Common Trading Mistakes: How to Avoid Them to Achieve Financial Success

Common Trading Mistakes: How to Avoid Them to Achieve Financial Success

Trading in financial markets is an activity that attracts many due to the possibility of achieving high returns. However, statistics indicate that the vast majority of traders lose their money. According to studies, about 80-95% of traders fail to achieve sustainable profits. The main reason behind this high failure rate is not a lack of intelligence or knowledge, but falling into common mistakes that can be avoided through awareness and discipline.

“The difference between a successful trader and a failing trader is not in knowledge, but in the ability to avoid common mistakes, control emotions, and adhere to a disciplined trading plan.”

:max_bytes(150000):strip_icc()/risk_management-5bfc36abc9e77c005182400f.jpg)

Emotional Trading: The First Enemy of Success

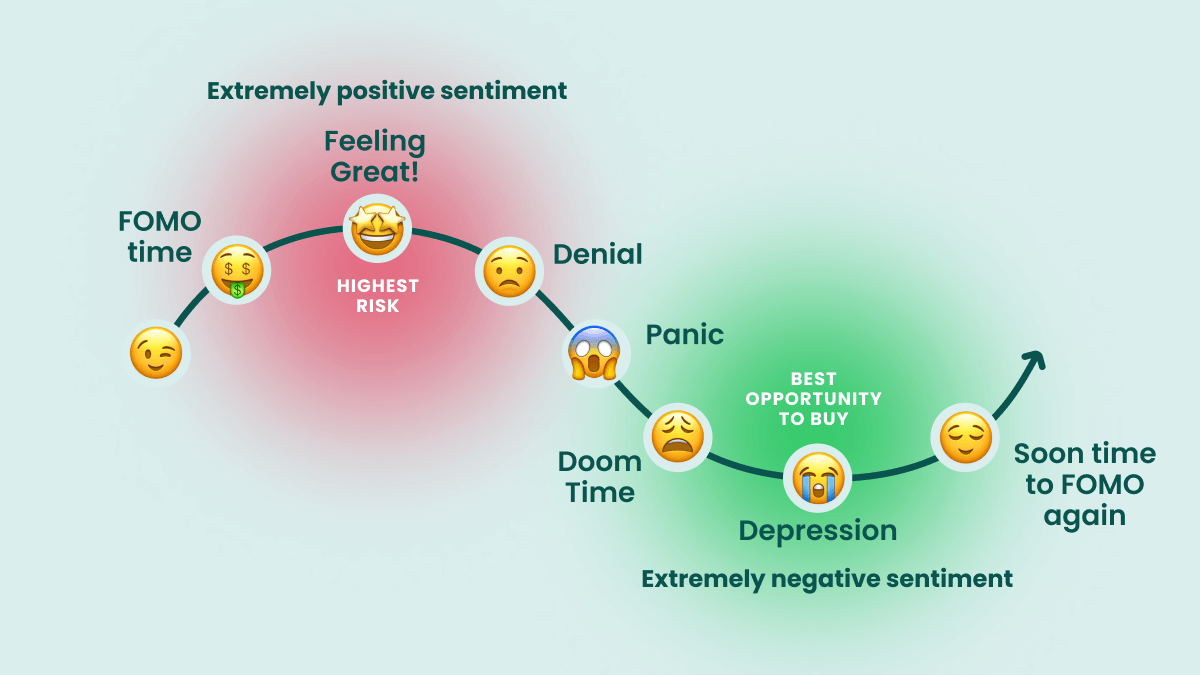

The emotion cycle that traders go through during different market phases

Emotional trading is one of the most common and destructive mistakes for traders’ accounts. When emotions such as fear and greed control trading decisions, the trader tends to make irrational decisions that conflict with their strategy and plan.

