Why Stablecoins Collapse: When Stable Currencies Fail

Discover the shocking truth behind stablecoin failures and why your "stable" digital assets might not be so stable after all. From Terra Luna's spectacular collapse to USDC's dramatic depeg, we expose the hidden risks that could destroy your crypto portfolio overnight.

Why Stablecoins Collapse: When Stable Currencies Fail

The Hidden Risks of Relying on Stablecoins

:max_bytes(150000):strip_icc()/terms_s_stablecoin_FINAL-89e1671b1f24486b84b74cebe6836573.jpg)

In the volatile world of cryptocurrency, stablecoins were supposed to be the safe haven—digital assets designed to maintain a stable value against traditional currencies like the US dollar. Yet, the harsh reality has proven otherwise. From the spectacular collapse of Terra Luna’s UST to the dramatic depegging of USDC during the Silicon Valley Bank crisis, stablecoins have repeatedly failed when investors needed them most.

Critical Reality Check

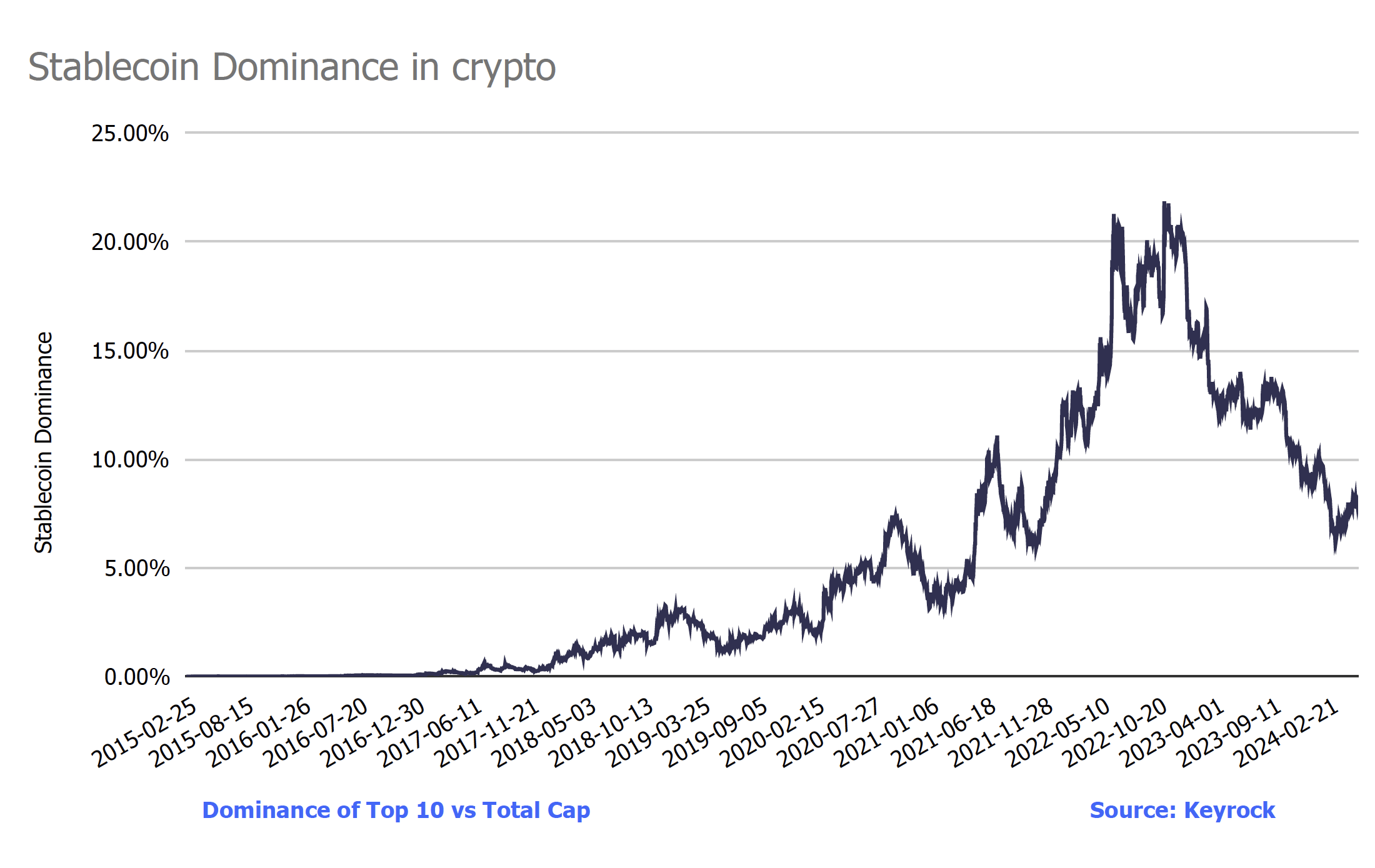

The stablecoin market, worth over $260 billion as of 2025, has experienced multiple catastrophic failures that wiped out billions in investor funds. Understanding why stablecoins collapse isn’t just academic—it’s essential for protecting your digital assets in an increasingly unstable crypto landscape.

This comprehensive analysis reveals the hidden vulnerabilities that make even the most trusted stablecoins susceptible to sudden collapse. We’ll examine the mechanisms behind major failures, identify warning signs, and explore the systemic risks that threaten the entire cryptocurrency ecosystem.

What Are Stablecoins and Why Do They Matter?

Stablecoins are cryptocurrencies designed to maintain a stable value relative to a reference asset, typically the US dollar. Unlike Bitcoin or Ethereum, which can fluctuate dramatically in value, stablecoins aim to provide the benefits of digital currencies—fast transactions, global accessibility, and programmability—without the extreme volatility.

Market Dominance

As of 2025, stablecoins process more transaction volume than traditional payment giants:

- $27.6 trillion in stablecoin transfers in 2024

- 7.68% higher than Visa and Mastercard combined

- 99% of stablecoins are pegged to the US dollar

- $260+ billion total market capitalization

Why Stablecoins Are Critical to Crypto

Trading Infrastructure

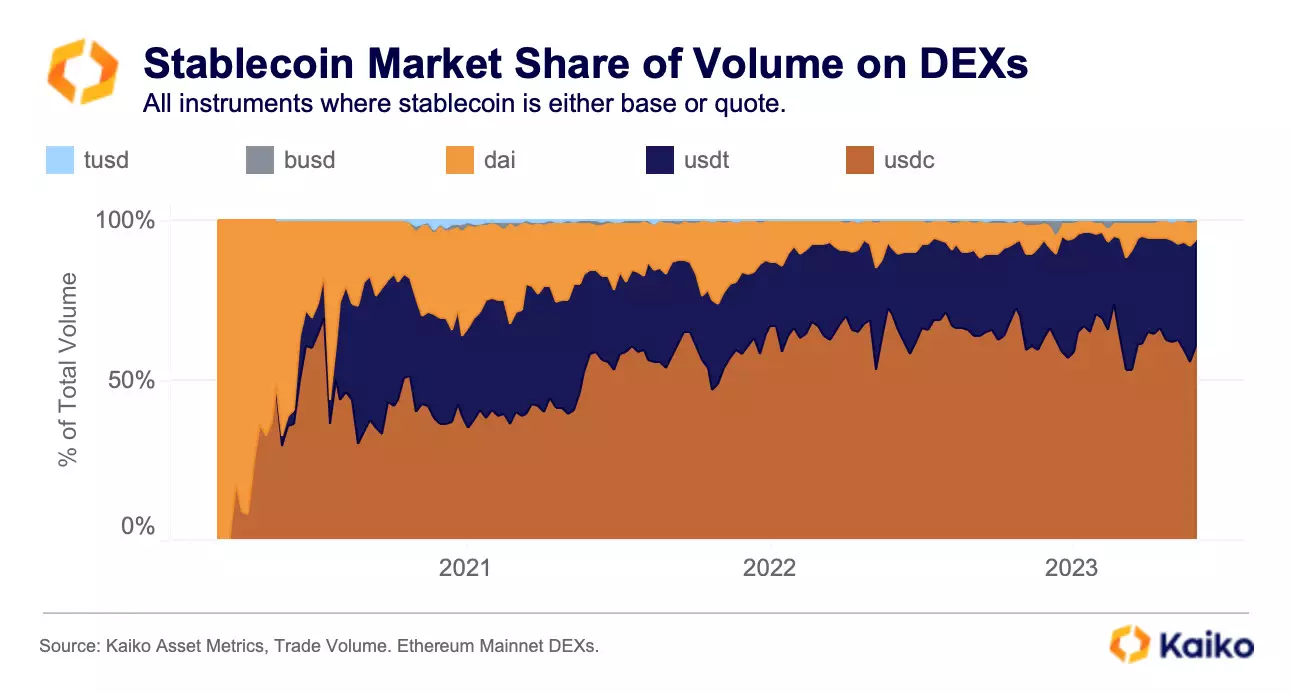

Stablecoins serve as the primary trading pairs for most cryptocurrency exchanges, enabling traders to move in and out of volatile positions without converting to fiat currency.

Store of Value

Many investors park their crypto gains in stablecoins during market uncertainty, expecting them to maintain their dollar value.

DeFi Foundation

Decentralized Finance protocols rely heavily on stablecoins for lending, borrowing, and yield farming activities.

Cross-border Payments

Businesses and individuals use stablecoins for international transfers, avoiding traditional banking delays and fees.

The Stability Paradox

The very infrastructure that makes stablecoins valuable also makes them systemically dangerous. When a major stablecoin fails, it doesn’t just affect holders—it can trigger cascading liquidations across the entire crypto ecosystem, freezing markets and destroying billions in value instantly.

