How to Use Bloomberg App for Financial News

Master Bloomberg's powerful financial news platform with expert techniques for tracking market-moving events, setting up intelligent alerts, and leveraging professional-grade analytics to stay ahead of global market trends.

How to Use Bloomberg App for Financial News: Maximizing Your Bloomberg Experience

In the rapidly evolving world of financial markets, having access to real-time, accurate, and comprehensive financial news is not just an advantage—it’s a necessity. Bloomberg Professional App has emerged as the gold standard for financial professionals, traders, and serious investors who demand institutional-grade market intelligence at their fingertips.

“The Bloomberg Terminal revolutionized how financial professionals access market data. Now, with the Bloomberg Professional App, that same power is available anywhere, anytime. It’s not just about having information—it’s about having the right information when market conditions demand split-second decisions.”

— Senior Portfolio Manager, Goldman Sachs Asset Management

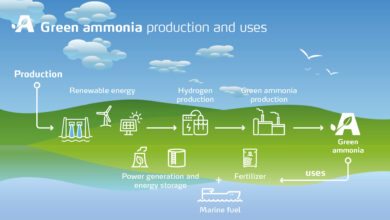

Understanding the Bloomberg Professional Ecosystem

Bloomberg Terminal

The legendary desktop platform used by over 325,000 financial professionals worldwide. Features comprehensive market data, advanced analytics, and professional trading tools with a $24,000+ annual subscription.

Bloomberg Professional App

The mobile extension of the Terminal experience, providing essential Bloomberg functionality on-the-go. Requires an active Bloomberg Terminal subscription and offers real-time market access from anywhere.

Bloomberg News App

The free consumer-facing application providing Bloomberg’s award-winning financial journalism, market updates, and basic portfolio tracking. Available to all users without Terminal subscription requirements.

Important Distinction: Two Different Bloomberg Apps

Many users confuse the Bloomberg Professional App with the free Bloomberg News app. Here’s the key difference:

- Bloomberg Professional App: Requires Terminal subscription ($24K+/year), provides full market data and trading capabilities

- Bloomberg News App: Free download, focuses on news and basic market information

This guide covers both applications, with specific sections dedicated to maximizing each platform’s unique capabilities.

Getting Started: Account Setup and Initial Configuration

Bloomberg Professional App Setup (Terminal Users)

Verify Terminal Access and Download

Ensure you have an active Bloomberg Terminal subscription through your institution or personal account. The Professional App is exclusively available to Terminal subscribers and cannot be used independently.

Download Sources:

- iOS: Search “Bloomberg Professional” in App Store

- Android: “Bloomberg Professional” on Google Play

- Alternative: Access through your Terminal’s mobile section

Authentication and B-Unit Setup

Bloomberg uses a two-factor authentication system. You’ll need to link your mobile device using the B-Unit app or hardware token for secure access to your Terminal functions.

Download the Bloomberg B-Unit app separately to streamline the authentication process. This eliminates the need for hardware tokens and provides seamless mobile access.

Initial Profile Configuration

Configure your professional profile, including your primary markets of interest, preferred asset classes, and notification preferences. This customization ensures you receive relevant market-moving information.

Essential Settings:

- Home market timezone

- Primary currency display

- Asset class preferences

- News alert thresholds

Advanced Options:

- Custom watchlist imports

- Institutional messaging setup

- Research alert categories

- Portfolio sync preferences

Bloomberg News App Setup (Free Users)

Download and Account Creation

The Bloomberg News app is freely available on both iOS and Android platforms. Create your account using email, or sign in with existing social media credentials for faster setup.

Personalization and Interests

Customize your news feed by selecting your areas of interest, preferred markets, and companies you want to follow. The app uses AI to learn your preferences and deliver increasingly relevant content.

Recommended Interest Categories:

Notification Optimization

Configure push notifications strategically to stay informed without overwhelming your device. Bloomberg’s notification system can be customized for different types of market events and news urgency levels.

Avoid enabling all notifications initially. Start with “Breaking News” and “Market Open/Close” alerts, then gradually add more specific categories based on your information needs. Too many notifications can lead to alert fatigue and missed important updates.