Manifestations of Emotional Trading

- Fear of loss leads to closing profitable trades too early

- Greed drives traders to stay in losing trades hoping to recover losses

- FOMO syndrome (Fear Of Missing Out) leads to entering unplanned trades

- Revenge trading through consecutive trades after a loss

- Regret prevents traders from making the right decisions

To overcome emotional trading, traders must develop strong self-discipline and stick to a clear trading plan that isn’t affected by emotional fluctuations. Using stop-loss orders and setting profit targets in advance can help reduce the impact of emotions on trading decisions.

Tips to Overcome Emotional Trading

- Develop a Trading Routine: Follow consistent procedures before, during, and after each trade

- Keep a Trading Journal: Record your thoughts and emotions during trades to analyze them later

- Meditation and Relaxation: Practice breathing and meditation techniques to maintain calmness

- Reduce Position Size: Trade with smaller sizes to reduce psychological pressure

- Automate Trading: Use pending orders and automatic stop-loss orders

- Take Breaks: Step away from screens after emotional trades to regain focus

Trading Without a Plan: A Guaranteed Recipe for Failure

Model of a professional trading plan that includes all necessary elements

One of the biggest mistakes beginner traders make is entering markets without a clear and specific trading plan. Trading without a plan is like sailing in the ocean without a compass – you might reach your destination by chance, but the greater probability is that you’ll get lost.

“Failing to plan is planning to fail. In the trading world, you can’t rely on luck for long-term success; you need a clear strategy and a methodical plan.”

An effective trading plan includes the following elements:

- Identifying markets and instruments you will trade

- Trading timeframe (daily, weekly, monthly)

- Clear entry and exit strategies

- Risk management rules and risk-to-reward ratio

- Position size and how to allocate capital

- Profit targets and stop-loss points

- Mechanism for evaluating trades and performance development

Entry Rules

Define precisely when and how you will enter a trade. For example, “Enter when an important resistance level is broken with confirmation from the Relative Strength Index (RSI) above level 50 and increasing trading volume.”

Exit Rules

Exit rules are more important than entry rules because they determine the amount of profit or loss. Predetermine “specific profit targets at key support/resistance levels, and stop-loss below/above the last important peak/trough.”

Trade Review

Dedicate weekly time to review all your trades and analyze strengths and weaknesses. Record “detailed notes for each trade with screenshots of entry and exit points and reasons for making decisions.”

Excessive Leverage: A Double-Edged Sword

Leverage is one of the most tempting and dangerous tools in the trading world. It gives traders the ability to control much larger positions than their available capital, which amplifies potential profits. However, at the same time, leverage amplifies losses by the same ratio.

“Leverage makes you feel like a genius when markets are in your favor and makes you feel extremely foolish when they move against you. The truth is, you’re neither a genius nor a fool; you’re just a trader using a dangerous tool without enough caution.”

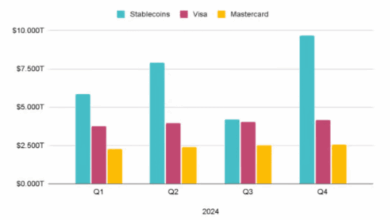

Impact of different leverage levels on trading results in profit and loss scenarios

Main Risks of Excessive Leverage

- Amplifies losses by the same ratio as profits

- Increases the probability of margin calls and liquidation of positions

- Accelerates capital depletion during high volatility periods

- Creates extreme psychological pressure affecting trading decisions

- Reduces the space and time for temporarily losing trades to recover

Rules for Using Leverage Wisely

- Do not exceed 1:10 leverage, especially for beginner traders

- Do not risk more than 1-2% of capital on a single trade

- Use strict stop-loss orders to protect capital

- Reduce leverage during important economic news events

- Maintain a sufficient margin level (no less than 50% of available margin)

Illustrative Example of Leverage Impact

Let’s assume you have a $10,000 trading account and enter a gold buying position:

- Using 1:1 leverage (no leverage): You can buy gold worth $10,000

- Using 1:10 leverage: You can buy gold worth $100,000

- Using 1:100 leverage: You can buy gold worth $1,000,000

If gold price rises by 1%:

- Without leverage: You profit $100 (1% of $10,000)

- With 1:10 leverage: You profit $1,000 (1% of $100,000)

- With 1:100 leverage: You profit $10,000 (1% of $1,000,000)

But if gold price falls by 1%:

- Without leverage: You lose $100

- With 1:10 leverage: You lose $1,000 (10% of your account)

- With 1:100 leverage: You lose $10,000 (100% of your account – complete loss)

Not Using Stop-Loss Orders

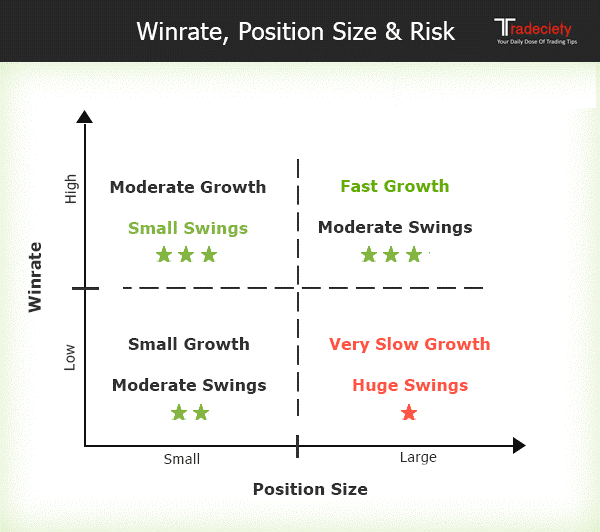

Relationship between win rate, position size, and using stop-loss orders

One of the fatal mistakes that traders make is trading without using stop-loss orders, setting them too far away, or constantly adjusting them to avoid taking a loss. This behavior often leads to catastrophic losses that deplete capital.

Why Do Traders Ignore Stop-Loss Orders?

- Excessive confidence in their market predictions

- Fear of exiting early and missing a price recovery opportunity

- Unwillingness to admit mistakes and take a loss

- The false belief that a trade isn’t losing until it’s closed

- “Averaging down” syndrome and buying more as the price falls

Stop-loss orders are like an insurance policy for your account. True, they may cost you frequent small losses, but they protect you from large losses that can completely wipe out your account. Professional traders know that small losses are a natural part of the trading process, and what’s most important is staying in the market for the next day.

Effective Strategies for Setting Stop-Loss Levels

Technical-Based Stop-Loss

- Setting stop-loss behind a strong support/resistance level

- Using specific moving averages (such as the 50 or 200 MA)

- Relying on previous peaks and troughs to determine the level

- Placing the stop behind a price reversal zone

Volatility-Based Stop-Loss

- Using Bollinger Bands to determine volatility

- Setting stops based on Average True Range (ATR) multiples

- Adjusting stop levels during high volatility periods

- Using a percentage of entry price (e.g., 2% for high-liquidity stocks)

Fear Of Missing Out (FOMO)

Impact of FOMO syndrome on trader’s decisions and how to deal with it

Fear Of Missing Out (FOMO) syndrome is a psychological state that drives traders to make hasty decisions out of fear of missing a major price movement. This condition appears especially during strong uptrends or sharp declines in markets.

“Markets will be around tomorrow, the day after, and next year. Don’t act as if this opportunity is the last one in your life. Good opportunities repeat continuously, and patience is your strongest weapon.”

A trader suffering from FOMO typically:

- Enters trades too late (buying after a big rise or selling after a sharp drop)

- Ignores strategy rules and bypasses warning signals

- Uses higher than normal leverage to compensate for late entry

- Trades excessively for fear of missing any “opportunity”

- Feels intense regret when not participating in a successful market move

How to Overcome FOMO Syndrome

1. Stick to Your Plan

Set clear and strict entry criteria and don’t deviate from them no matter how tempting. If the opportunity doesn’t align with your plan, it’s not an opportunity for you.

