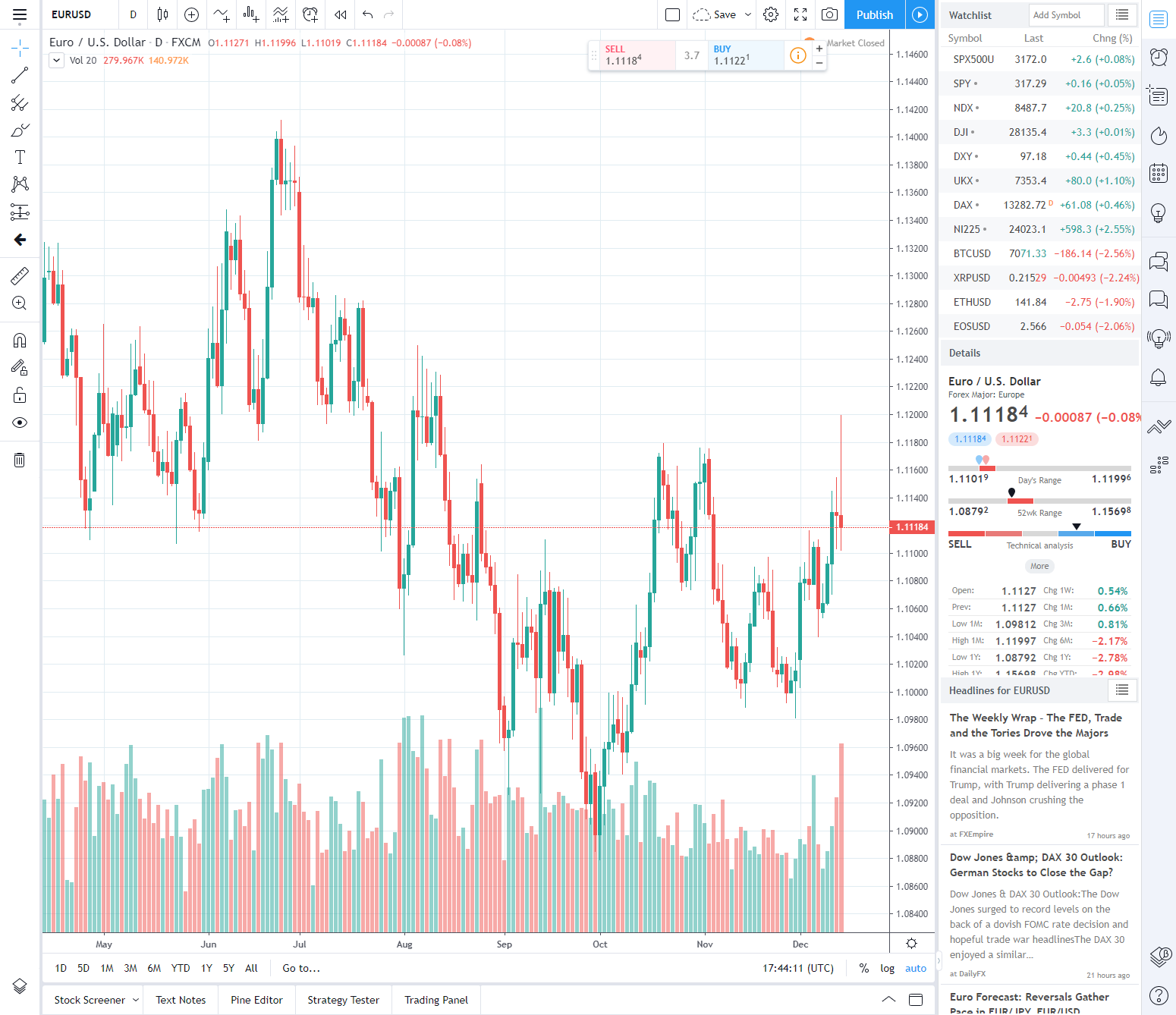

Case Study 2: EUR/USD Breakout Strategy

Setup: EUR/USD consolidating in triangle pattern for 3 days

Confluence Factors:

- Ascending triangle with resistance at 1.1850

- MACD showing bullish divergence

- Volume increasing on higher lows

- Break above 20 and 50 EMAs

Entry: Long at 1.1855 (5 pips above resistance)

Stop Loss: 1.1820 (35 pips risk)

Target: 1.1920 (65 pips – pattern height projection)

Result: Initial target reached, then continued to 1.1960 (+105 pips)

Case Study 3: USD/JPY Range Trading

Setup: USD/JPY trading in 150-pip range for 5 days

Range Boundaries: Support 149.50, Resistance 151.00

Strategy: Fade the ranges with tight stops

Trade 1 – Short at Resistance:

- Entry: 150.95, Stop: 151.15, Target: 150.20 (+75 pips)

Trade 2 – Long at Support:

- Entry: 149.55, Stop: 149.35, Target: 150.30 (+75 pips)

Combined Result: +150 pips over 2 days with tight risk management

Common Mistakes That Destroy Trading Accounts

Learning from mistakes is crucial for long-term success. Understanding and avoiding these common pitfalls can save you significant capital and accelerate your path to consistent profitability.