Mastering the Bloomberg Professional App Interface

Navigation and Core Interface Elements

The Bloomberg Professional App maintains the familiar Terminal command structure while adapting to mobile interfaces. Understanding the navigation hierarchy is crucial for efficient market monitoring and analysis.

Command Line Integration

Access Terminal functions using the same commands (e.g., AAPL US <Equity> <GO> for Apple stock analysis)

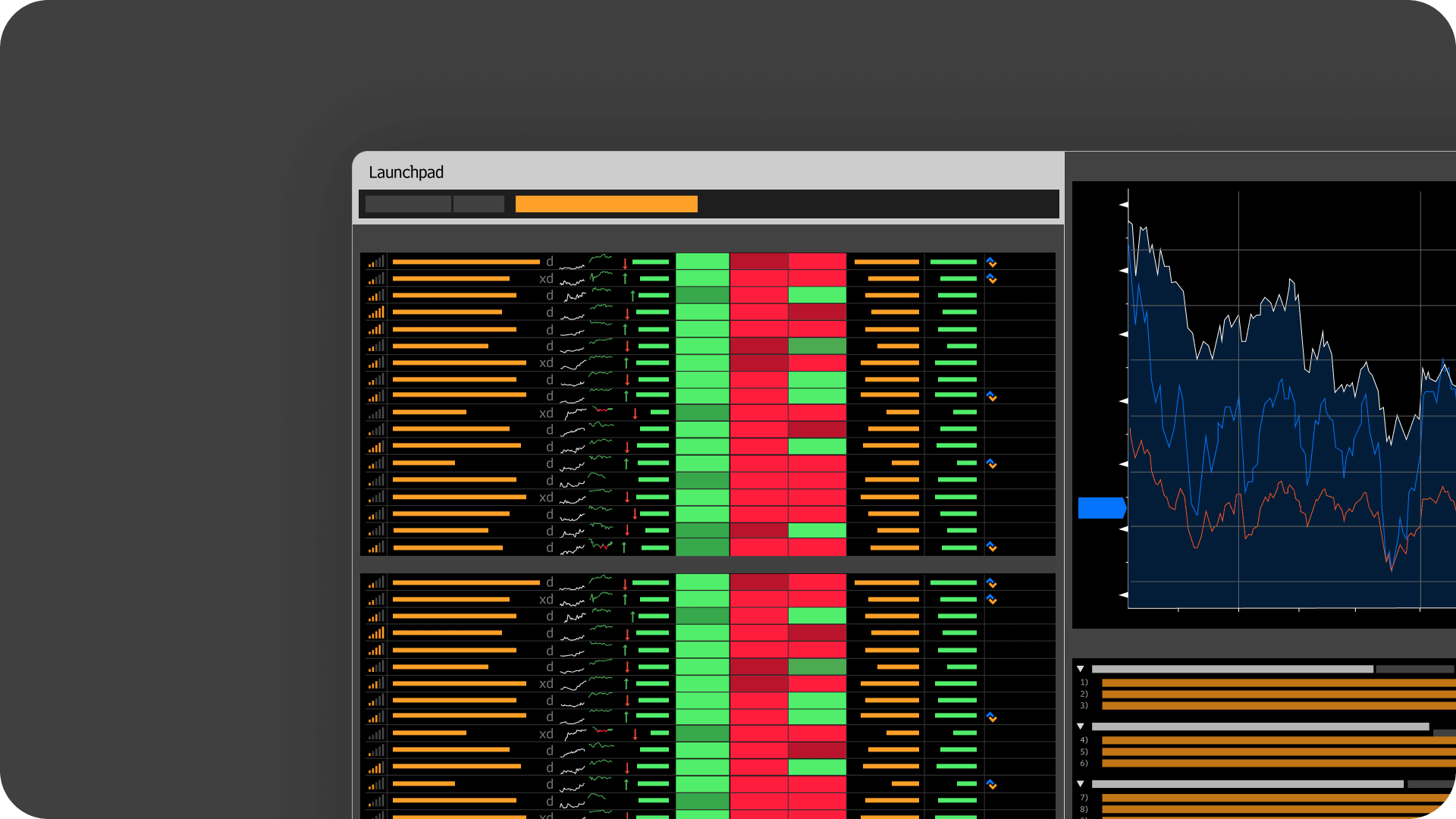

Launchpad Dashboard

Customizable home screen with market overviews, personal watchlists, and recent research