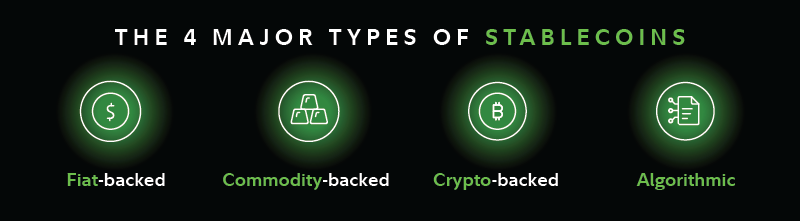

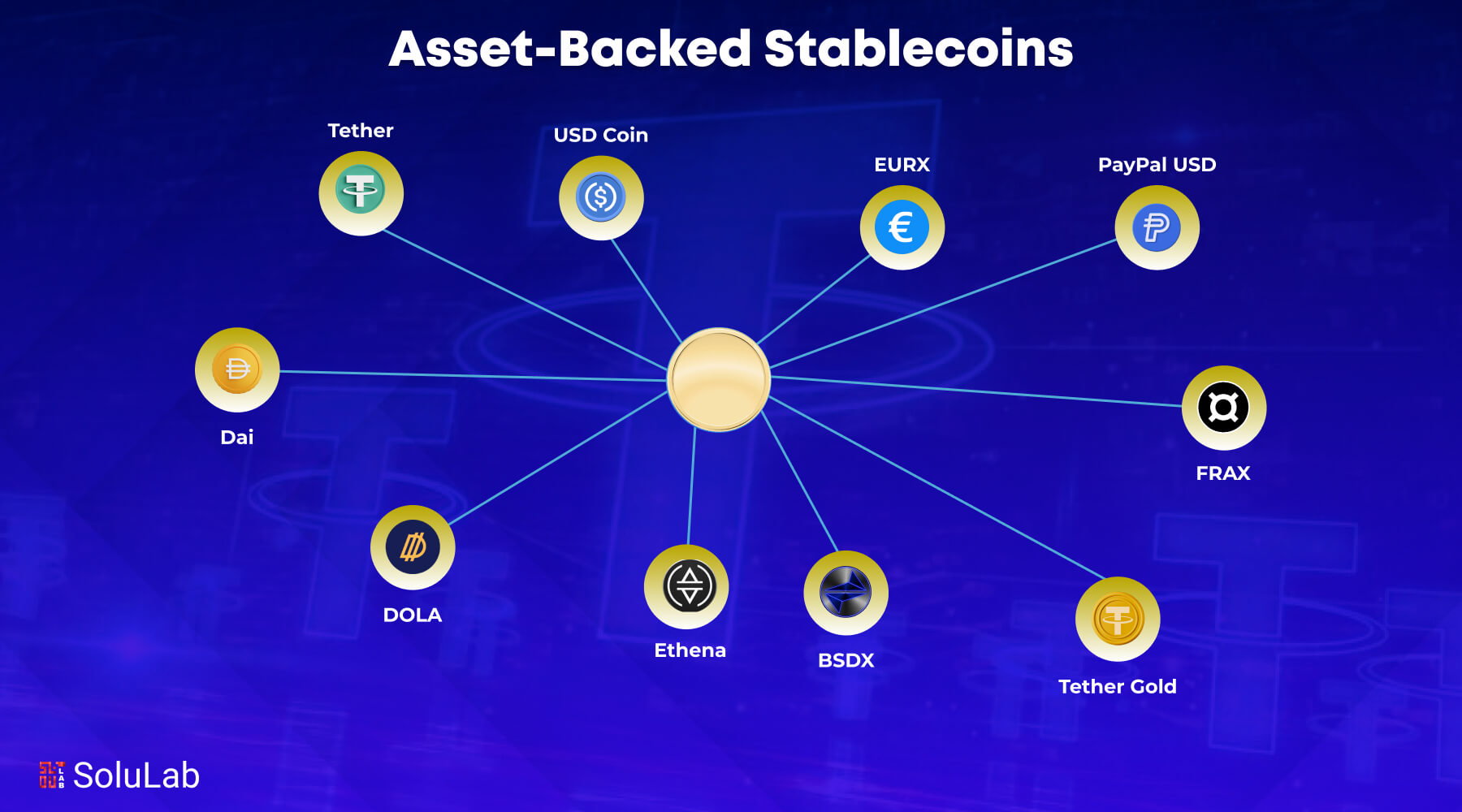

The Different Types of Stablecoins and Their Vulnerabilities

Not all stablecoins are created equal. Understanding the different types and their underlying mechanisms is crucial for identifying potential points of failure. Each category carries unique risks that have led to spectacular collapses.

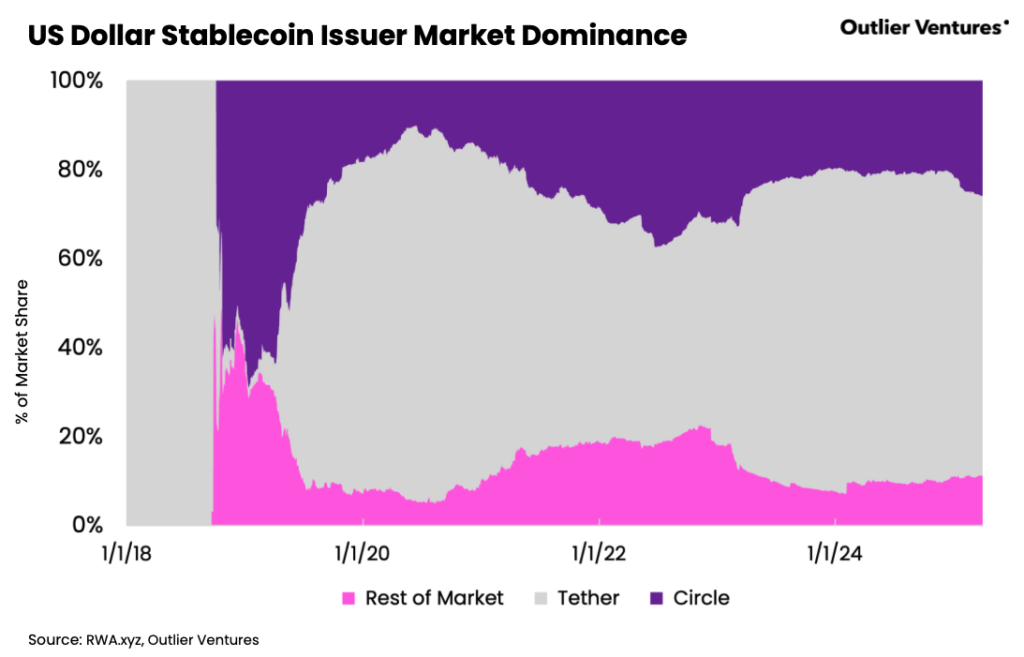

Fiat-Collateralized Stablecoins

These stablecoins are backed by traditional fiat currency reserves held in bank accounts. Popular examples include USDT (Tether), USDC (USD Coin), and BUSD (Binance USD).

How They Work

- For every token issued, $1 (or equivalent) is held in reserve

- Users can redeem tokens for fiat currency through the issuer

- Reserves are typically held in bank accounts or short-term Treasury bills

- Regular attestations (audits) verify reserve backing

Critical Vulnerabilities

- Bank Run Risk: If too many users try to redeem simultaneously

- Custodial Risk: Centralized control over reserves

- Banking System Exposure: Vulnerable to traditional banking crises

- Regulatory Risk: Subject to government intervention and asset freezing

- Reserve Mismanagement: Funds may be invested in risky assets

Crypto-Collateralized Stablecoins

These stablecoins are backed by other cryptocurrencies, typically over-collateralized to account for crypto volatility. DAI (MakerDAO) is the most prominent example.