The Top 10 Account-Killing Mistakes

Critical Warning: These mistakes have destroyed more trading accounts than any market crash or economic event. Each one represents a fundamental misunderstanding of risk management or market dynamics.

1. Overleveraging and Position Sizing Errors

- The Mistake: Risking 10-20% per trade to “make money faster”

- The Reality: Even with 70% win rate, this approach leads to ruin

- The Solution: Never risk more than 1-2% per trade, regardless of confidence level

- Example: $10,000 account risking $100-200 per trade maximum

2. Trading Without Stop Losses

- The Mistake: “The market will come back” mentality

- The Reality: One major move against you wipes out months of profits

- The Solution: Set stop loss before entering every trade

- Professional Practice: Use ATR-based stops for volatility adjustment

3. Revenge Trading After Losses

- The Mistake: Increasing position size to “win back” losses quickly

- The Reality: Emotional trading leads to bigger losses

- The Solution: Take a break after 2-3 consecutive losses

- Professional Approach: Reduce position size after losing streaks

4. Overtrading and FOMO

- The Mistake: Taking every setup to avoid missing out

- The Reality: Quality over quantity determines profitability

- The Solution: Limit trades to 2-3 high-probability setups daily

- Focus Area: Master one strategy before adding others

5. Ignoring Market Sessions and News

- The Mistake: Trading through major news events without preparation

- The Reality: News can create massive volatility and gaps

- The Solution: Use economic calendar and avoid trading during high-impact news

- Best Practice: Close positions before major announcements

Professional Secret: The most successful traders have experienced every mistake on this list. The difference is they learned from each one and implemented systems to prevent repetition. Treat mistakes as expensive lessons, not failures.

Your Complete 100-Pip Daily Action Plan

Success in forex trading requires more than knowledge—it demands consistent execution of proven processes. This comprehensive action plan provides the framework for implementing everything you’ve learned.

Phase 1: Foundation Building (Weeks 1-4)

Week 1-2: Education and Setup

- Open demo account with reputable broker

- Download and familiarize with MetaTrader 4 or TradingView

- Set up charts with essential indicators (MA, RSI, MACD)

- Practice identifying support/resistance levels

- Study 50+ chart examples of successful setups

Week 3-4: Strategy Practice

- Focus on one currency pair (EUR/USD recommended)

- Practice entry and exit timing on historical data

- Record 100+ paper trades with detailed analysis

- Calculate theoretical performance and statistics

- Identify personal strengths and weaknesses

Phase 2: Demo Trading Mastery (Weeks 5-12)

Demo Trading Requirements

- Achieve 2 consecutive months of 15%+ monthly returns

- Maintain maximum drawdown below 10%

- Record minimum 100 trades with complete statistics

- Demonstrate consistent risk management (1% per trade)