Swipe Navigation

Horizontal swiping between charts, news, and analysis for seamless multi-tasking

Essential Bloomberg Functions on Mobile

Market Monitoring Functions

Analysis and Research Functions

Core Features: News, Data, and Market Intelligence

Real-Time News Intelligence

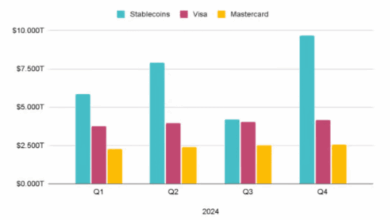

Bloomberg’s news engine processes over 5,000 stories daily from 2,700+ journalists worldwide. The mobile app provides instant access to market-moving news with advanced filtering and alert capabilities.

First Word Speed

Breaking news alerts delivered within 3 seconds of publication

AI-Powered Relevance

Machine learning algorithms prioritize news based on your portfolio and interests

Market Impact Scoring

Automated assessment of news impact on specific securities and sectors

Professional Data Access

Access to Bloomberg’s comprehensive financial database covering 35 million securities across 350+ exchanges globally. Real-time pricing, historical data, and fundamental analysis tools available on-demand.

Multi-Asset Coverage

Equities, bonds, commodities, FX, derivatives, and alternative investments

Institutional Quality

Same data feeds used by hedge funds and investment banks

Custom Analytics

Build and save custom screens, calculations, and monitoring dashboards

Advanced Chart Analysis on Mobile

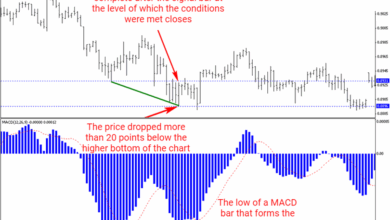

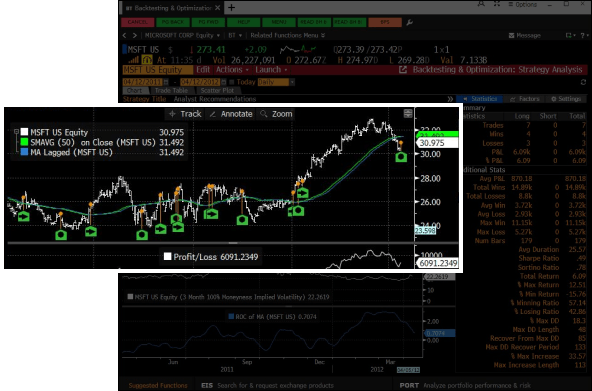

Mobile Chart Capabilities

The Bloomberg Professional App brings desktop-class charting to mobile devices, with touch-optimized controls and gesture-based navigation for efficient technical analysis.

Use two-finger pinch gestures for zooming and single-finger swipe for panning. Double-tap to fit chart to screen. Long-press on any point to access contextual analysis tools and news related to that specific time period.

Professional News Analysis Techniques

Bloomberg’s News Engine: Understanding the Information Flow

Bloomberg’s news operation is arguably the most sophisticated financial information network in the world. Understanding how to leverage this system effectively can provide significant competitive advantages in market timing and decision-making.

First Word News

Ultra-fast breaking news designed for algorithmic and high-frequency trading systems

Bloomberg News

Comprehensive reporting with analysis and market context

Bloomberg Intelligence

Research-grade analysis from Bloomberg’s team of industry specialists

News Priority Levels

Geographic Coverage

Sector Specialization

Michael Chen, CFA

Senior Portfolio Manager, Bridgewater Associates

“The Bloomberg Professional App has fundamentally changed how our team operates. We’re managing $15 billion in assets, and having real-time access to Bloomberg’s news flow and data on mobile devices has improved our reaction time to market events by an average of 12 minutes—which in our business can mean millions in performance.”

“What sets Bloomberg apart is not just the speed of information, but the quality of analysis. When the Fed announces rate decisions or when there’s geopolitical turmoil, Bloomberg’s instant analysis helps us understand not just what happened, but what it means for our positions. The mobile app ensures we’re never out of touch with critical market developments.”