Mechanism

- Users deposit crypto (ETH, BTC) as collateral

- Over-collateralization (typically 150-200%) protects against volatility

- Smart contracts automatically liquidate positions if collateral falls too low

- Governance tokens control protocol parameters

Vulnerability Profile

- Market Crash Risk: Collateral value can plummet faster than liquidations

- Smart Contract Risk: Bugs or exploits in the code

- Governance Risk: Malicious or poor governance decisions

- Liquidation Cascades: Mass liquidations can destabilize the peg

- Oracle Failures: Price feed manipulation or failures

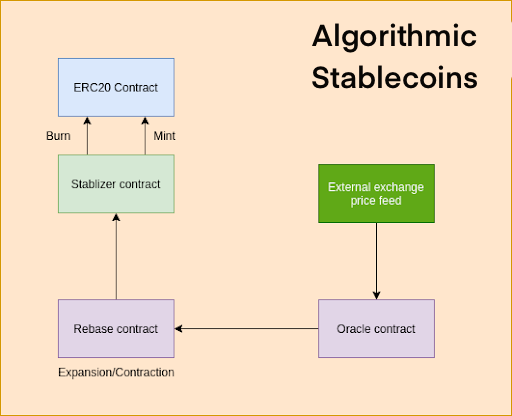

Algorithmic Stablecoins

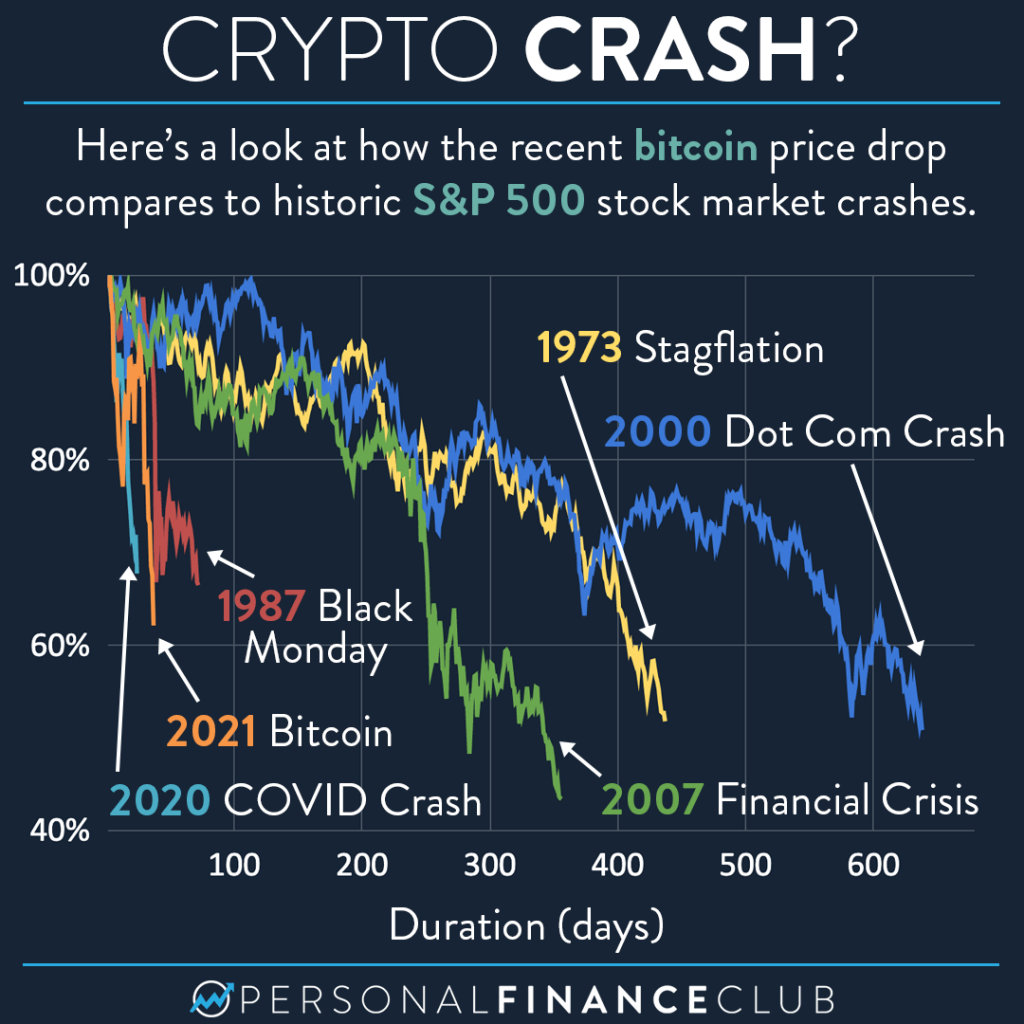

The most controversial and failure-prone category, algorithmic stablecoins use market mechanisms and algorithms to maintain their peg without traditional collateral. TerraUSD (UST) was the most prominent example before its catastrophic collapse.

The Algorithm Promise

- Mint/burn mechanisms to control supply and demand

- Arbitrage opportunities to maintain the peg

- No need for traditional collateral or reserves

- Supposedly fully decentralized and autonomous

Fatal Flaws

Death Spiral Risk: When confidence is lost, the algorithm can enter a self-reinforcing collapse where selling pressure increases token supply, devaluing the backing token, leading to more selling.

Confidence Dependence: The entire system relies on market confidence and arbitrage activity, which can evaporate instantly during stress.

Market Manipulation: Large actors can exploit the mechanism to trigger collapses.

Regulatory Pressure: Vulnerable to government intervention due to their experimental nature.

The Hierarchy of Risk

Based on historical failures and inherent design flaws:

- Algorithmic Stablecoins: Highest risk – Multiple catastrophic failures

- Crypto-Collateralized: Medium-high risk – Vulnerable to market crashes

- Fiat-Collateralized: Medium risk – Banking and regulatory vulnerabilities

Remember: Even “low-risk” stablecoins have experienced significant depegging events that cost investors millions.

Historical Overview: Major Stablecoin Collapses

The history of stablecoins is littered with spectacular failures that have cost investors billions of dollars. Each collapse has revealed new vulnerabilities and highlighted the systemic risks these “stable” assets pose to the broader cryptocurrency ecosystem.

Timeline of Catastrophic Failures

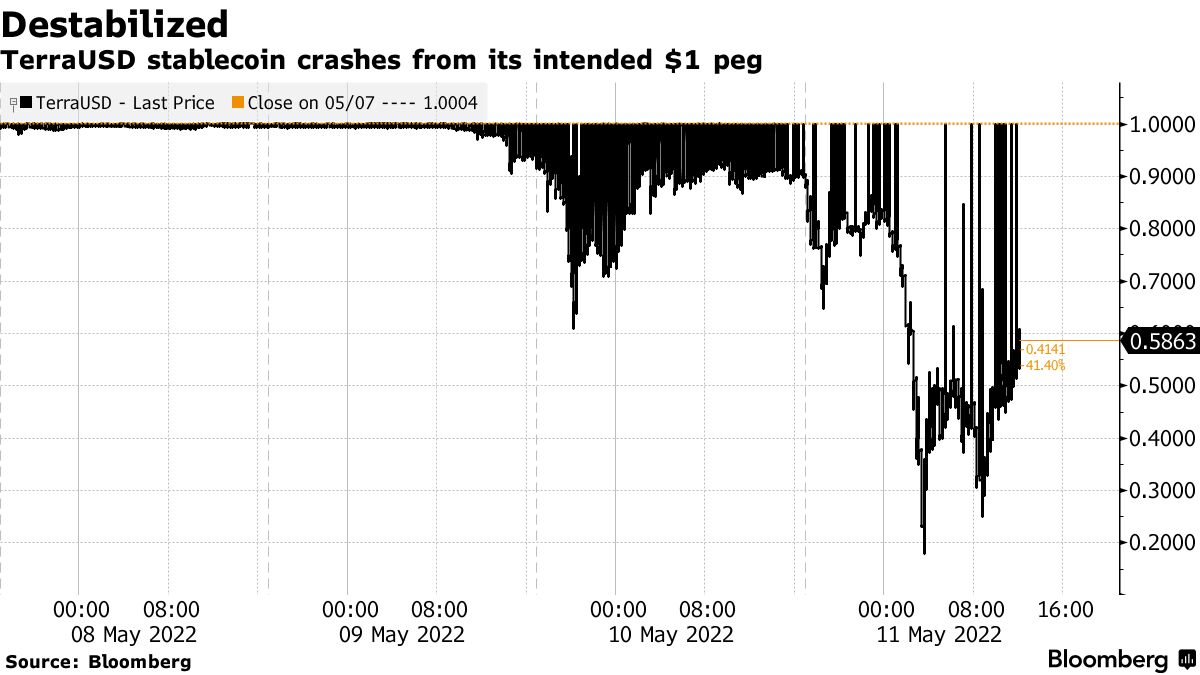

TerraUSD (UST) Collapse

The most devastating stablecoin collapse in history. UST, an algorithmic stablecoin, lost its dollar peg and crashed to near zero, taking the entire Terra ecosystem with it.

Peak Market Cap: $18.7 billion

Value Lost: Over $60 billion (including LUNA)

Time to Collapse: 72 hours

Trigger: Large UST redemptions

Cause: Death spiral mechanism

Current Status: Worthless

USDC Silicon Valley Bank Crisis

Circle’s USDC lost its dollar peg after revealing $3.3 billion exposure to the collapsed Silicon Valley Bank, falling as low as 87 cents.

Lowest Price: $0.877

Market Cap Impact: $8+ billion lost

Duration: 4 days

Trigger: Banking crisis exposure

Cause: Custodial risk materialized

Resolution: Government intervention

Iron Finance TITAN Collapse

IRON, a partially algorithmic stablecoin, collapsed when its backing token TITAN lost 99.9% of its value in a death spiral.

TITAN Peak: $64.19

Final Value: $0.000001

Collapse Duration: 24 hours

Celebrity Loss: Mark Cuban affected

Mechanism: Algorithmic failure

Warning Sign: Ignored by many

Early Algorithmic Experiments

Multiple early algorithmic stablecoins failed, including Basis, which shut down before launch due to regulatory concerns, and several smaller projects that lost their pegs permanently.

Pattern: Algorithmic designs consistently failed under market stress

Cascading Effects of Stablecoin Failures

Market Contagion

- Terra collapse triggered crypto winter 2022

- Bitcoin fell from $40K to $15K

- Total crypto market lost $2 trillion

- Multiple crypto companies bankrupted

Institutional Impact

- Three Arrows Capital bankruptcy

- Celsius Network collapse

- FTX exchange implosion

- Voyager Digital liquidation

Critical Lessons from History

Recurring Patterns:

- Confidence loss triggers rapid collapse

- Algorithmic mechanisms fail under stress

- Centralized risks always materialize eventually

- Market stress tests reveal hidden vulnerabilities

Systemic Risks:

- Stablecoin failures trigger market-wide crashes

- DeFi protocols become illiquid instantly

- Cross-collateralization amplifies losses

- Recovery takes months or never happens

Current Stablecoin Landscape (2025)

Market Leaders:

- USDT: $143+ billion

- USDC: $74+ billion

- Combined: 92% market share

Risk Factors:

- High concentration risk

- Regulatory uncertainty

- Banking system exposure

New Threats:

- CBDC competition

- Stricter regulations

- Technological disruption

What’s Next?

This comprehensive analysis continues with deeper examinations of specific collapse mechanisms, regulatory risks, and strategies for identifying vulnerable stablecoins before they fail. Understanding these patterns is crucial for protecting your investments in the volatile crypto landscape.