- Show proficiency in multiple market conditions

Advanced Skills Development

- Master multi-timeframe analysis techniques

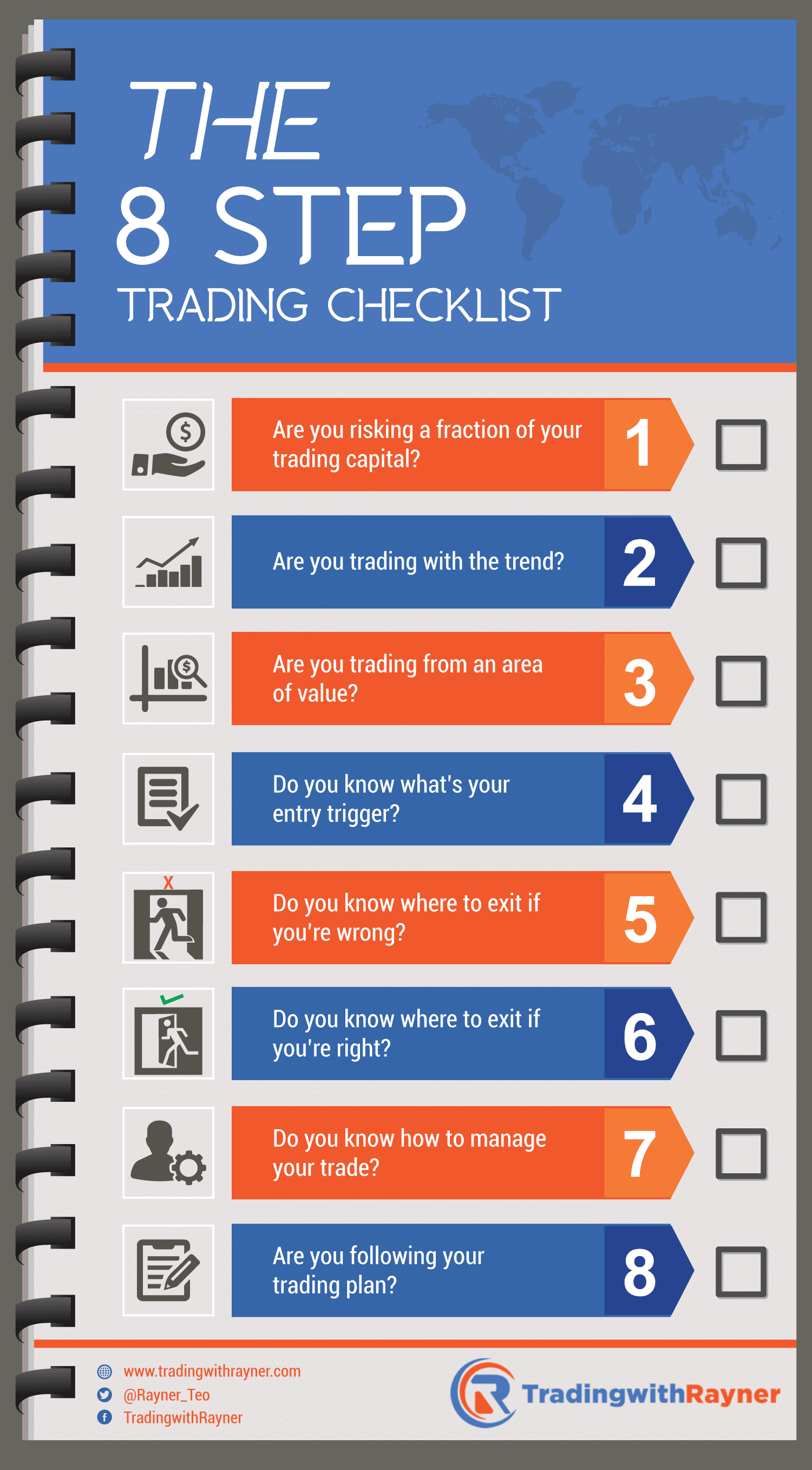

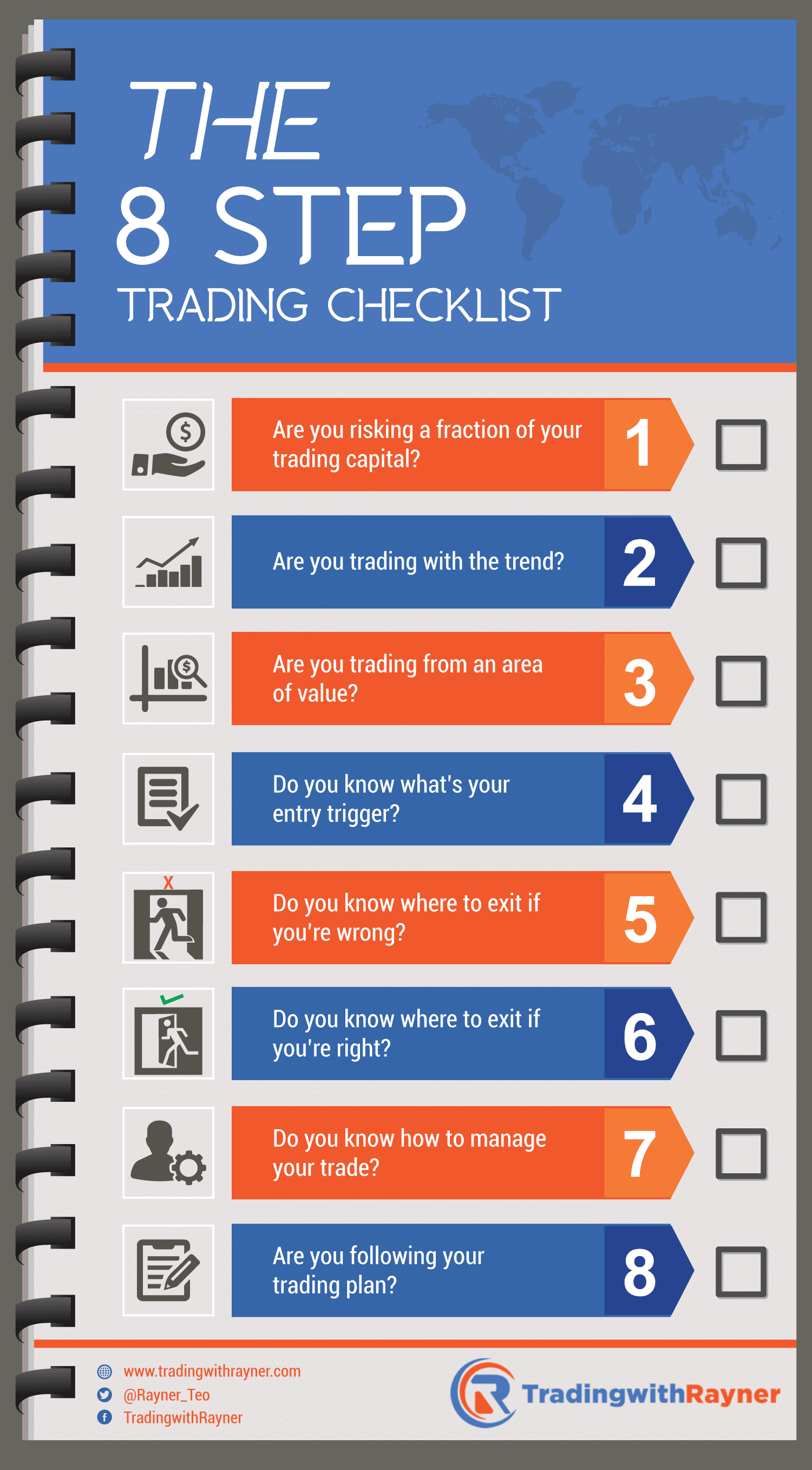

- Develop personal trading checklist and routine

- Practice various exit strategies and position management

- Build psychological discipline and emotional control

- Create comprehensive trading plan and rules

Phase 3: Live Trading Transition (Weeks 13-16)

Live Account Preparation

- Start with micro lots (0.01) for minimum risk

- Fund account with money you can afford to lose

- Set monthly and daily loss limits

- Establish performance tracking and review system

- Prepare for psychological challenges of real money

Gradual Position Size Increase

- Month 1: 0.01 lots maximum

- Month 2: 0.02 lots if profitable

- Month 3: 0.05 lots with continued success

- Only increase after demonstrating consistency

- Always maintain 1% risk rule regardless of position size

Daily Trading Routine Checklist

Pre-Market Analysis (30 minutes)

- Review economic calendar for high-impact news

- Analyze major currency pairs on daily timeframe

- Identify key support/resistance levels

- Mark potential trading opportunities

- Set alerts for breakout or reversal levels

During Market Hours

- Monitor alert notifications and price action

- Execute only high-probability setups

- Manage existing positions with trailing stops

- Record all trade decisions and reasoning

- Avoid overtrading or revenge trading

Post-Market Review (20 minutes)

- Review all trades taken during the session

- Analyze missed opportunities and reasons

- Update trading journal with lessons learned

- Calculate daily P&L and risk metrics

- Plan for next trading session

Building Long-Term Trading Success

Achieving consistent 100-pip daily targets is just the beginning of your forex trading journey. Long-term success requires continuous improvement, adaptation to changing market conditions, and persistent focus on the fundamentals that drive profitability.

Advanced Performance Optimization

Once you’ve mastered the basic 100-pip strategy, consider these advanced techniques for enhanced performance:

- Multi-Strategy Approach: Combine breakout, reversal, and trend-following strategies

- Correlation Trading: Use currency correlations for enhanced opportunities

- Seasonality Analysis: Understand monthly and weekly patterns in major pairs

- News Trading: Develop skills for trading around economic announcements