Maximizing the Free Bloomberg News App

Advanced Features in the Free Version

While the Bloomberg Professional App requires a Terminal subscription, the free Bloomberg News app offers substantial functionality for serious market participants. Understanding how to maximize this platform can provide significant value for individual investors and smaller institutions.

Core Features Available for Free

Premium Features Worth Upgrading

Strategic News Consumption Techniques

Time-Based Strategy

Information Filtering

Analytical Approach

Advanced Bloomberg App Features: Mastering News Alerts and Market Analysis

Advanced News Alert Configuration

Bloomberg’s alert system is one of the most sophisticated financial notification platforms available, capable of processing millions of data points and delivering precisely targeted information to users within seconds. Understanding how to configure these alerts strategically can transform your market responsiveness and decision-making capabilities.

“The difference between successful traders and everyone else often comes down to information timing. Bloomberg alerts give you that critical 30-second to 3-minute advantage that can make or break a trading decision. The key is knowing how to filter the signal from the noise.”

— Head of Trading, JPMorgan Asset Management

:max_bytes(150000):strip_icc()/10Analysis2-a5aec147b8174a07b5d63bcfdea28cf4.jpg)

Breaking News Alerts

Configure alerts for market-moving news events, including economic data releases, corporate earnings, geopolitical developments, and regulatory announcements.

Priority Levels

Set different notification sounds and urgency levels for various news categories

Keyword Filtering

Create custom alerts based on specific companies, sectors, or economic indicators

Time-Based Filters

Customize alert timing based on your trading schedule and time zones

Price Movement Alerts

Set sophisticated price-based triggers that go beyond simple percentage moves, including volume-weighted alerts, technical indicator breaches, and volatility spikes.

Technical Indicators

RSI, MACD, moving average crossovers, and Bollinger Band touches

Volume Anomalies

Unusual trading volume or volume-weighted average price deviations

Options Flow

Large options trades and unusual implied volatility movements

Step-by-Step Alert Setup Guide

Access Alert Creation Panel

In Bloomberg Professional App: Navigate to Menu → Alerts → Create New Alert

In Bloomberg News App: Go to Settings → Notifications → Customize Alerts

Professional App Path:

Menu → Alerts → BEFL <GO> for Bloomberg Event-Driven Functions

News App Path:

Profile → Settings → Push Notifications → Alert Preferences

Define Alert Criteria

Specify the exact conditions that should trigger your alert. Bloomberg’s system supports complex Boolean logic for sophisticated filtering.

Example Alert Configurations:

Configure Delivery Methods

Bloomberg offers multiple delivery channels for alerts. Strategic configuration ensures you receive critical information through the most appropriate medium.

🔔 Push Notifications

Immediate mobile alerts for urgent market events

📧 Email Alerts

Detailed summaries for non-urgent updates

📱 SMS Messages

Critical alerts when app access isn’t available

Test and Optimize Alert Performance

After setup, monitor alert performance for 1-2 weeks to identify false positives and missed opportunities. Bloomberg provides analytics on alert effectiveness.

Use Bloomberg’s Alert History function (BEFL <GO> → History) to analyze which alerts led to profitable actions. Gradually refine your criteria to reduce noise while maintaining comprehensive coverage of your key risk factors.

Portfolio Tracking and Watchlist Management

Advanced Watchlist Strategies

:max_bytes(150000):strip_icc()/6marketmonitor2-ad8a371c3aa84d45894f9b798da94285.jpg)

Professional traders and portfolio managers don’t just track individual securities—they monitor market ecosystems. Bloomberg’s watchlist functionality enables sophisticated portfolio surveillance that goes far beyond simple price tracking.

Multi-Asset Integration

Track equities, bonds, commodities, currencies, and derivatives in unified views

Risk Factor Monitoring

Monitor correlations, sector exposures, and geographic risk concentrations

Performance Attribution

Analyze contribution of individual positions to overall portfolio performance

Risk Management Lists

Opportunity Tracking

Sector Rotation

Professional Watchlist Construction

Hierarchical Watchlist Structure

Core Holdings (20-30 positions)

- • Primary portfolio positions

- • High-conviction, long-term holdings

- • Daily monitoring required

- • Full fundamental and technical analysis

Watch Zone (50-75 positions)

- • Potential future investments

- • Stocks approaching buy zones

- • Weekly review cycle

- • Price alert monitoring

Peer Group Analysis

Create watchlists of competing companies within the same industry to identify relative strength and weakness patterns.