The Terra Luna Catastrophe: A Case Study in Algorithmic Failure

The dramatic collapse of Terra Luna from DeFi darling to death spiral

The collapse of Terra Luna (LUNA) and its associated stablecoin TerraUSD (UST) in May 2022 stands as one of the most spectacular failures in cryptocurrency history. This algorithmic stablecoin catastrophe wiped out over $60 billion in market value within days, demonstrating the inherent vulnerabilities of purely algorithmic stabilization mechanisms.

The Scale of Destruction

In just 72 hours, Terra Luna’s price plummeted from over $80 to virtually zero, while UST lost its dollar peg entirely. The collapse triggered a domino effect across the entire cryptocurrency market, causing billions in liquidations and destroying countless retail investors’ portfolios.

The Visionary Behind the Collapse: Do Kwon

Do Kwon, the controversial founder of Terra Luna, whose ambitious vision led to catastrophic failure

Do Kwon, the charismatic founder of Terraform Labs, positioned himself as a revolutionary who would challenge the traditional financial system. His aggressive social media presence and bold predictions about Terra’s future created a cult-like following among crypto enthusiasts.

Kwon’s Fatal Overconfidence

Do Kwon famously dismissed critics of UST’s stability mechanism, often engaging in public betting and making grandiose claims about the protocol’s resilience. His overconfidence in algorithmic mechanisms and dismissal of traditional risk management principles ultimately contributed to the system’s downfall.

Understanding Terra’s Algorithmic Mechanism

The complex algorithmic mechanism that was supposed to maintain UST’s stability

Terra’s dual-token system relied on a complex algorithmic relationship between LUNA and UST:

- Minting Process: When UST demand increased, users could burn $1 worth of LUNA to mint 1 UST

- Burning Process: When UST traded below $1, arbitrageurs could burn 1 UST to receive $1 worth of LUNA

- Anchor Protocol: Offered unsustainable 20% yields on UST deposits, creating artificial demand

- Bitcoin Reserves: Terra held Bitcoin reserves as additional backing, but these proved insufficient

The Fatal Flaw

The system only worked when LUNA’s market cap exceeded UST’s supply. When confidence eroded and LUNA’s price collapsed, the mechanism entered a deadly feedback loop where more LUNA needed to be minted to maintain UST’s peg, further diluting LUNA’s value.

The Collapse Timeline: A Financial Disaster Unfolds

May 7, 2022 – The First Cracks

Large UST redemptions began as whales started selling positions. UST briefly depegged to $0.98, triggering the first wave of algorithmic adjustments.

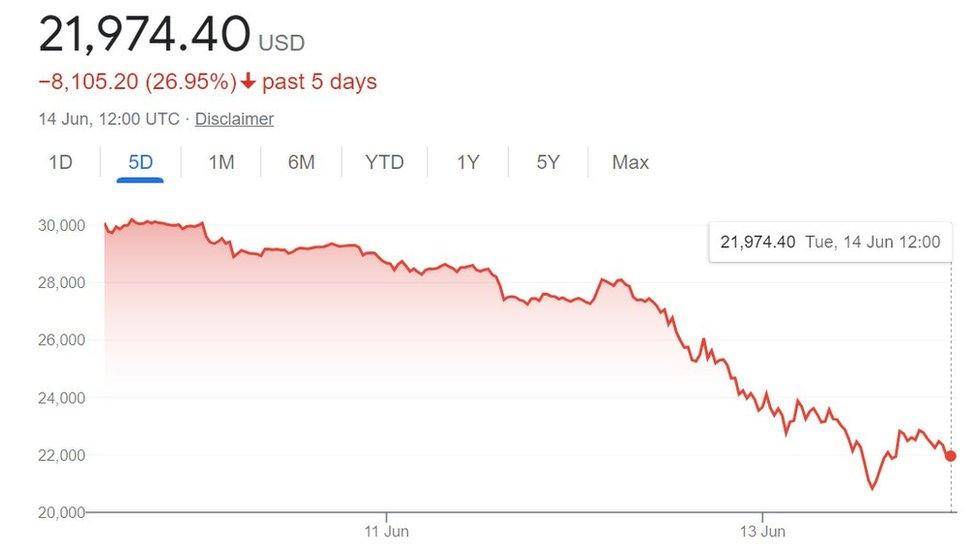

May 9, 2022 – The Avalanche Begins

UST lost its peg entirely, trading as low as $0.60. LUNA began its catastrophic decline as massive amounts were minted to defend the peg.

May 11, 2022 – Total Collapse

LUNA’s price fell from $80 to under $1. The Terra blockchain was temporarily halted to prevent further chaos.

May 13, 2022 – The Aftermath

LUNA traded at fractions of a cent. UST was completely worthless. The Terra ecosystem had effectively ceased to exist.

Visual representation of the Terra Luna death spiral that destroyed billions in value

Death Spiral Mechanics: How Algorithmic Stablecoins Self-Destruct

:max_bytes(150000):strip_icc()/deathspiral_final-eac75909682a433583087176a46031eb.png)

The economic mechanics of a death spiral in financial markets

A death spiral in algorithmic stablecoins represents one of the most dangerous failure modes in decentralized finance. Understanding these mechanics is crucial for identifying similar risks in other algorithmic stablecoin protocols and protecting your investments from catastrophic losses.

The Death Spiral Definition

A death spiral occurs when the mechanism designed to maintain stability becomes the very force that destroys it. In algorithmic stablecoins, this happens when the backing token’s value falls below the stablecoin’s market cap, creating an impossible mathematical situation.

The Five Stages of Algorithmic Stablecoin Death

Stage 1: Initial Confidence Loss

The death spiral begins with a loss of market confidence, often triggered by:

- Large holders selling their positions

- Regulatory concerns or negative news

- Technical vulnerabilities being discovered

- Unsustainable yield farming rewards being questioned

Stage 2: The Depeg Event

As selling pressure mounts, the stablecoin begins trading below its target value. This triggers automatic market responses and creates arbitrage opportunities that sophisticated traders exploit mercilessly.

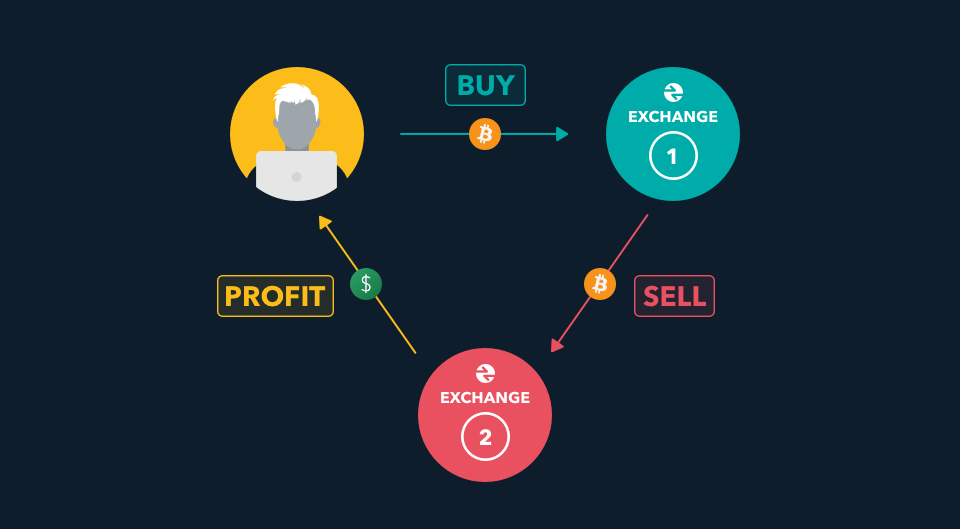

How arbitrage trading mechanisms work in cryptocurrency markets

Stage 3: Algorithmic Response Overwhelm

The protocol’s stabilization mechanism kicks in, typically involving:

- Token Burning: Stablecoins are burned to reduce supply

- Backing Token Minting: New backing tokens are created to pay for burned stablecoins

- Price Pressure: Massive new token supply creates downward price pressure

- Accelerated Redemptions: Smart money exits rapidly, exacerbating the problem

Stage 4: Hyperinflation Phase

As more backing tokens are minted to defend the peg, their value collapses exponentially. This creates a hyperinflationary environment where billions of new tokens flood the market within hours.

The Hyperinflation Trap

During Terra’s collapse, LUNA’s supply increased from 350 million tokens to over 6.5 trillion tokens in just days. This 18,571% increase in supply made each token virtually worthless, regardless of any utility or backing the protocol might have had.

Stage 5: Total System Collapse

The final stage sees complete failure of the stabilization mechanism. The backing token becomes worthless, the stablecoin loses all value, and the entire ecosystem collapses.

The anatomy of a financial death spiral and its devastating effects

Mathematical Impossibility: The Core Problem

The fundamental issue with algorithmic stablecoins lies in a simple mathematical relationship:

The Death Spiral Formula

When: Market Cap of Backing Token < Market Cap of Stablecoin

Result: Mathematical impossibility to maintain peg

This situation forces the protocol to mint backing tokens exponentially, creating infinite dilution and guaranteed collapse.

Other Algorithmic Stablecoin Failures

Terra Luna wasn’t the first algorithmic stablecoin to fail catastrophically. The history is littered with similar disasters:

- Iron Finance (TITAN/IRON): Collapsed in June 2021, causing massive losses including Mark Cuban’s portfolio

- Empty Set Dollar (ESD): Failed to maintain its peg multiple times throughout 2020-2021

- Basis Cash (BAC): Never achieved sustained stability and gradually lost all value

- Ampleforth (AMPL): Experiences extreme volatility despite algorithmic adjustments

Lessons for Investors

Understanding death spiral mechanics helps investors identify similar risks in new projects. Any algorithmic stablecoin that relies solely on token minting/burning without adequate overcollateralization faces these same mathematical constraints.