- Algorithm Integration: Use automated tools for position sizing and trade management

Psychological Mastery: The Final Frontier

Technical skills will get you started, but psychological mastery determines long-term success. Focus on developing these mental attributes:

- Emotional Regulation: Maintain calm during both winning and losing streaks

- Patience: Wait for high-quality setups rather than forcing trades

- Adaptability: Adjust strategies based on changing market conditions

- Persistence: Continue learning and improving despite temporary setbacks

- Humility: Respect the market and never assume you have all the answers

Master Trader Mindset: The best traders view each trade as one of thousands they’ll make over their career. They focus on process over individual results, knowing that consistent execution of proven strategies leads to long-term profitability.

Resources for Continued Learning

Forex trading is a lifelong learning journey. Stay ahead of the curve with these essential resources:

Educational Platforms

- BabyPips: Comprehensive forex education from beginner to advanced

- Investopedia: Financial education and market analysis

- FXStreet: Real-time news and market analysis

- MyFXBook: Trading performance tracking and analysis

Market Analysis Tools

- Forex Factory: Economic calendar and market sentiment

- DailyFX: Professional market analysis and forecasts

- FXCM: Market insights and educational content

- OANDA: Currency data and analysis tools

Success Formula: Combine the strategies outlined in this guide with continuous learning, disciplined practice, and unwavering commitment to risk management. Remember, forex trading is a business—treat it with the seriousness and professionalism it demands.

Final Words: Your Journey to 100 Pips Daily

You now possess the complete blueprint for achieving consistent 100-pip daily profits in forex trading. This comprehensive guide has covered everything from basic concepts to advanced strategies, real-world examples to psychological mastery.

Remember that success in forex trading isn’t about finding a “holy grail” system—it’s about consistently executing proven strategies with proper risk management and unwavering discipline. The 100-pip daily target is absolutely achievable, but it requires dedication, practice, and continuous improvement.

Start with the fundamentals, master the basics through extensive practice, and gradually build your skills and confidence. Focus on process over profits, and the financial rewards will follow naturally.