Example: Technology Giants

AAPL, MSFT, GOOGL, AMZN, META – Track relative performance during earnings seasons and market volatility

Geographic Diversification

Monitor international exposure through ADRs, ETFs, and currency pairs to manage geographic concentration risk.

Example: Emerging Markets

EEM, BABA, TSM, ASML – Correlate with DXY and VIX for risk-on/risk-off signals

Market Impact Analysis and News Intelligence

Understanding Market-Moving Events

Event Classification System

Fed announcements, major earnings beats/misses, geopolitical crises, regulatory changes

Economic data releases, analyst upgrades/downgrades, M&A announcements

Routine earnings guidance, minor corporate announcements, sector updates

Bloomberg’s Impact Scoring

Bloomberg uses proprietary algorithms to score news impact on a scale of 1-100, considering historical price reactions, event type, and market conditions.

Scoring Factors:

Market Response Timeline to News Events

Algorithmic Response

High-frequency trading systems react to headlines

Professional Traders

Bloomberg Terminal users receive alerts and react

Retail Platforms

News reaches retail trading platforms

Market Consensus

Full market incorporation of news impact

Sarah Williams, CFA

Chief Investment Officer, BlackRock Multi-Asset Strategies

“Bloomberg’s news impact analysis has become integral to our risk management process. When managing $50 billion in multi-asset strategies, understanding not just what news is breaking, but how markets are likely to react, is crucial. The app’s integration of news sentiment with real-time price action gives us insights that were impossible to obtain even five years ago.”

“We’ve found that Bloomberg’s market impact scores are particularly valuable during earnings seasons and FOMC meetings. The system’s ability to predict which earnings reports will move broader sector indices, rather than just individual stocks, has helped us adjust our sector rotation strategies more effectively. It’s not just about being fast—it’s about being smart with the information.”

Advanced Technical Analysis Integration

Combining News Flow with Technical Signals

:max_bytes(150000):strip_icc()/7marketmonitor3-35b05cb6507c490b885aa1b0169d9146.jpg)

The most sophisticated Bloomberg users don’t rely solely on either fundamental news or technical analysis—they synthesize both data streams to create comprehensive market views. This integration is where Bloomberg’s true power becomes apparent.

News-Technical Confluence

Identify when breaking news aligns with technical breakout levels for higher-probability trades

Sentiment vs. Price Action

Detect divergences between news sentiment and actual price movement for contrarian opportunities

Volume Confirmation

Use news flow to explain unusual volume patterns and validate technical signals

Pre-Market Analysis

Intraday Monitoring

Post-Market Review

Common Pitfalls in News-Based Trading

Avoid These Mistakes:

- • Reacting to every headline without context

- • Ignoring technical levels during news events

- • Over-leveraging on news-driven trades

- • Failing to set stop-losses on news trades

- • Chasing momentum after initial move

Best Practices:

- • Wait for news confirmation and price action

- • Use position sizing appropriate to volatility

- • Maintain disciplined entry and exit criteria

- • Consider both immediate and delayed reactions

- • Review news impact effectiveness regularly

Professional Integration Strategies

Building a Comprehensive Bloomberg Workflow

The most successful Bloomberg users develop systematic workflows that integrate all platform capabilities into their daily routines. This systematic approach ensures comprehensive market coverage while avoiding information overload.

Morning Market Preparation (6:30-9:30 AM)

Market Hours Monitoring (9:30 AM-4:00 PM)

Key Performance Metrics for Bloomberg Usage

Bloomberg Professional Mastery: Expert Strategies and Advanced Techniques

Advanced Research Tools and Document Analysis

Bloomberg’s research capabilities extend far beyond basic financial data. Professional users leverage sophisticated document analysis tools, proprietary research databases, and AI-powered insights that can process millions of documents instantly. These tools represent the cutting edge of financial intelligence gathering.

“The Bloomberg Terminal isn’t just a data provider—it’s an intelligence platform. The document search capabilities alone have saved our research team hundreds of hours while uncovering insights that would have been impossible to find manually. In 2025, the AI enhancements have made it an indispensable research partner.”