The USDC Depeg: When Centralized Stablecoins Break

The impact of Silicon Valley Bank’s collapse on USDC’s stability

While algorithmic stablecoins face inherent structural risks, even centralized stablecoins backed by traditional assets can experience dramatic failures. The USDC depeg incident in March 2023 demonstrated that no stablecoin is immune to systemic risks, especially when their backing relies on traditional financial institutions.

USDC: The “Safe” Stablecoin

USD Coin (USDC), issued by Centre and backed by Circle, was long considered one of the most reliable stablecoins. With full regulatory compliance and regular attestations of its dollar reserves, USDC represented the gold standard for centralized stablecoins.

The Silicon Valley Bank Connection

Circle, USDC’s issuer, held approximately $3.3 billion of its reserves at Silicon Valley Bank (SVB). When SVB collapsed on March 10, 2023, these funds became temporarily inaccessible, creating an immediate crisis of confidence in USDC’s backing.

The Depeg Timeline: Panic in the Markets

March 10, 2023 – SVB Collapse

Silicon Valley Bank failed after a bank run, leaving Circle’s $3.3 billion deposit in limbo. Circle immediately disclosed this exposure to maintain transparency.

March 11, 2023 – Market Panic

USDC began trading as low as $0.87, representing a 13% depeg. Massive redemptions began as holders rushed to exit their positions.

March 12, 2023 – Government Intervention

The US government announced it would guarantee all SVB deposits, including Circle’s funds. USDC began recovering toward its $1 peg.

March 13, 2023 – Full Recovery

With government backing confirmed, USDC fully restored its $1 peg. Circle recovered its funds and strengthened its reserve management policies.

Market analysis showing USDC’s dramatic price movements during the Silicon Valley Bank crisis

Cascading Effects Across DeFi

The USDC depeg had immediate and severe consequences across the entire decentralized finance (DeFi) ecosystem:

DeFi Protocol Disruptions

- MakerDAO: The protocol backing DAI stablecoin held significant USDC reserves, threatening DAI’s stability

- Compound Finance: USDC collateral became less valuable, triggering liquidations

- Uniswap: Trading volumes spiked as users rushed to swap USDC for other assets

- Aave: Borrowing costs increased dramatically as USDC’s reliability was questioned

The Counterparty Risk Reality

The USDC depeg exposed a critical vulnerability in centralized stablecoins: counterparty risk. Despite being fully backed by dollar reserves, USDC’s stability depended entirely on the health of traditional financial institutions holding those reserves.

Hidden Dependencies

Even the most transparent and well-managed stablecoin can fail if its backing institutions experience problems. This creates a systemic risk that most investors don’t fully understand or appreciate.

Market Contagion and Flight to Safety

As USDC depegged, investors frantically sought alternatives, creating massive volatility across stablecoin markets:

- Tether (USDT): Benefited from flight to safety, but faced renewed scrutiny about its reserves

- Binance USD (BUSD): Saw increased demand but was already facing regulatory pressure

- DAI: Experienced its own depeg due to USDC exposure in its backing collateral

- FRAX: Algorithmic components were stress-tested as market confidence evaporated

Understanding the warning signs of financial crises and their impact on digital assets

Regulatory Implications and Lessons Learned

The USDC incident highlighted several critical issues for stablecoin regulation and risk management:

Key Regulatory Takeaways

- Diversification Requirements: Reserves should be spread across multiple institutions

- Real-time Reporting: Stablecoin issuers need better transparency mechanisms

- Government Backing: The role of deposit insurance in stablecoin stability

- Systemic Risk Assessment: Understanding how stablecoin failures can impact traditional finance

Circle’s response to the crisis was exemplary in terms of transparency and communication, but the incident demonstrated that even the best-managed centralized stablecoin faces risks beyond the issuer’s control. This reality has profound implications for the future of digital currency stability and regulation.

Protection Strategies

Investors can protect themselves by diversifying across multiple stablecoins, understanding the backing mechanisms of each, and maintaining awareness of the traditional financial institutions that support centralized stablecoins.

7. Tether’s Shadow: Reserve Transparency and Trust Issues

Tether’s ongoing transparency challenges have raised serious questions about USDT’s backing

Tether (USDT), the world’s largest stablecoin by market capitalization, has long been shrouded in controversy regarding the transparency of its reserve backing. Despite claims that each USDT token is fully backed by reserves, the company’s reluctance to undergo comprehensive audits has created a cloud of uncertainty that threatens the entire stablecoin ecosystem.

The Audit Problem

Tether’s repeated promises of full audits have yet to materialize into comprehensive transparency

Unlike traditional financial institutions that undergo regular audits, Tether has consistently avoided full-scale audits by major accounting firms. Instead, the company has relied on “attestations” – limited reviews that don’t provide the same level of scrutiny as a complete audit.

Key Transparency Issues:

- No Full Audit: Despite promises, Tether has never completed a comprehensive audit by a Big Four accounting firm

- Opaque Reserve Composition: The exact breakdown of reserves remains unclear, with significant portions in “commercial paper”

- Banking Relationships: Tether’s banking partners and reserve custody arrangements lack transparency

- Regulatory Scrutiny: Multiple jurisdictions have raised concerns about Tether’s practices

Historical Red Flags

Consumer advocacy groups have repeatedly raised concerns about Tether’s reserve transparency

Tether’s history is littered with incidents that have raised serious questions about its stability and transparency. From the 2019 revelation that USDT was only 74% backed by cash and cash equivalents to ongoing regulatory investigations, the pattern of opacity is deeply concerning.

The Systemic Risk

The lack of transparency surrounding Tether’s reserves creates a systemic risk that extends far beyond individual investors. If Tether were to collapse due to insufficient reserves, the ripple effects would be felt across the entire cryptocurrency market, potentially triggering a liquidity crisis that could destabilize digital asset trading globally.

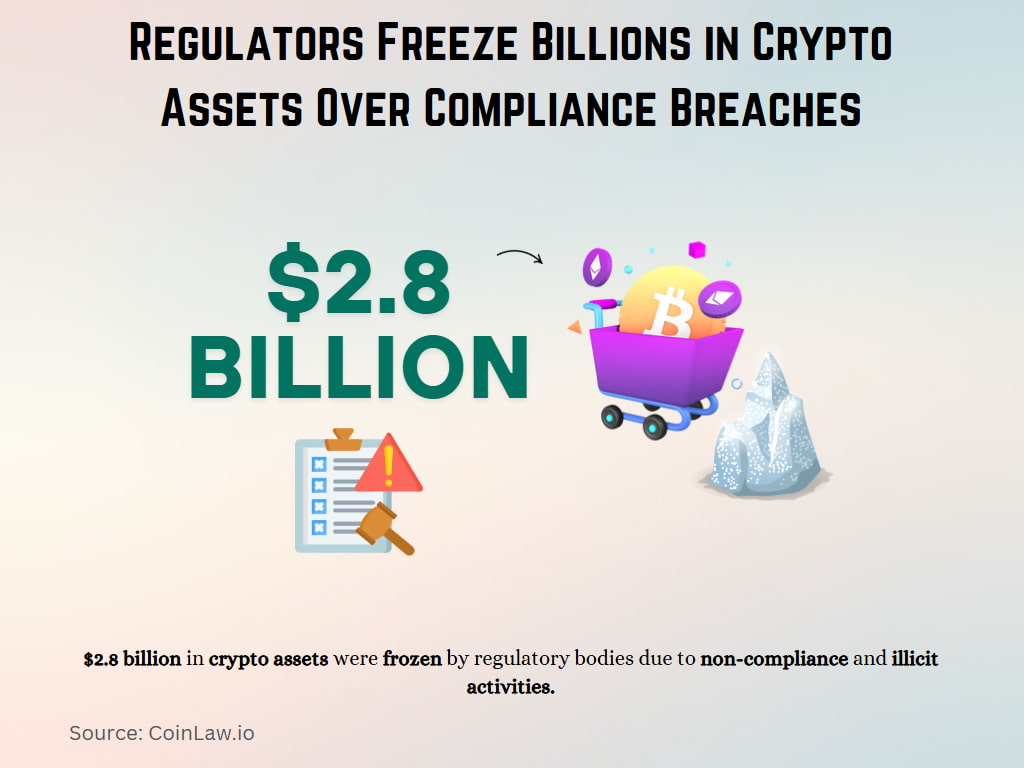

8. Regulatory Risks: Government Intervention and Asset Freezing

Regulators worldwide have frozen billions in crypto assets, highlighting compliance risks

One of the most underestimated risks facing stablecoin holders is the potential for government intervention and asset freezing. Unlike decentralized cryptocurrencies, centralized stablecoins can be frozen, seized, or blocked by their issuers at the request of regulatory authorities or law enforcement agencies.

The Power to Freeze

The mechanisms behind cryptocurrency seizure and freezing by authorities

Most major stablecoins, including USDT and USDC, contain smart contract functions that allow their issuers to freeze specific addresses or tokens. This capability, while designed to comply with regulatory requirements and combat illicit activities, creates a significant risk for legitimate users who may find their assets frozen without prior notice.

Regulatory Intervention Scenarios:

- Compliance Violations: Assets can be frozen if the issuer faces regulatory action

- Sanctions Compliance: Addresses linked to sanctioned entities can be instantly blacklisted

- Court Orders: Legal proceedings can result in asset freezing pending investigation

- Operational Shutdowns: Regulatory pressure could force stablecoin issuers to cease operations

CBDC Competition and Regulatory Pressure

:max_bytes(150000):strip_icc()/terms_c_central-bank-digital-currency-cbdc_FINAL-671aefb2905b407583007d63fa46e49d.jpg)

Central banks worldwide are developing CBDCs that could compete with or replace private stablecoins

As central banks worldwide advance their Central Bank Digital Currency (CBDC) initiatives, private stablecoins face increasing regulatory pressure. Governments may view stablecoins as competition to their monetary sovereignty and could implement restrictive regulations or outright bans to protect their own digital currencies.