Important Disclaimer: Forex trading involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. Always trade with money you can afford to lose and consider seeking advice from an independent financial advisor.

Your forex trading journey begins today. Take the first step, stay committed to your goals, and remember that every professional trader was once a beginner who refused to give up.

Advanced Technical Analysis: The Professional’s Toolkit

Technical analysis forms the backbone of successful forex trading. Professional traders who consistently achieve 100 pips daily rely on sophisticated analysis techniques that go beyond basic chart reading. This comprehensive approach combines multiple indicators, price action analysis, and market structure understanding to identify high-probability trading opportunities.

Professional Insight: The key to consistent profitability isn’t using more indicators—it’s using the right indicators in the right combination at the right time. Master traders focus on confluence, where multiple technical factors align to create powerful trading signals.

Multi-Timeframe Analysis: The Foundation of Professional Trading

Successful 100-pip strategies require a systematic approach to timeframe analysis. Each timeframe provides unique insights that, when combined, create a comprehensive market picture:

- Monthly Charts: Long-term trend identification and major support/resistance zones

- Weekly Charts: Momentum direction and key swing levels

- Daily Charts: Trade setup identification and risk management levels

- 4-Hour Charts: Entry timing and trade management

- 1-Hour Charts: Precise entry points and stop loss placement

Professional Technique: Use the “top-down” approach: start with higher timeframes to understand the big picture, then drill down to lower timeframes for precise execution. This method significantly improves success rates and reduces false signals.

Essential Technical Indicators for 100-Pip Strategies

While price action remains the ultimate indicator, certain technical tools provide valuable confirmation and timing signals. Here are the most effective indicators for consistent pip capture:

| Indicator | Primary Use | Best Timeframes | Key Signals |

|---|---|---|---|

| Moving Averages (20, 50, 200) | Trend identification | Daily, 4H, 1H | Crossovers, price bounces |

| RSI (14) | Momentum & reversal signals | 4H, 1H | Overbought/oversold, divergence |

| MACD (12,26,9) | Trend change confirmation | Daily, 4H | Signal line cross, histogram |

| Bollinger Bands (20,2) | Volatility & mean reversion | 4H, 1H | Band touches, squeezes |

| ATR (14) | Volatility measurement | Daily, 4H | Stop loss sizing, target setting |

Support and Resistance: The Market’s Roadmap

Support and resistance levels represent the most fundamental concept in technical analysis. These levels act as psychological barriers where price tends to react, providing excellent opportunities for the 100-pip daily strategy.

Identifying High-Quality Support and Resistance Levels

Not all support and resistance levels are created equal. Professional traders focus on levels that demonstrate strong psychological significance and multiple confirmations:

- Multiple Touches: Levels tested 3+ times show strong psychological importance

- Volume Confirmation: High volume at key levels increases their significance

- Timeframe Confluence: Levels visible across multiple timeframes are most reliable

- Round Numbers: Psychological levels like 1.2000, 1.2500 often act as strong barriers

- Previous Highs/Lows: Historical extreme points maintain long-term significance

Support/Resistance Trading Strategy:

- Identify key levels on daily and 4-hour charts

- Wait for price to approach these levels

- Look for confirmation signals (pin bars, RSI divergence, volume spikes)

- Enter trades with tight stops beyond the level

- Target 50-100+ pips in the opposite direction

Dynamic Support and Resistance: Moving Averages

While static levels provide fixed reference points, moving averages create dynamic support and resistance that adapts to changing market conditions. Key moving averages for forex trading include:

- 20 EMA: Short-term trend and immediate support/resistance

- 50 SMA: Medium-term trend strength indicator

- 200 SMA: Long-term trend and major market sentiment

Advanced Technique: The 20/50 EMA crossover system provides excellent entry signals. When 20 EMA crosses above 50 EMA in an uptrend, look for long opportunities. When it crosses below in a downtrend, focus on short setups.

Price Action Mastery: Reading the Market’s Language

Price action analysis represents the purest form of market analysis. By understanding how price moves and reacts at key levels, traders can identify high-probability setups without relying heavily on lagging indicators.

Essential Candlestick Patterns for 100-Pip Strategies

Certain candlestick patterns provide reliable signals for significant price movements. These patterns work exceptionally well when combined with support/resistance analysis:

- Pin Bars (Doji/Hammer): Rejection of price levels, strong reversal signals

- Engulfing Patterns: Momentum shifts and trend changes

- Inside Bars: Consolidation before breakouts

- Shooting Stars: Bearish reversal signals at resistance

- Morning/Evening Stars: Major reversal patterns

Important Note: Candlestick patterns are most reliable when they occur at significant support/resistance levels and are confirmed by other technical factors. Never trade patterns in isolation.