— Director of Research, Goldman Sachs Asset Management

Professional Document Search Strategies

Bloomberg Terminal Functions

Access Bloomberg’s comprehensive document database with over 200 million filings, reports, and research documents.

AI-powered document discovery that identifies related documents and emerging themes across your search criteria.

Create sophisticated news filters that monitor specific document types, regulatory filings, and research publications.

Advanced Search Techniques

Boolean Search Mastery

Use complex logical operators to refine searches:

Date Range Filtering

Precise temporal analysis:

Sentiment Analysis

AI-powered sentiment scoring:

Regulatory Filings Analysis

Expert LevelDeep dive into SEC filings, regulatory submissions, and compliance documents to identify material changes, risk factors, and strategic shifts before they’re reflected in stock prices.

AI-Powered Research

Master LevelLeverage Bloomberg’s proprietary AI algorithms to identify patterns, correlations, and insights across massive datasets that would be impossible to discover manually.

Cross-Reference Analysis

ProfessionalConnect disparate pieces of information across Bloomberg’s ecosystem to build comprehensive investment theses and identify multi-factor investment opportunities.

Bloomberg Terminal Integration with Mobile Platform

Seamless Desktop-Mobile Workflow

Professional Integration Architecture

Terminal Desktop

Complex analysis, strategy development, portfolio management

Cloud Sync

Real-time synchronization across all devices and platforms

Mobile App

Monitoring, alerts, quick analysis, execution

Decision Making

Informed trading decisions with complete data continuity

Terminal-to-Mobile Workflow

Morning Preparation (Terminal)

- • Comprehensive market analysis using WSCR <GO>

- • Set up complex multi-condition alerts

- • Create and save custom worksheets

- • Analyze overnight international developments

Mobile Monitoring

- • Receive real-time alerts on the go

- • Access synchronized watchlists

- • Quick chart analysis and pattern recognition

- • Instant news impact assessment

Evening Review (Terminal)

- • Analyze mobile-flagged opportunities

- • Update complex models and scenarios

- • Prepare next-day trading strategies

- • Review alert effectiveness and adjust parameters

Advanced Integration Features

Synchronized Worksheets

All Terminal worksheets automatically sync to mobile app, maintaining formatting and functionality.

Cross-Platform Alerts

Alerts created on Terminal trigger across all devices with context-appropriate formatting.

Instant Bloomberg (IB) Integration

Continue Bloomberg messaging conversations seamlessly between Terminal and mobile.

Dr. James Liu, CFA, FRM

Head of Quantitative Research, Bridgewater Associates

“The integration between Bloomberg Terminal and mobile platforms has fundamentally changed how our team operates. We can now maintain the same level of analytical rigor whether we’re at our desks or traveling globally. The synchronized worksheet feature means our quantitative models are always accessible, and the alert system ensures we never miss critical market developments.”

“What’s particularly impressive is how Bloomberg has maintained the professional-grade functionality while optimizing for mobile use. The charting capabilities on mobile now rival what we had on desktop just five years ago. For a global macro fund like ours, where markets never sleep, this integration has been a game-changer for productivity and responsiveness.”

Expert Trading Strategies and Advanced Techniques

Professional-Grade Trading Methodologies

Multi-Asset Strategy Development

Elite traders use Bloomberg to develop sophisticated strategies that span multiple asset classes, time frames, and geographical markets. The platform’s comprehensive data allows for complex correlation analysis and risk-adjusted portfolio construction.

Global Macro Strategies

Combine FX, rates, equities, and commodities using Bloomberg’s cross-asset analytics

Relative Value Trading

Identify mispricings across similar instruments using Bloomberg’s pricing models

Event-Driven Opportunities

Capitalize on corporate actions, earnings, and economic releases

Key Performance Metrics

Momentum Strategies

Mean Reversion

Risk Management

Advanced Mobile vs Desktop Optimization

Platform-Specific Excellence

Terminal Desktop Advantages

Multi-Monitor Support

Utilize up to 6 monitors for comprehensive market surveillance and analysis

Advanced Charting

Complex technical analysis with 150+ indicators and custom studies

API Integration

Custom applications and algorithmic trading system connectivity

Excel Integration

Real-time data feeds into Excel for complex modeling and analysis

Mobile Platform Strengths

Instant Accessibility

24/7 market access from anywhere in the world with full functionality

Push Notifications

Real-time alerts ensure you never miss critical market movements

Touch Optimization

Intuitive interface designed specifically for mobile interaction

Voice Commands

Voice-activated search and analysis for hands-free operation

Optimal Usage Scenarios

Pre-Market (4:00-9:30 AM)

