Energy Transition: How It Will Impact the Global Oil Market by 2030?

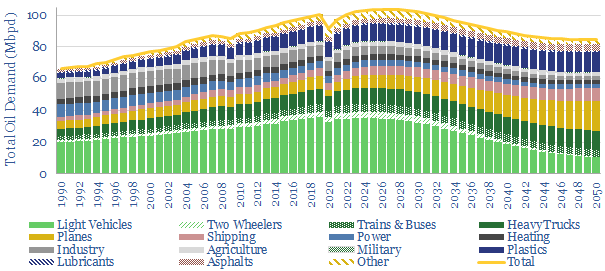

The world is experiencing an unprecedented transition in energy, with an accelerating shift from fossil fuels to renewable energy sources. While oil remains the primary source of global energy, estimates suggest that demand for it may peak by 2030, creating enormous challenges for oil companies and producing countries, and reshaping the global economy in profound ways.

“The energy transition is not just a technological shift, but a comprehensive economic and geopolitical restructuring that will reshape the global power map and wealth distribution in the coming decades.”

Peak Oil Demand: Are We Approaching the End of an Era?

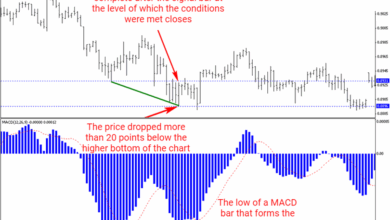

Forecasts for global oil demand reaching its peak in the 2030s then gradually declining

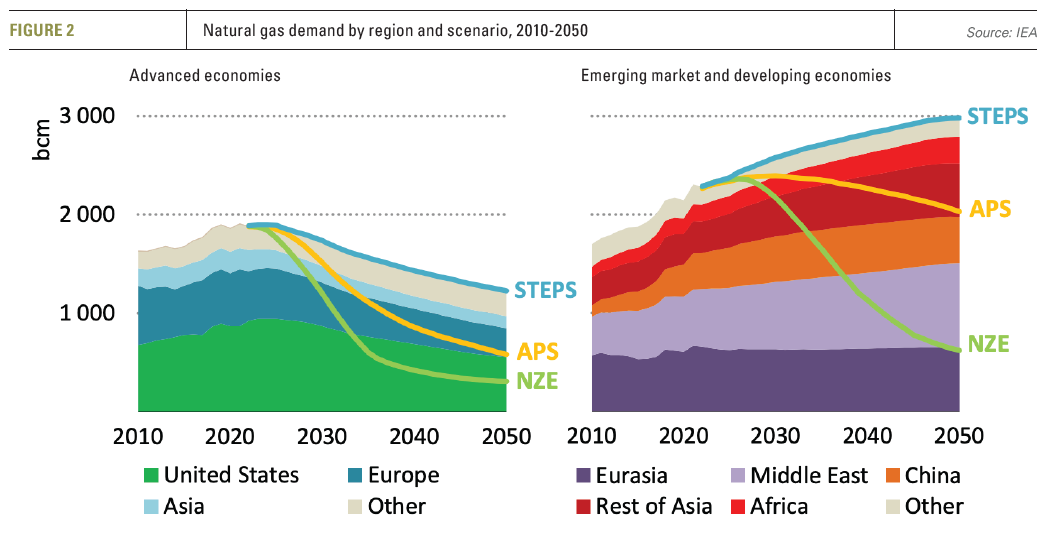

Forecasts from global energy agencies and consulting firms differ on when global oil demand will peak. While the International Energy Agency (IEA) in its latest reports expects demand to peak before 2030, major oil companies like BP anticipate this occurring in the mid-2030s.

Forecasts for Global Oil Demand Peak

- International Energy Agency (IEA): Before 2030

- BP: Mid-2030s

- OPEC: After 2045

- U.S. Energy Information Administration (EIA): Continued growth until 2050

The variation in these forecasts reflects differences in assumptions about the speed of electric vehicle adoption, the development of renewable energy technologies, government climate policies, and economic growth in emerging markets.