Case Studies in Asset Freezing

Real-world examples of frozen cryptocurrency assets demonstrate the risks of centralized control

Recent years have seen numerous instances of stablecoin freezing, from sanctions-related blacklisting to compliance with law enforcement requests. These cases highlight the reality that stablecoin holders have limited recourse when their assets are frozen, as the centralized nature of these tokens gives issuers ultimate control over user funds.

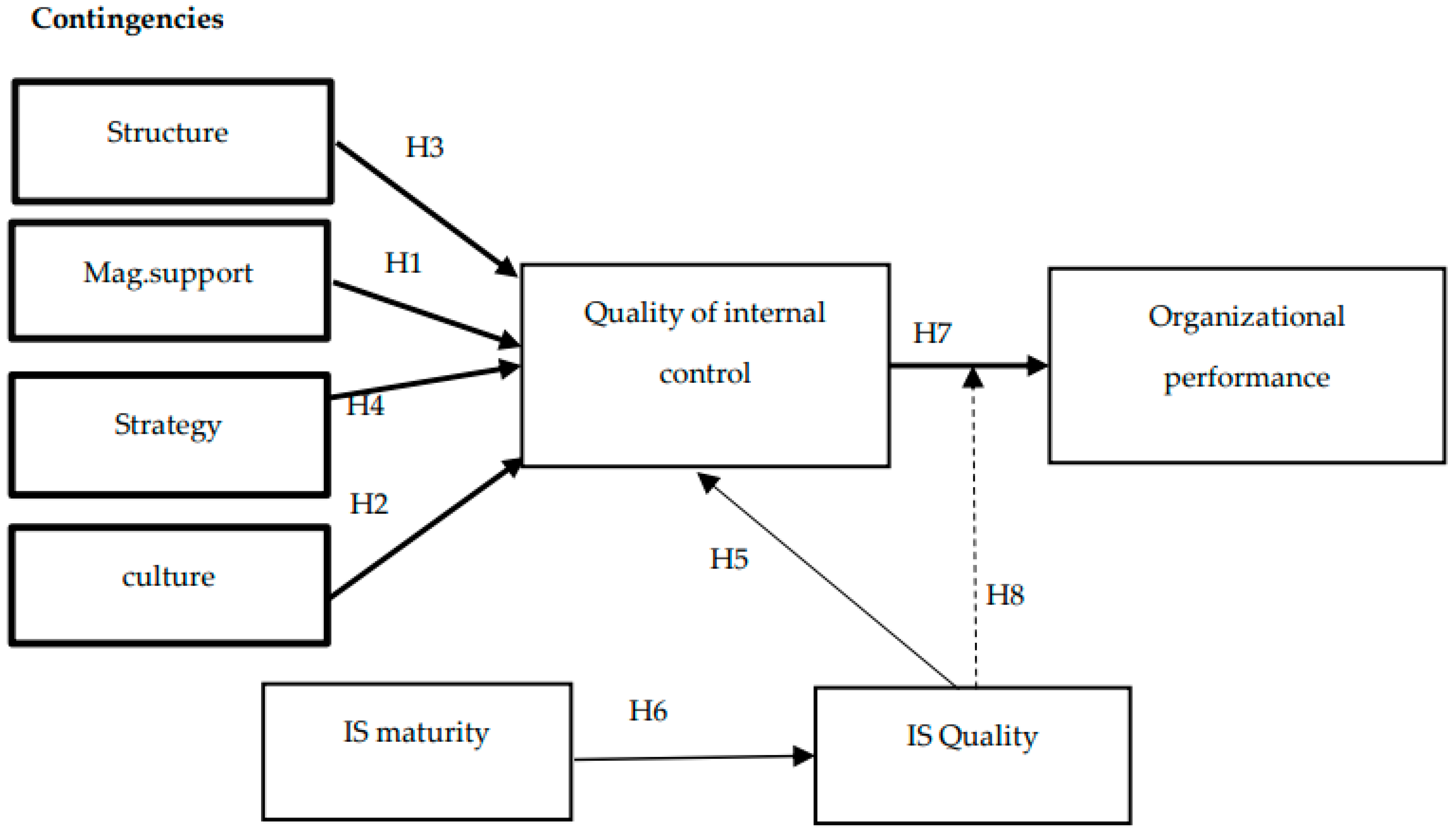

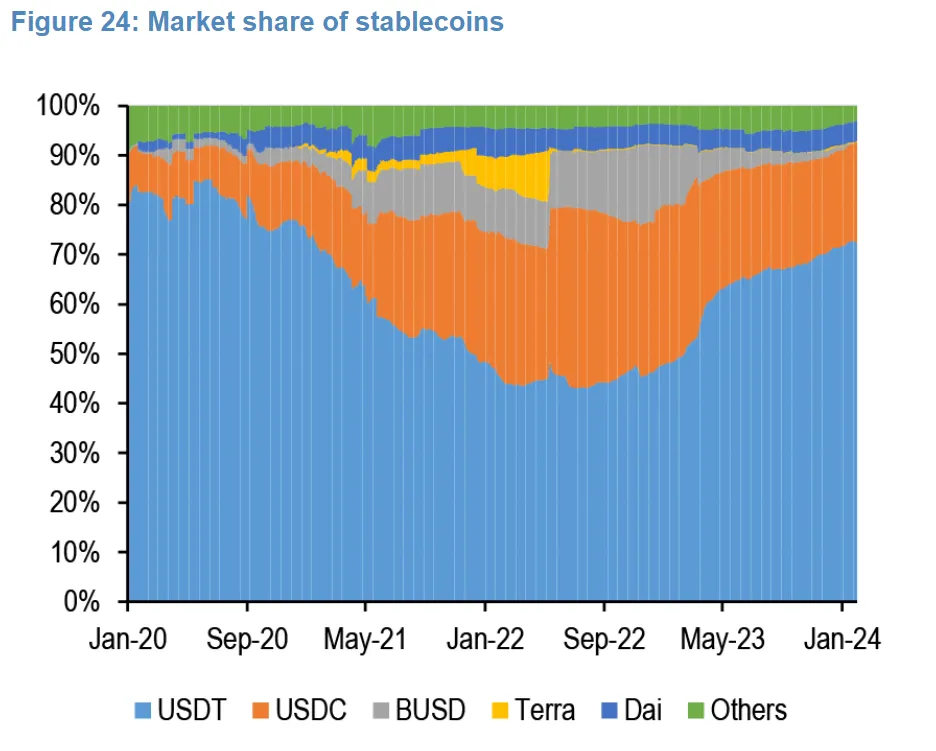

9. Market Concentration: The Systemic Risk of Stablecoin Dominance

The concentration of the stablecoin market in just a few major players creates significant systemic risk

The stablecoin market’s extreme concentration represents one of its greatest vulnerabilities. With Tether (USDT) and USD Coin (USDC) controlling over 90% of the market, the failure of either could trigger a cascade of liquidations and market instability that would dwarf previous crypto crashes.

The Concentration Problem

Market data showing the extreme concentration of stablecoin market share among top players

Market concentration in the stablecoin space has reached dangerous levels. Tether alone accounts for approximately 65% of the total stablecoin market capitalization, while USDC holds another 20-25%. This duopoly creates a single point of failure that could devastate the entire decentralized finance (DeFi) ecosystem.

Market Concentration Risks:

- Systemic Failure Risk: The collapse of either USDT or USDC could trigger ecosystem-wide liquidations

- Liquidity Concentration: Most DeFi protocols rely heavily on these two stablecoins for liquidity

- Single Point of Failure: Critical infrastructure depends on just two entities

- Regulatory Target: High concentration makes the market vulnerable to targeted regulation

DeFi Dependency and Cascade Effects

The extensive use of stablecoins in DeFi protocols creates interconnected risks

The DeFi ecosystem’s heavy reliance on USDT and USDC creates interconnected risks that could amplify the impact of any stablecoin failure. Lending protocols, decentralized exchanges, and yield farming platforms all depend on these stablecoins for liquidity, meaning their failure could trigger a domino effect of liquidations and protocol failures.

Too Big to Fail?

Trading volume data highlighting the dominance of major stablecoins in crypto markets

The question of whether major stablecoins have become “too big to fail” is increasingly relevant as their market dominance grows. However, unlike traditional banks that might receive government bailouts, private stablecoins operate in a regulatory gray area where no such safety net exists.

The Path Forward: Diversification and Competition

Addressing the concentration risk in the stablecoin market requires both increased competition and user diversification. The development of alternative stablecoins with different backing mechanisms, the growth of decentralized stablecoins, and user education about concentration risks are all essential for creating a more resilient stablecoin ecosystem.

Risk Mitigation Strategies:

- Portfolio Diversification: Spread stablecoin holdings across multiple issuers and backing mechanisms

- Alternative Stablecoins: Consider emerging stablecoins with different risk profiles

- Decentralized Options: Explore algorithmic and over-collateralized stablecoins for diversity

- Regular Monitoring: Stay informed about the health and transparency of stablecoin issuers

The stablecoin market’s concentration represents a clear and present danger to the stability of the entire cryptocurrency ecosystem. As these digital assets become increasingly integrated into global finance, the need for diversification, transparency, and regulatory clarity becomes ever more urgent. Investors and users must remain vigilant and prepared for the potential consequences of this concentration as the market continues to evolve.