Desktop for comprehensive analysis, mobile for gap scanning and international news

Market Hours (9:30 AM-4:00 PM)

Desktop for trading execution, mobile for monitoring and quick analysis

After Hours (4:00 PM+)

Mobile for international markets, news monitoring, and next-day preparation

Maximizing Your Bloomberg Investment

ROI Optimization Strategies

Cost-Benefit Analysis

At $24,000+ annually, Bloomberg Terminal represents a significant investment. Professional users must optimize usage to ensure positive ROI through enhanced decision-making, time savings, and improved performance.

Quantifiable Benefits

Efficiency Maximization

Keyboard Shortcuts Mastery

Learn Bloomberg’s extensive keyboard shortcuts to reduce navigation time by 60-80%.

Custom Workspace Setup

Create and save personalized workspaces for different market conditions and strategies.

Automation Setup

Automate routine tasks using Bloomberg’s scripting and alert systems.

Professional Development Path

Beginner (0-6 months)

Basic navigation, news monitoring, simple charting

Intermediate (6-18 months)

Advanced charting, screening, basic API usage

Advanced (18+ months)

Custom functions, complex modeling, automation

Expert (Continuous)

Platform innovation, mentoring, optimization

Future of Bloomberg and Financial Technology

Emerging Technologies and Trends

Artificial Intelligence

Bloomberg’s AI initiatives are revolutionizing financial analysis through natural language processing, predictive analytics, and automated research generation.

Blockchain Integration

Bloomberg is incorporating blockchain technology for trade settlement, smart contracts, and decentralized finance (DeFi) analytics.

Immersive Technologies

Virtual and augmented reality applications are being developed for immersive data visualization and collaborative analysis environments.

“The future of financial technology isn’t just about better data or faster execution—it’s about augmenting human intelligence with artificial intelligence to make better decisions. Bloomberg’s continued innovation in AI, combined with their unmatched data quality, positions them to remain the dominant force in professional financial technology for the next decade.”

— Chief Technology Officer, Renaissance Technologies

Conclusion: Mastering the Bloomberg Ecosystem

Bloomberg’s financial news and analysis platform remains the gold standard for professional market participants. From the comprehensive Terminal desktop experience to the increasingly sophisticated mobile applications, Bloomberg provides an ecosystem of tools that can transform how financial professionals analyze markets, manage risk, and execute trades.

The integration between Bloomberg’s various platforms—Terminal, Professional App, and specialized tools—creates a seamless workflow that adapts to the modern professional’s need for constant market connectivity. Whether you’re conducting deep fundamental analysis at your desk or monitoring breaking news while traveling, Bloomberg’s ecosystem ensures you maintain the same level of analytical capability across all environments.

Success with Bloomberg requires more than just access to the platform—it demands a systematic approach to information consumption, alert configuration, and workflow optimization. The strategies and techniques outlined in this comprehensive guide represent years of accumulated wisdom from professional users who have maximized their Bloomberg investment.

Key Takeaways for Bloomberg Mastery

Technical Excellence

- • Master keyboard shortcuts and workflow automation

- • Develop sophisticated alert systems for different market conditions

- • Integrate Terminal and mobile platforms for seamless operation

- • Leverage AI and advanced analytics for competitive advantage

Strategic Application

- • Combine multiple data sources for comprehensive market views

- • Develop systematic approaches to news analysis and market timing

- • Use Bloomberg’s research tools for deep fundamental analysis

- • Continuously optimize and refine your Bloomberg usage patterns

As financial markets continue to evolve and become more complex, Bloomberg’s platform evolves alongside them, incorporating new technologies, data sources, and analytical capabilities. The professionals who master this ecosystem—combining technical proficiency with strategic application—will continue to maintain their competitive edge in an increasingly challenging global financial landscape.