IEA forecasts for peak demand of all types of fossil fuels by 2030

Drivers of Declining Oil Demand

- Rapid expansion of electric vehicles (expected increase from 14% of global new car sales in 2023 to over 60% by 2030)

- Improved fuel efficiency in traditional transportation

- Increased use of renewable energy in electricity generation

- Government policies supporting the transition to clean energy

- Technological advances in fossil fuel alternatives

Factors That May Delay Demand Decline

- Strong economic growth in emerging markets, especially India

- Slow pace of clean energy infrastructure development

- Continued demand for petrochemical products

- Higher alternative energy costs in some regions

- Technical challenges in large-scale renewable energy storage

Oil Companies’ Strategies to Adapt to the Energy Transition

Global oil companies’ strategies for adapting to the energy transition

Global oil companies face a major strategic dilemma: how to continue generating profits from their traditional businesses while preparing for a low-carbon future. These companies have taken divergent paths in their responses to the challenges of the energy transition.

“The transformation in oil companies’ strategy is the biggest reshaping in the history of the energy industry, as they transform from oil and gas companies to integrated energy companies capable of surviving and thriving in a low-carbon world.”

Comprehensive Transformation Model

Adopted by companies like BP and TotalEnergies, it involves massive investments in renewable energy, hydrogen, and electric charging technologies, with a gradual reduction in oil production.

Balanced Diversification Model

Followed by companies like Shell and ENI, balancing investment in clean energy while maintaining oil and gas production levels, focusing on reducing carbon intensity.

Efficiency Focus Model

Adopted by companies like ExxonMobil and Chevron, with continued focus on traditional oil and gas operations, improving efficiency and reducing emissions in existing operations.

Strategic Challenges and Risks

Rapid Transition Risks

- Insufficient returns from renewable energy investments

- Lack of expertise in new technologies

- Competition from specialized renewable energy companies

- Adapting to different business models and lower profit margins

Slow Transition Risks

- Stranded assets if demand declines faster than expected

- Tightening of climate-related regulations

- Difficulty accessing financing for oil and gas projects

- Declining market value as investors shift toward more sustainable companies

Impact of Energy Transition on Oil-Producing Countries

Declining revenues for oil-producing countries due to falling demand in different scenarios

Serious Economic Challenges

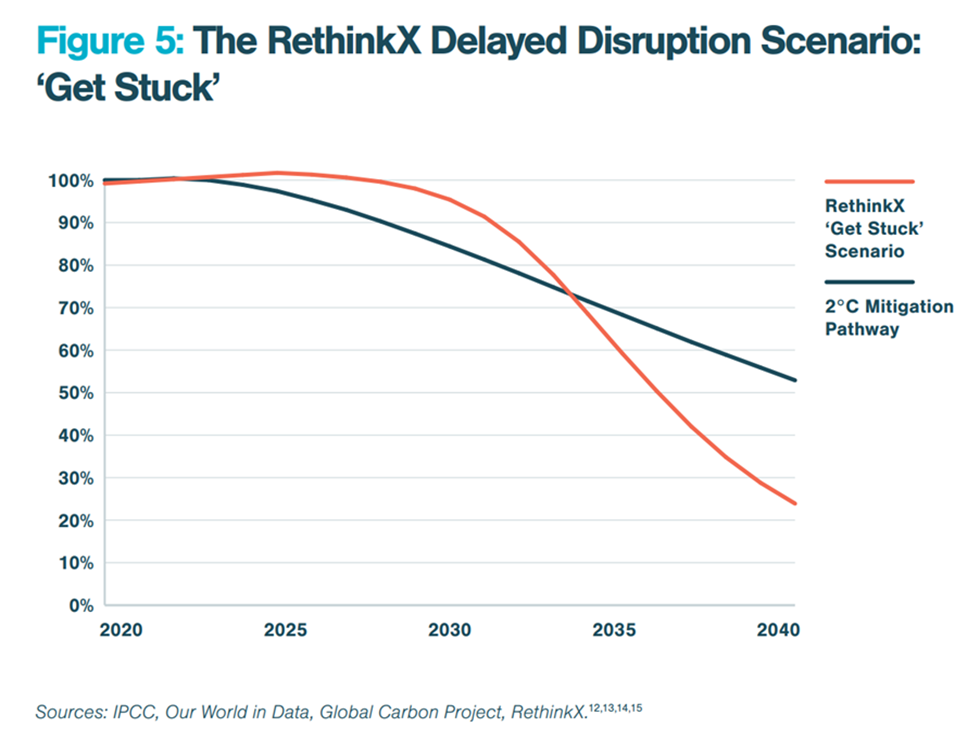

According to the International Energy Agency, per capita income from oil and gas in producer economies may decline by 60% by 2030 in a 1.5-degree global warming scenario. This decline will pose a significant challenge to countries heavily dependent on oil revenues.