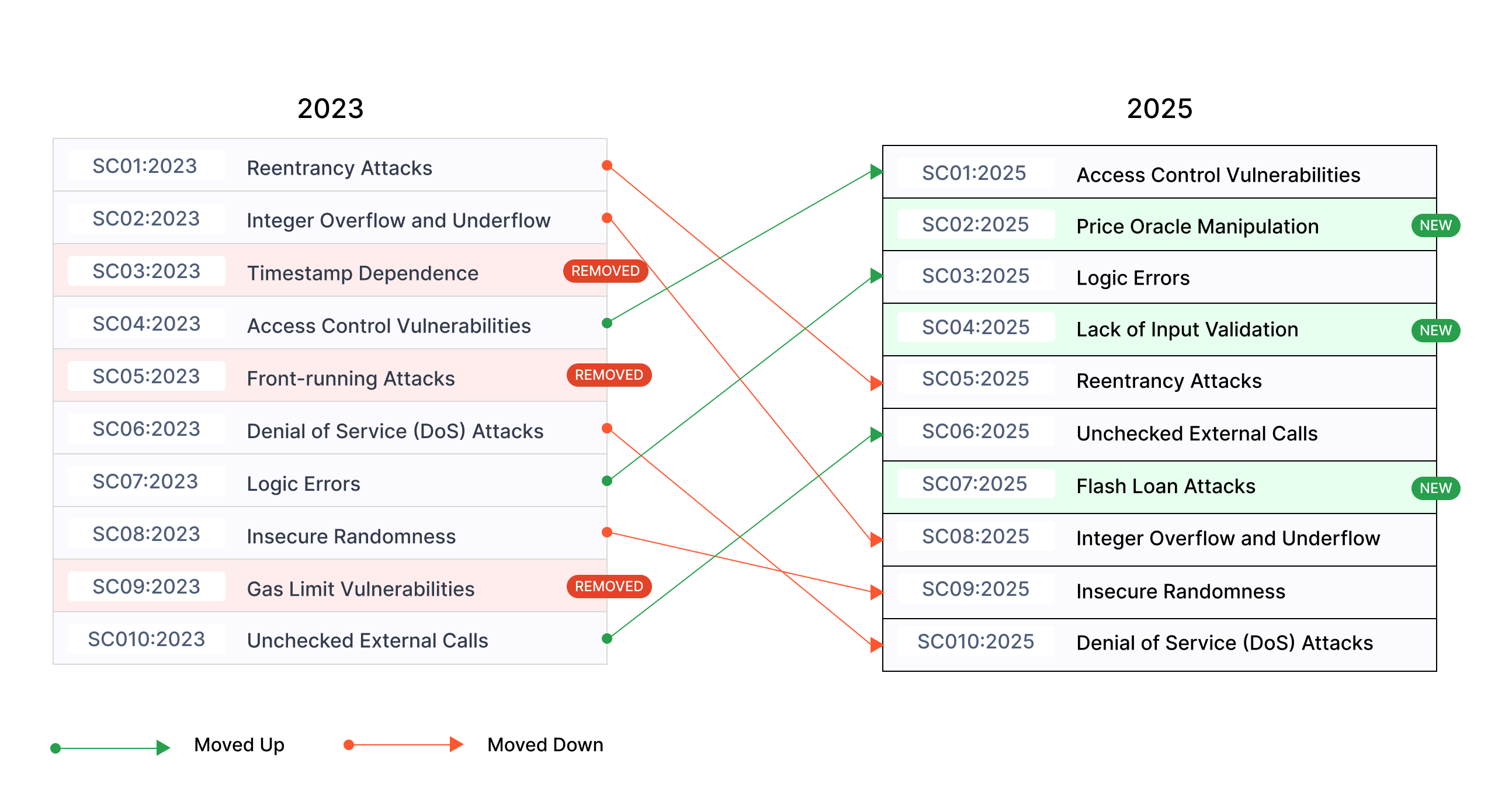

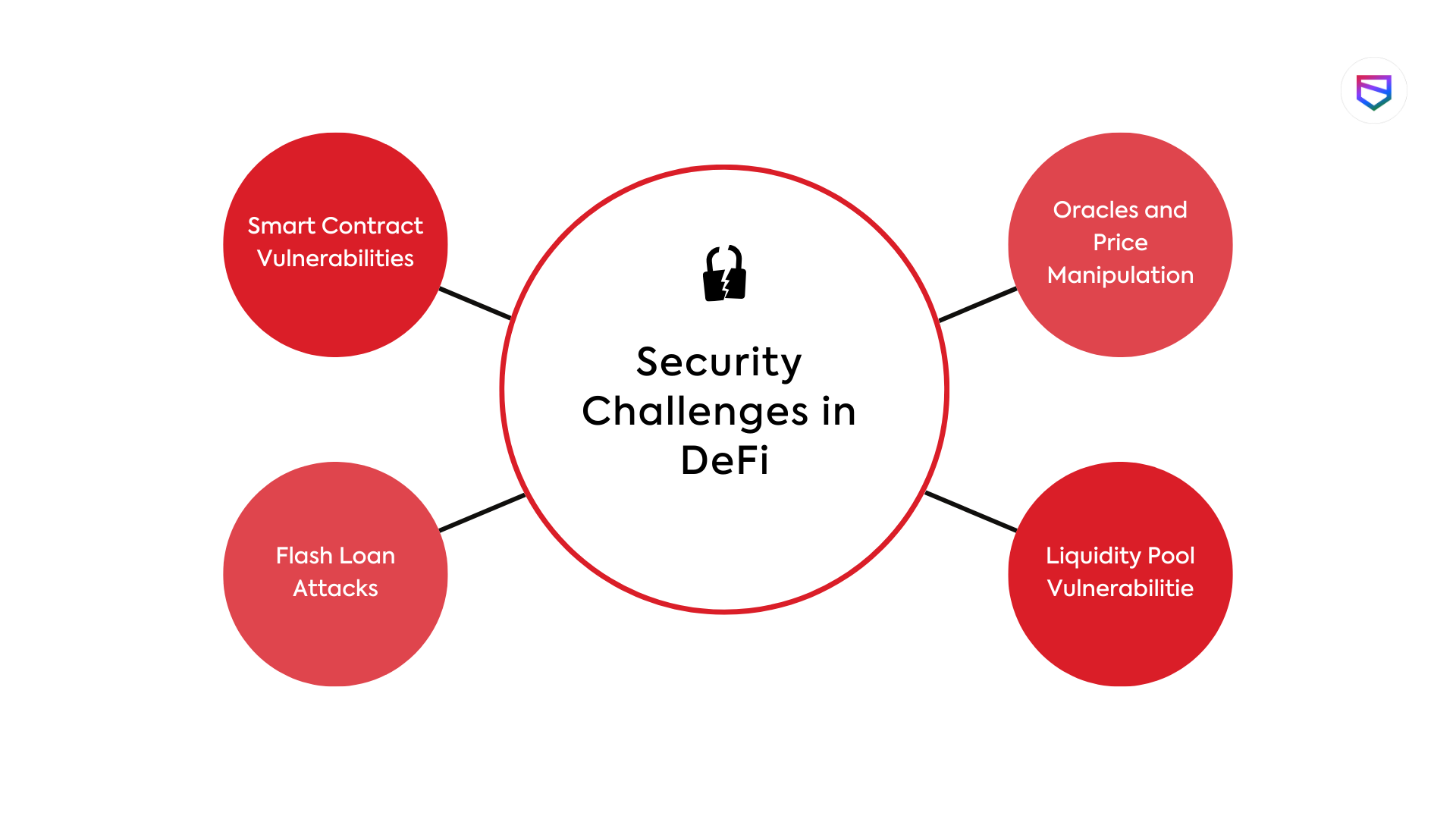

Technical Vulnerabilities: Smart Contract Risks and Oracle Failures

Beyond economic models and regulatory risks, stablecoins face significant technical vulnerabilities that can lead to catastrophic failures. Smart contract bugs, oracle manipulation attacks, and protocol exploits represent some of the most dangerous threats to stablecoin stability. Understanding these technical risks is crucial for both developers and users in the cryptocurrency ecosystem.

Smart Contract Security Risks

Critical Smart Contract Vulnerabilities

- Reentrancy Attacks: Malicious contracts can drain funds by repeatedly calling functions before state updates

- Integer Overflow/Underflow: Mathematical errors can create or destroy tokens unexpectedly

- Access Control Failures: Insufficient permission checks allow unauthorized minting or burning

- Flash Loan Attacks: Temporary large loans can manipulate prices and trigger unintended behaviors

The OWASP Smart Contract Top 10 provides a comprehensive framework for understanding the most critical security risks in smart contract development. Stablecoin projects must implement rigorous security audits and testing procedures to identify and mitigate these vulnerabilities before deployment.

Oracle Manipulation Attacks

Oracle attacks represent one of the most sophisticated threats to stablecoin infrastructure. These attacks exploit the dependency of decentralized applications on external data feeds, allowing malicious actors to manipulate price information and trigger unintended smart contract behaviors.

Types of Oracle Attacks

- • Flash loan attacks on AMM pools

- • Coordinated market manipulation

- • Front-running oracle updates

- • Oracle node compromises

- • Network congestion delays

- • Centralized data source failures

Projects like Chainlink and Band Protocol provide decentralized oracle solutions, but even these systems are not immune to sophisticated attacks. Stablecoin protocols must implement multiple oracle sources, time-weighted averages, and circuit breakers to prevent manipulation.

DeFi Protocol Integration Risks

As stablecoins become deeply integrated into the DeFi ecosystem, they inherit the risks of the protocols they interact with. Composability, while powerful, creates complex interdependencies that can lead to cascading failures across multiple platforms.

DeFi Integration Vulnerabilities

- Liquidity Pool Exploits: Attacks on AMM algorithms can destabilize stablecoin pairs

- Governance Token Attacks: Malicious governance proposals can modify stablecoin parameters

- Bridge Vulnerabilities: Cross-chain bridges represent major attack vectors for stablecoins

- Composability Risks: Failures in one protocol can cascade to connected stablecoin systems

Warning Signs: How to Identify a Stablecoin at Risk

Identifying warning signs before a stablecoin collapses can save investors from significant losses. By understanding the key risk indicators and red flags, market participants can make more informed decisions about their exposure to various stablecoin projects. Here are the critical warning signs every investor should monitor.