Chart Patterns: Blueprint for Big Moves

Chart patterns represent crowd psychology in visual form. These formations often precede significant price movements, making them valuable for 100-pip strategies:

- Triangles (Ascending, Descending, Symmetrical): Consolidation patterns before breakouts

- Head and Shoulders: Reversal patterns with clear profit targets

- Double Tops/Bottoms: Strong reversal signals at key levels

- Flags and Pennants: Continuation patterns in strong trends

- Rectangles: Range-bound patterns with clear breakout potential

Professional Trading Platforms and Tools

The right trading platform can significantly impact your ability to execute the 100-pip daily strategy effectively. Professional platforms provide advanced charting, analysis tools, and execution capabilities essential for consistent success.

MetaTrader 4: The Industry Standard

MetaTrader 4 remains the most popular forex trading platform worldwide, offering:

- Advanced Charting: Multiple timeframes and comprehensive technical analysis tools

- Expert Advisors (EAs): Automated trading capabilities for strategy implementation

- Custom Indicators: Thousands of free and paid indicators available

- Mobile Trading: Full-featured mobile app for trade management

- Market Analysis: Built-in news feed and economic calendar

MT4 Optimization: Customize your MT4 workspace by creating templates with your preferred indicators and chart settings. This saves time and ensures consistency across all your analysis.

MetaTrader 5: Enhanced Capabilities

MetaTrader 5 builds on MT4’s foundation with additional features:

- More Timeframes: 21 timeframes vs MT4’s 9 timeframes

- Advanced Orders: More order types and execution options

- Economic Calendar: Integrated fundamental analysis tools

- Market Depth: Level II pricing information

- Multi-Asset Trading: Stocks, commodities, and indices alongside forex

TradingView: Superior Charting and Analysis

TradingView has gained popularity among professional traders for its advanced features:

- Professional Charting: Industry-leading chart quality and customization

- Social Trading: Share ideas and learn from other traders

- Pine Script: Custom indicator and strategy development

- Multi-Market Analysis: Comprehensive coverage of global markets

- Alert System: Advanced notification system for trade setups

Platform Integration: Many brokers now offer TradingView integration, allowing you to analyze on TradingView and execute trades through your broker’s platform. This combination provides the best of both worlds.

Entry and Exit Strategies: Timing is Everything

Successful implementation of the 100-pip daily strategy requires precise timing for both entries and exits. Professional traders use systematic approaches to optimize their trade timing and maximize profit potential.

High-Probability Entry Techniques

The difference between profitable and unprofitable trading often comes down to entry timing. Here are professional techniques for optimal entries:

1. The Confluence Method

Confluence Entry Strategy:

- Identify support/resistance level on daily chart

- Wait for price to approach this level

- Look for additional confirmation:

- RSI showing overbought/oversold

- MACD divergence

- Pin bar or engulfing pattern

- Fibonacci retracement level

- Enter when 2-3 factors align

- Place stop beyond the key level

- Target minimum 2:1 risk-reward ratio

2. Breakout Strategy

Breakouts from consolidation patterns often produce the largest and most reliable moves for 100-pip captures:

- Volume Confirmation: Strong breakouts show increased volume

- Retest Entry: Enter on pullback to broken level for better risk-reward

- False Breakout Filter: Wait for candle close beyond level before entry

- Target Calculation: Measure pattern height and project from breakout point

3. Momentum Strategy

Trend-following strategies capture sustained moves in trending markets:

- Moving Average Bounce: Enter when price bounces off key moving average

- Higher Highs/Lower Lows: Enter on breakout of previous swing points

- Momentum Indicators: Use RSI and MACD to confirm trend strength

- Trend Line Breaks: Enter on break of counter-trend lines

Professional Exit Strategies

Knowing when to exit is equally important as knowing when to enter. Professional exit strategies maximize profits while protecting capital:

1. Scaling Out Method

- First Target (50% position): Take profits at 1:1 risk-reward ratio

- Move Stop to Breakeven: Eliminate risk on remaining position

- Second Target (25% position): Take profits at 2:1 risk-reward ratio

- Final Target (25% position): Let run to major resistance/support or 3:1 ratio

2. Trailing Stop Techniques

- ATR Trailing Stop: Trail stop using Average True Range multiplier

- Moving Average Trail: Use 20 EMA as dynamic stop loss

- Swing Point Trail: Move stop to previous swing highs/lows

- Time-Based Exit: Close positions after predetermined time period

Advanced Exit Technique: Use multiple exit criteria simultaneously. For example, close 50% at resistance level, 25% on RSI divergence, and final 25% on break of trend line. This approach maximizes profit extraction while managing risk.

Market Session Analysis: Timing Your Trades

The forex market operates 24 hours a day, but not all hours offer equal opportunities. Understanding market sessions and their characteristics is crucial for optimizing your 100-pip strategy.

Major Trading Sessions

- Asian Session (00:00-09:00 GMT): Lower volatility, range-bound trading

- London Session (08:00-17:00 GMT): Highest volume and volatility

- New York Session (13:00-22:00 GMT): High volatility, trend continuation

- Session Overlaps: Maximum volatility during London/New York overlap

Session Strategy: Focus your 100-pip hunting during the London and London/New York overlap periods when major currency pairs show their highest volatility and trending behavior.