Adaptation Strategies

- Economic Diversification: Investing in non-oil sectors such as tourism, manufacturing, and financial services

- Investment in Clean Energy: Utilizing natural resources (such as solar energy) to develop the renewable energy sector

- Hydrogen Industry Development: Using existing oil infrastructure to produce and transport hydrogen

- Diversification of Sovereign Wealth Funds: Investing oil revenues in globally diversified assets

- Reducing Budget Dependence on Oil: Reforming subsidy systems and diversifying government revenue sources

UAE Model: Successful Diversification Strategy

The United Arab Emirates is one of the most prominent models in diversifying the economy away from oil. The contribution of the oil and gas sector to GDP has decreased from about 43% in 2000 to less than 30% currently.

The UAE has invested heavily in tourism, renewable energy (Masdar project), technology, financial services, and transportation, making it less vulnerable to oil price fluctuations. It has also launched ambitious initiatives in green hydrogen as part of its Energy Strategy 2050.

Saudi Arabia: Vision 2030 and Economic Transformation

Vision 2030 represents Saudi Arabia’s ambitious plan to reduce its dependence on oil. The plan aims to increase the private sector’s contribution to GDP from 40% to 65%, and increase non-oil exports from 16% to 50% of total exports.

Key initiatives include the NEOM project (a $500 billion smart city), the Red Sea tourism project, massive investment in renewable energy (targeting 50% of electricity production by 2030), and the development of the green hydrogen industry.