Reserve and Backing Red Flags

Critical Reserve Warning Signs

Transparency Issues:

- • Lack of regular audit reports

- • Vague asset composition disclosure

- • Delayed or incomplete reserve attestations

- • Refusal to provide proof of reserves

Asset Quality Concerns:

- • High percentage of commercial paper

- • Exposure to related-party investments

- • Concentration in high-risk assets

- • Maturity mismatches in backing assets

Market Behavior Indicators

Market behavior often provides early warning signals before a stablecoin collapse. Experienced traders and analysts monitor specific metrics and patterns that indicate underlying stress in stablecoin systems.

Market Warning Indicators

- • Frequent depegging events (>0.5% deviation)

- • Extended periods trading below $0.99

- • Large bid-ask spreads on major exchanges

- • Premium trading on certain platforms

- • Unusually high redemption volumes

- • Sudden spikes in trading activity

- • Decreasing liquidity in major pairs

- • Exchange delisting announcements

Governance and Operational Red Flags

Team and Governance Concerns

- Anonymous or Inexperienced Teams: Lack of verifiable credentials or track record

- Centralized Control: Single points of failure in governance or technical infrastructure

- Regulatory Issues: Ongoing legal disputes or regulatory investigations

- Communication Problems: Poor community engagement or delayed responses to issues

- Technical Debt: Unaddressed security vulnerabilities or outdated infrastructure

Due Diligence Checklist

Essential Due Diligence Steps

Financial Analysis:

- ✓ Review latest audit reports

- ✓ Analyze reserve composition

- ✓ Check redemption mechanisms

- ✓ Monitor peg stability history

Technical Assessment:

- ✓ Review smart contract audits

- ✓ Assess oracle dependencies

- ✓ Evaluate governance structure

- ✓ Check for upgrade mechanisms

Tools like DeFi Pulse, DefiLlama, and Dune Analytics provide valuable data for monitoring stablecoin health and identifying potential risk factors before they become critical issues.

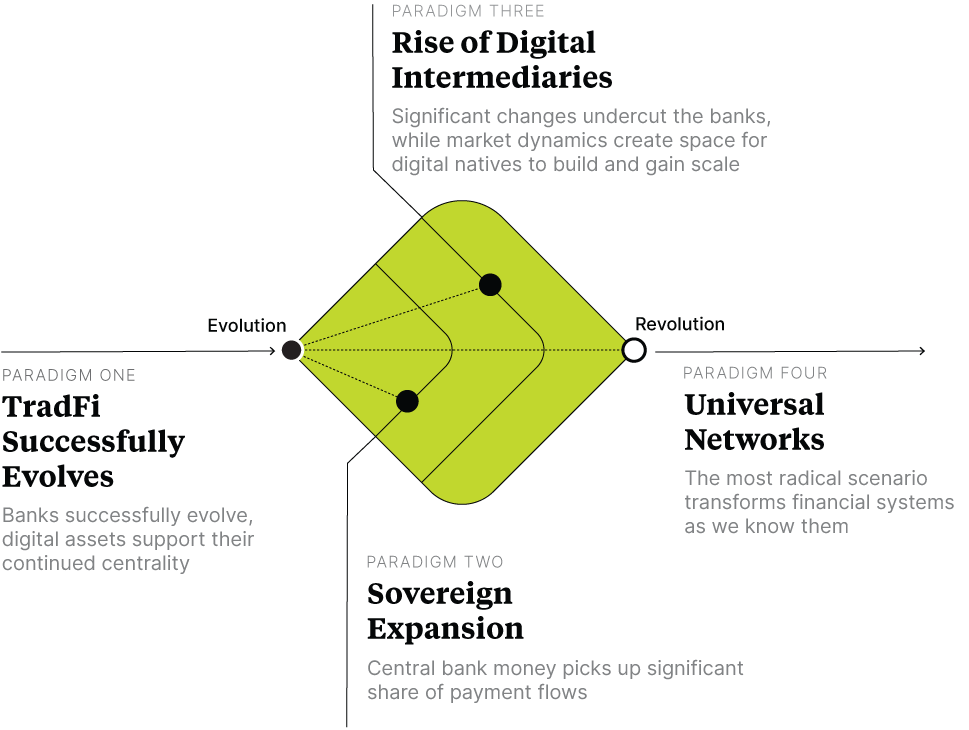

The Future of Stable Digital Assets: Lessons Learned

The stablecoin market has evolved significantly through periods of both innovation and crisis. The failures of Terra Luna, temporary depegging of USDC, and ongoing controversies around Tether have provided valuable lessons that are shaping the next generation of stable digital assets. Understanding these lessons is crucial for the future development of truly stable and reliable digital currencies.

Regulatory Evolution and Compliance

The regulatory landscape for stablecoins is rapidly evolving, with governments worldwide recognizing both the potential benefits and risks of these digital assets. The European Union’s Markets in Crypto-Assets (MiCA) regulation and proposed U.S. stablecoin legislation represent significant steps toward comprehensive regulatory frameworks.

Key Regulatory Developments

- • Enhanced reserve requirements and regular auditing

- • Clear redemption rights and consumer protections

- • Licensing requirements for stablecoin issuers

- • Integration with traditional banking supervision

- • Anti-money laundering (AML) and know-your-customer (KYC) standards

- • Real-time transaction monitoring and reporting

- • Capital adequacy requirements for issuers

- • Operational resilience and business continuity planning

Central Bank Digital Currencies (CBDCs)

Central Bank Digital Currencies represent a potential paradigm shift in the stable digital asset landscape. As central banks worldwide explore CBDC implementations, the competitive dynamics between CBDCs and private stablecoins will likely reshape the entire ecosystem.

CBDC vs. Stablecoin Comparison

CBDC Advantages:

- • Full government backing and guarantee

- • Integration with monetary policy

- • Enhanced financial inclusion

- • Reduced counterparty risk

Stablecoin Advantages:

- • Permissionless innovation

- • Cross-border accessibility

- • DeFi ecosystem integration

- • Private sector efficiency

Countries like China with the Digital Yuan and the European Central Bank’s Digital Euro project are leading CBDC development. However, the coexistence model where CBDCs and regulated stablecoins operate in complementary roles appears most likely, with each serving different use cases and user needs.

Technological Innovations

The future of stablecoins will be shaped by technological innovations that address current limitations and vulnerabilities. These advances focus on improving stability mechanisms, enhancing security, and increasing scalability while maintaining decentralization benefits.

Emerging Technologies

- • Multi-collateral algorithmic designs with robust backing

- • AI-powered stability algorithms and risk management

- • Real-world asset tokenization for diverse backing

- • Cross-chain stability protocols and bridges

- • Formal verification of smart contracts

- • Decentralized oracle networks with cryptographic proofs

- • Zero-knowledge proofs for privacy and verification

- • Quantum-resistant cryptographic implementations

Market Structure Evolution

The stablecoin market is evolving toward greater diversification, improved risk management, and enhanced interoperability. This evolution is driven by lessons learned from past failures and the growing sophistication of market participants.

Future Market Characteristics

- Diversified Ecosystem: Multiple stablecoin types serving different use cases and risk profiles

- Improved Transparency: Real-time reserve monitoring and automated compliance reporting

- Enhanced Interoperability: Seamless cross-chain transfers and protocol integration

- Institutional Adoption: Enterprise-grade solutions with institutional custody and compliance

- DeFi Integration: Native stability mechanisms built into DeFi protocols

Recommendations for the Future

Key Recommendations

For Investors:

- • Diversify across multiple stablecoin types

- • Monitor reserve quality and transparency

- • Understand the risks of each stability mechanism

- • Stay informed about regulatory developments

For Developers:

- • Implement robust testing and formal verification

- • Design with regulatory compliance in mind

- • Build in multiple layers of security and failsafes

- • Ensure transparent and auditable operations

The future of stable digital assets will be characterized by greater regulatory clarity, technological sophistication, and market maturity. While challenges remain, the lessons learned from past failures are driving innovations that promise more resilient and trustworthy stable digital currencies.

Success in this evolving landscape will require continuous adaptation, robust risk management, and a commitment to transparency and user protection. The stablecoin projects that survive and thrive will be those that learn from past mistakes and build with security, compliance, and user trust as foundational principles.

Conclusion: Navigating the Stablecoin Landscape

The journey through stablecoin collapses, from the Terra Luna catastrophe to USDC’s temporary depeg, reveals a complex landscape of risks and opportunities. While stablecoins promise financial stability and innovation, their failures have demonstrated the critical importance of understanding the underlying mechanisms, risks, and warning signs that can lead to catastrophic outcomes.

Key Takeaways

- No Stablecoin is Risk-Free: Even the most established stablecoins carry inherent risks that investors must understand

- Diversification is Essential: Spreading exposure across different stablecoin types and mechanisms reduces concentration risk

- Transparency Matters: Regular audits, reserve disclosures, and open communication are critical trust factors

- Technology is Evolving: New innovations are addressing current limitations but also introducing new risks

- Regulation is Coming: The regulatory landscape is rapidly evolving and will significantly impact the stablecoin market

As the cryptocurrency ecosystem continues to mature, stablecoins will play an increasingly important role in bridging traditional finance and digital assets. However, this evolution requires a commitment to learning from past failures, implementing robust risk management practices, and maintaining the highest standards of transparency and user protection.

The future belongs to stablecoin projects that prioritize security, compliance, and user trust over short-term gains. By understanding the risks, recognizing warning signs, and staying informed about technological and regulatory developments, market participants can better navigate this dynamic and evolving landscape.