2. Wait for Pullbacks

Markets rarely move in one direction without a pullback. Set pending orders at potential pullback levels instead of chasing the price.

3. Reduce Market Monitoring

Don’t watch prices all day. Set specific times to analyze the market and make decisions away from the pressure of the moment.

Not Conducting Post-Trade Analysis

One of the key differences between professional and amateur traders is the professionals’ commitment to regular review and detailed analysis of all their trades. Many traders ignore this crucial step, either out of laziness or to avoid confronting their mistakes.

Benefits of Post-Trade Analysis

- Identifying recurring patterns in successful and losing trades

- Discovering weaknesses in your strategy

- Determining market conditions that suit your trading style

- Measuring the effectiveness of adjustments you make to your strategy

- Building confidence through deep understanding of why trades succeed or fail

To get the most benefit from post-trade analysis, you must be honest with yourself and objective in evaluating your performance. Record all trade details, including reasons for entry and exit, psychological state, and external factors that may have influenced your decisions.

Regular trade review helps significantly improve performance

Simplified Trade Analysis Model

- Basic Details: Pair/instrument, entry and exit dates, position size

- Entry Reasons: Technical/fundamental signals you relied on

- Risk Management Rules: Risk size, stop-loss level, and profit target

- Psychological State: Confidence, stress, excitement, hesitation, etc.

- Trade Result: Profit/loss in points and percentage of account

- Strategy Adherence Assessment: Did you follow your plan precisely?

- Lessons Learned: What can be improved next time?

Strategies to Overcome Common Mistakes

Mental Preparation Before Trading

Before starting your trading day, dedicate time for mental and psychological preparation. Review your daily plan and identify potential opportunities based on your analysis. Clearly define:

- Assets you will trade today

- Time frame you will focus on

- Key support and resistance levels

- Important economic events and their timing

- Maximum daily loss limit

- Target number of trades

Tip: Use breathing and meditation techniques for 5-10 minutes before trading to reach a balanced mental state.

Paper Trading

Before risking real money, use paper trading to test your strategies and build confidence. Even experienced traders use paper trading when:

- Testing a new strategy or modifying an existing one

- Trading in a new market or financial instrument

- Returning to trading after a break or a series of losses

- Testing psychological response under different market conditions

Tip: Treat paper trading with the same seriousness as real trading. Record all trades and analyze them as if they were with real money.

Shifting from Quantity to Quality

Focus on the quality of trades rather than their number. Identify 2-3 high-quality opportunities daily that perfectly align with your strategy instead of executing 10-20 medium-quality trades.

Scaling Position Sizes

Instead of opening a full position at once, use the scaling method. For example, enter with 30% of your planned position size, then add another 30% when the trend is confirmed, and the rest when the movement is established.

Recording Emotions Before and After Trading

Create an “emotion diary” where you record your psychological state before, during, and after each trade. Over time, you’ll notice clear patterns in the relationship between your psychological state and trading results.

Conclusion

Success in trading isn’t about having a secret strategy or a magical indicator, but about avoiding the fundamental mistakes that destroy most traders’ accounts. By being aware of these common mistakes and taking proactive steps to avoid them, you can put yourself on the right track toward achieving sustainable success in trading.

Always remember that trading is a profession that requires continuous self-development. Start by identifying your most frequent mistakes in your trades and work on addressing them one by one. Don’t try to fix everything at once; focus on gradual and continuous improvement.

“Success in trading isn’t measured just by the amount of profits, but also by your ability to avoid major mistakes. A successful trader isn’t someone who never loses, but someone who learns from losses and preserves capital to come back stronger the next day.”

Finally, don’t forget to treat trading as a long-term business project, not as a means for quick wealth. Patience, discipline, and continuous learning are the foundations of real success in the trading world.