Investment Opportunities in the Energy Transition Era

Accelerating growth in global renewable energy capacity

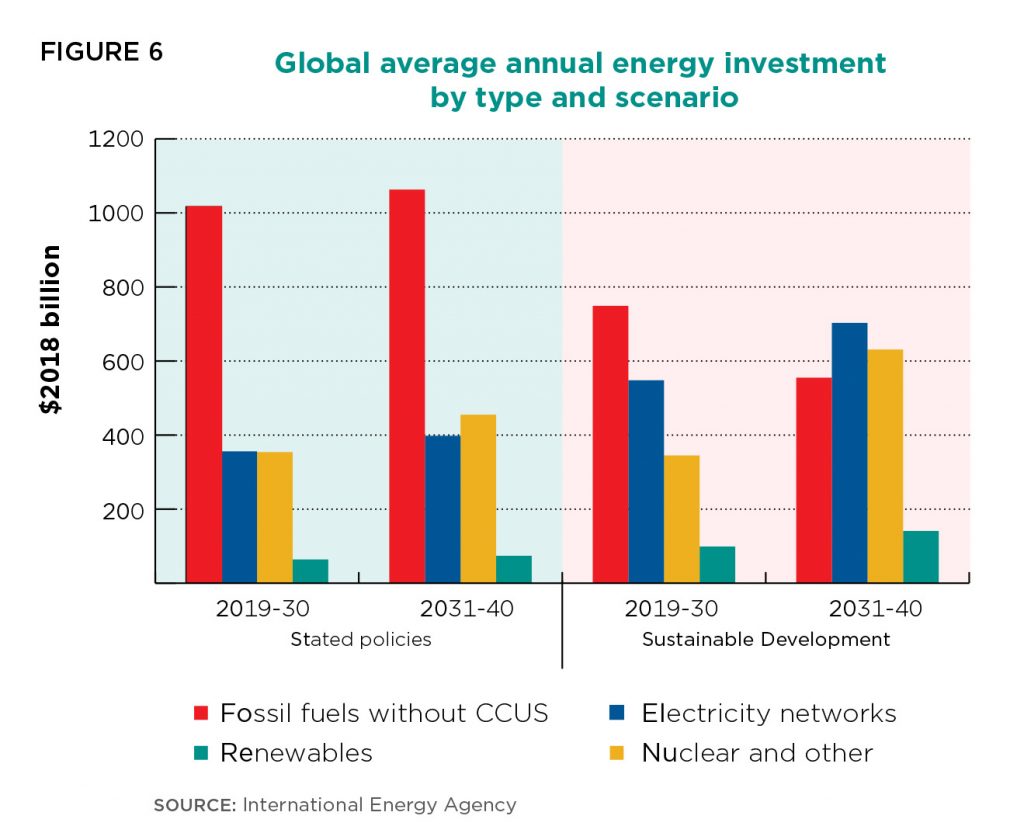

The energy transition opens a wide window of investment opportunities in multiple sectors. With global investments expected to exceed $10 trillion in clean energy by 2030, attractive opportunities emerge for investors who understand the dynamics of this transition.

“The clean energy revolution heralds the biggest investment opportunity of the 21st century, with a scale surpassing the industrial revolution and digital revolution combined.”

1. Renewable Energy

- Solar (PV) and onshore and offshore wind energy

- Energy storage technologies and batteries

- Smart grids and energy management solutions

- Hybrid power plants

2. Sustainable Transportation

- Electric vehicles and their batteries

- Electric charging infrastructure

- Environmentally friendly public transportation

- Low-emission trucks and ships

3. Hydrogen Economy

- Green and blue hydrogen production

- Fuel cells and their applications

- Hydrogen transport and distribution infrastructure

- Hydrogen uses in energy-intensive industries

4. Low-Carbon Technologies

- Carbon capture and storage (CCS) technologies

- Energy efficiency in buildings and industry

- Smart grids and demand management

- New low-carbon materials

5. Strategic Metals for Clean Energy

- Lithium, cobalt, and nickel for batteries

- Copper for transformers and electrical cables

- Rare earth elements for magnets

- Platinum and iridium for hydrogen technologies

Potential Scenarios for the Future of the Oil Market Through 2030

Optimistic Scenario for the Oil Industry

Continued growth in oil demand until the mid-2030s, driven by strong growth in emerging markets and slow adoption of alternative technologies.

Average Price: $80-90 per barrel

Probability: 25%

Base Scenario

Oil demand reaching its peak around 2030 at a level of 103-105 million barrels per day, then beginning a gradual decline thereafter.

Average Price: $65-75 per barrel

Probability: 50%

Pessimistic Scenario for the Oil Industry

Oil demand reaching its peak before 2030, with rapid decline thereafter, due to accelerated adoption of electric vehicles and stringent climate policies.

Average Price: $45-55 per barrel

Probability: 25%

Different scenarios for oil demand evolution in the coming decades

Critical Factors That Will Determine Market Direction

- Speed of Electric Vehicle Adoption: Specifically in key markets like China, Europe, and the United States

- Global Climate Policies: Specifically after COP30 in 2025

- Evolution of Renewable Energy and Storage Costs: Rate of decline in battery and solar energy costs

- Economic Growth in Asia: Especially India, China, and Southeast Asia

- Development of Hydrogen Technologies: Reducing production, transport, and usage costs

- Major Oil Companies’ Strategies: Investment decisions in traditional production versus clean energy

- OPEC+ Production Policies: Their ability to adapt to declining demand

- Progress in Carbon Capture Technologies: Their ability to extend the life of fossil fuels

Conclusion

The energy transition is not just a technological or environmental change, but a profound reshaping of the global economy and geopolitical relations. While long-term trends seem clear – a gradual decline in oil demand and the rise of renewable energy – the timing and specific path of this transition remain uncertain.

For oil companies, the challenge is finding the right balance between continuing to generate returns from traditional businesses and investing in the future of clean energy. For oil-producing countries, economic diversification is not an option but a necessity to maintain stability and prosperity in the post-oil era.

While these transitions pose significant challenges, they also open enormous investment opportunities in renewable energy, sustainable transportation, hydrogen technologies, and strategic metals. Investors who understand the dynamics of this transition and adapt to it will be better positioned to achieve strong returns in the coming decades, while contributing to building a more sustainable energy system for the future.