Armed with these advanced technical analysis techniques and professional tools, you’re now equipped with the knowledge that separates successful traders from the crowd. The final section will cover practical implementation, real-world examples, and advanced tips to help you consistently achieve your 100-pip daily targets.

Real-World Case Studies: 100-Pip Strategies in Action

Theory without practical application remains just academic knowledge. To truly master the 100-pip daily strategy, you need to understand how these concepts work in real market conditions. Let’s examine specific examples of successful trades that demonstrate the principles we’ve covered.

Reality Check: The examples shown here represent ideal scenarios. Real trading involves losses, partial fills, and market noise. Success comes from consistent application of proven principles over time, not from expecting perfect trades every day.

Case Study 1: GBP/USD Support Level Bounce

Setup: GBP/USD approaching major daily support at 1.2650

Confluence Factors:

- Previous support level tested 3 times over 2 weeks

- RSI showing oversold conditions (below 30)

- Pin bar formation at support level

- 200 EMA providing additional support

Entry: Long at 1.2655 (5 pips above support)

Stop Loss: 1.2620 (35 pips risk)

Target: 1.2725 (70 pips profit – 2:1 risk-reward)

Result: Target reached in 6 hours during London session

Additional Profit: Extended to 1.2780 using trailing stop (+125 pips total)

Case Study 2: EUR/USD Breakout Strategy

Setup: EUR/USD consolidating in triangle pattern for 3 days

Confluence Factors:

- Ascending triangle with resistance at 1.1850

- MACD showing bullish divergence

- Volume increasing on higher lows

- Break above 20 and 50 EMAs

Entry: Long at 1.1855 (5 pips above resistance)

Stop Loss: 1.1820 (35 pips risk)

Target: 1.1920 (65 pips – pattern height projection)

Result: Initial target reached, then continued to 1.1960 (+105 pips)

Case Study 3: USD/JPY Range Trading

Setup: USD/JPY trading in 150-pip range for 5 days

Range Boundaries: Support 149.50, Resistance 151.00

Strategy: Fade the ranges with tight stops

Trade 1 – Short at Resistance:

- Entry: 150.95, Stop: 151.15, Target: 150.20 (+75 pips)

Trade 2 – Long at Support:

- Entry: 149.55, Stop: 149.35, Target: 150.30 (+75 pips)

Combined Result: +150 pips over 2 days with tight risk management

Common Mistakes That Destroy Trading Accounts

Learning from mistakes is crucial for long-term success. Understanding and avoiding these common pitfalls can save you significant capital and accelerate your path to consistent profitability.

The Top 10 Account-Killing Mistakes

Critical Warning: These mistakes have destroyed more trading accounts than any market crash or economic event. Each one represents a fundamental misunderstanding of risk management or market dynamics.

1. Overleveraging and Position Sizing Errors

- The Mistake: Risking 10-20% per trade to “make money faster”

- The Reality: Even with 70% win rate, this approach leads to ruin

- The Solution: Never risk more than 1-2% per trade, regardless of confidence level

- Example: $10,000 account risking $100-200 per trade maximum

2. Trading Without Stop Losses

- The Mistake: “The market will come back” mentality

- The Reality: One major move against you wipes out months of profits

- The Solution: Set stop loss before entering every trade

- Professional Practice: Use ATR-based stops for volatility adjustment

3. Revenge Trading After Losses

- The Mistake: Increasing position size to “win back” losses quickly

- The Reality: Emotional trading leads to bigger losses

- The Solution: Take a break after 2-3 consecutive losses

- Professional Approach: Reduce position size after losing streaks

4. Overtrading and FOMO

- The Mistake: Taking every setup to avoid missing out

- The Reality: Quality over quantity determines profitability

- The Solution: Limit trades to 2-3 high-probability setups daily

- Focus Area: Master one strategy before adding others

5. Ignoring Market Sessions and News

- The Mistake: Trading through major news events without preparation

- The Reality: News can create massive volatility and gaps

- The Solution: Use economic calendar and avoid trading during high-impact news

- Best Practice: Close positions before major announcements

Professional Secret: The most successful traders have experienced every mistake on this list. The difference is they learned from each one and implemented systems to prevent repetition. Treat mistakes as expensive lessons, not failures.

Your Complete 100-Pip Daily Action Plan

Success in forex trading requires more than knowledge—it demands consistent execution of proven processes. This comprehensive action plan provides the framework for implementing everything you’ve learned.

Phase 1: Foundation Building (Weeks 1-4)

Week 1-2: Education and Setup

- Open demo account with reputable broker

- Download and familiarize with MetaTrader 4 or TradingView

- Set up charts with essential indicators (MA, RSI, MACD)

- Practice identifying support/resistance levels

- Study 50+ chart examples of successful setups

Week 3-4: Strategy Practice

- Focus on one currency pair (EUR/USD recommended)

- Practice entry and exit timing on historical data

- Record 100+ paper trades with detailed analysis

- Calculate theoretical performance and statistics

- Identify personal strengths and weaknesses

Phase 2: Demo Trading Mastery (Weeks 5-12)

Demo Trading Requirements

- Achieve 2 consecutive months of 15%+ monthly returns

- Maintain maximum drawdown below 10%

- Record minimum 100 trades with complete statistics

- Demonstrate consistent risk management (1% per trade)

- Show proficiency in multiple market conditions

Advanced Skills Development

- Master multi-timeframe analysis techniques

- Develop personal trading checklist and routine

- Practice various exit strategies and position management

- Build psychological discipline and emotional control

- Create comprehensive trading plan and rules

Phase 3: Live Trading Transition (Weeks 13-16)

Live Account Preparation

- Start with micro lots (0.01) for minimum risk

- Fund account with money you can afford to lose

- Set monthly and daily loss limits

- Establish performance tracking and review system

- Prepare for psychological challenges of real money

Gradual Position Size Increase

- Month 1: 0.01 lots maximum

- Month 2: 0.02 lots if profitable

- Month 3: 0.05 lots with continued success

- Only increase after demonstrating consistency

- Always maintain 1% risk rule regardless of position size

Daily Trading Routine Checklist

Pre-Market Analysis (30 minutes)

- Review economic calendar for high-impact news

- Analyze major currency pairs on daily timeframe

- Identify key support/resistance levels

- Mark potential trading opportunities

- Set alerts for breakout or reversal levels

During Market Hours

- Monitor alert notifications and price action

- Execute only high-probability setups

- Manage existing positions with trailing stops

- Record all trade decisions and reasoning

- Avoid overtrading or revenge trading

Post-Market Review (20 minutes)

- Review all trades taken during the session

- Analyze missed opportunities and reasons

- Update trading journal with lessons learned

- Calculate daily P&L and risk metrics

- Plan for next trading session

Building Long-Term Trading Success

Achieving consistent 100-pip daily targets is just the beginning of your forex trading journey. Long-term success requires continuous improvement, adaptation to changing market conditions, and persistent focus on the fundamentals that drive profitability.

Advanced Performance Optimization

Once you’ve mastered the basic 100-pip strategy, consider these advanced techniques for enhanced performance:

- Multi-Strategy Approach: Combine breakout, reversal, and trend-following strategies

- Correlation Trading: Use currency correlations for enhanced opportunities

- Seasonality Analysis: Understand monthly and weekly patterns in major pairs

- News Trading: Develop skills for trading around economic announcements

- Algorithm Integration: Use automated tools for position sizing and trade management

Psychological Mastery: The Final Frontier

Technical skills will get you started, but psychological mastery determines long-term success. Focus on developing these mental attributes:

- Emotional Regulation: Maintain calm during both winning and losing streaks

- Patience: Wait for high-quality setups rather than forcing trades

- Adaptability: Adjust strategies based on changing market conditions

- Persistence: Continue learning and improving despite temporary setbacks

- Humility: Respect the market and never assume you have all the answers

Master Trader Mindset: The best traders view each trade as one of thousands they’ll make over their career. They focus on process over individual results, knowing that consistent execution of proven strategies leads to long-term profitability.

Resources for Continued Learning

Forex trading is a lifelong learning journey. Stay ahead of the curve with these essential resources:

Educational Platforms

- BabyPips: Comprehensive forex education from beginner to advanced

- Investopedia: Financial education and market analysis

- FXStreet: Real-time news and market analysis

- MyFXBook: Trading performance tracking and analysis

Market Analysis Tools

- Forex Factory: Economic calendar and market sentiment

- DailyFX: Professional market analysis and forecasts

- FXCM: Market insights and educational content

- OANDA: Currency data and analysis tools

Success Formula: Combine the strategies outlined in this guide with continuous learning, disciplined practice, and unwavering commitment to risk management. Remember, forex trading is a business—treat it with the seriousness and professionalism it demands.

Final Words: Your Journey to 100 Pips Daily

You now possess the complete blueprint for achieving consistent 100-pip daily profits in forex trading. This comprehensive guide has covered everything from basic concepts to advanced strategies, real-world examples to psychological mastery.

Remember that success in forex trading isn’t about finding a “holy grail” system—it’s about consistently executing proven strategies with proper risk management and unwavering discipline. The 100-pip daily target is absolutely achievable, but it requires dedication, practice, and continuous improvement.

Start with the fundamentals, master the basics through extensive practice, and gradually build your skills and confidence. Focus on process over profits, and the financial rewards will follow naturally.

Important Disclaimer: Forex trading involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. Always trade with money you can afford to lose and consider seeking advice from an independent financial advisor.

Your forex trading journey begins today. Take the first step, stay committed to your goals, and remember that every professional trader was once a beginner who refused to give up.